Question: I need help with 8.1, 8.2 part b only PROBLEMS not QUESTIONS section 314 Gopenski's Healthcare Finance a. Calculate and interpret the profit variance. b.

I need help with 8.1, 8.2 part b only PROBLEMS not QUESTIONS section

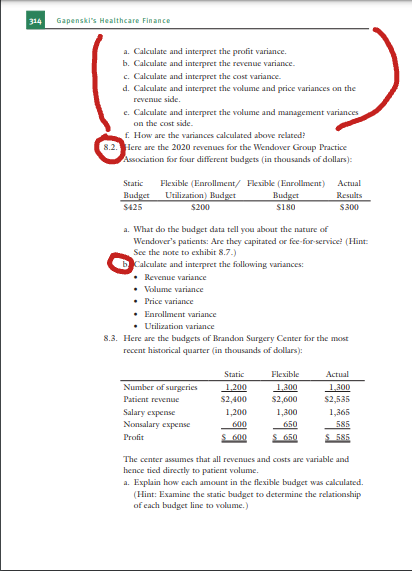

314 Gopenski's Healthcare Finance a. Calculate and interpret the profit variance. b. Calculate and interpret the revenue variance. c. Calculate and interpret the cost variance. d. Calculate and interpret the volume and price variances on the revenue side. c. Calculate and interpret the volume and management variances on the cost side. f. How are the variances calculated above related? 8.2. Here are the 2020 revenues for the Wendover Group Practice Association for four different budgets (in thousands of dollars): Static Flexible (Enrollment/ Flexible (Enrollment) Actual Budget Utilization) Budget Budget Results $426 $200 $180 $300 a. What do the budget data tell you about the nature of Wendover's patients: Are they capitated or fee for service! (Hint: See the note to exhibit 8.7.) Cb Calculate and interpret the following variances: Revenue variance Volume variance Price variance * Enrollment variance . Utilization variance 8.3. Here are the budgets of Brandon Surgery Center for the most recent historical quarter (in thousands of dollars): Static Flexible Actual Number of surgeries 1,200 1,200 1,300 Patient revenue $2,400 $2,600 $2,535 Salary expense 1,200 1,200 1,365 Nonsalary expense 60 0 650 685 Profit 650 The center assumes that all revenues and costs are variable and hence tied directly to patient volume. a. Explain how each amount in the flexible budget was calculated. (Hint: Examine the static budget to determine the relationship of each budget line to volume.)Chapter 8: Financial Planning and Budgeting 317 This chapter concludes the discussion of managerial accounting. Chapter 9 begins the examination of basic financial management concepts. Questions 8.1. Who are planning and budgeting so important oran organization's 8.2. Briefly describe the planning process. Be are to include summaries of the strategic, operating, and financial 8.3. Describe the components of a fing fal plan. 8.4. How are the me tics, revenue expense, and operating budgets related! 8.5. a. What are the advan is and disadvantages of conventional budgeting versus based budgeting! b. What organiza and characteristics create likely candidates for zero- based budgetings 8.6. If you were pot CEO of Ex view Hospital, would you advocate a top down of a bottom-up approach to budgeting? Explain your rational 8.7. What & variance analysis! 8.8. ay splain the relationships among the static budget, flexible budget, and actual results. Assume that a group practice has ha capitated and fee for service (FFS) patients. Furthermore, the number of capitated enrollees has changed over the budget perine To calculate the volume variance and break it down into emit Nment and utilization components, how many flexible budgets \\must be constructed: Problems 8.1. Consider the following 2020 data for Newark General Hospital (in millions of dollars): Static Budget Flexible Budget Actual Results Revenues $4.7 $4.8 $4.5 Costs 4.1 1.1 1.2 Profits 0.6 07 0.3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts