Question: I need help with #9. Cells C6-C14 is the Parent (Domestic) company. Thanks! Current Values Data: Metric Sales (units) Units Produced Labor (hours) Labor Cost

I need help with #9. Cells C6-C14 is the Parent (Domestic) company. Thanks!

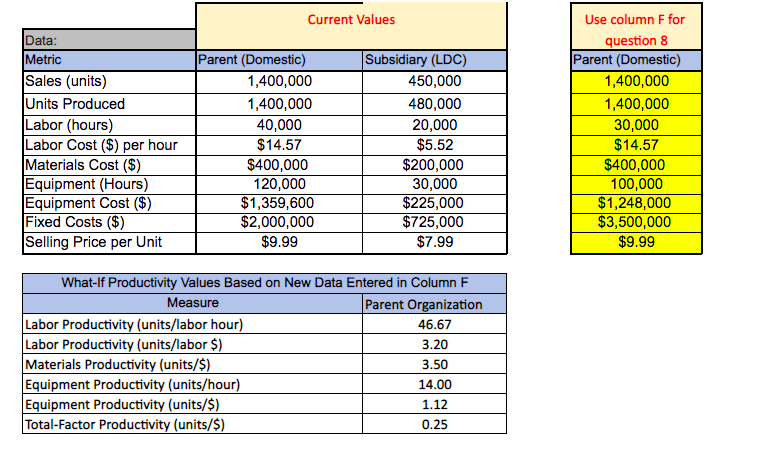

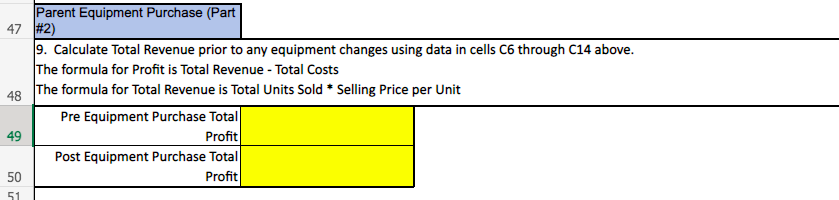

Current Values Data: Metric Sales (units) Units Produced Labor (hours) Labor Cost ($) per hour Materials Cost ($) Equipment (Hours) Equipment Cost ($) Fixed Costs ($) Selling Price per Unit Parent (Domestic) 1,400,000 1,400,000 40,000 $14.57 $400,000 120,000 $1,359,600 $2,000,000 $9.99 Subsidiary (LDC) 450,000 480,000 20,000 $5.52 $200,000 30,000 $225,000 $725,000 $7.99 Use column F for question 8 Parent (Domestic) 1,400,000 1,400,000 30,000 $14.57 $400,000 100,000 $1,248,000 $3,500,000 $9.99 What-lf Productivity Values Based on New Data Entered in Column F Measure Parent Organization Labor Productivity (units/labor hour) 46.67 Labor Productivity (units/labor $) 3.20 Materials Productivity (units/$) 3.50 Equipment Productivity (units/hour) 14.00 Equipment Productivity (units/$) 1.12 Total-Factor Productivity (units/$) 0.25 Parent Equipment Purchase (Part 47 #2) 9. Calculate Total Revenue prior to any equipment changes using data in cells C6 through C14 above. The formula for Profit is Total Revenue - Total Costs 48 The formula for Total Revenue is Total Units Sold * Selling Price per Unit Pre Equipment Purchase Total 49 Profit Post Equipment Purchase Total 50 Profit 51Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock