Question: I need help with A), B), and C) for this project, thank you. the spreadsheet should be set up similar to the one on pages

I need help with A), B), and C) for this project, thank you.

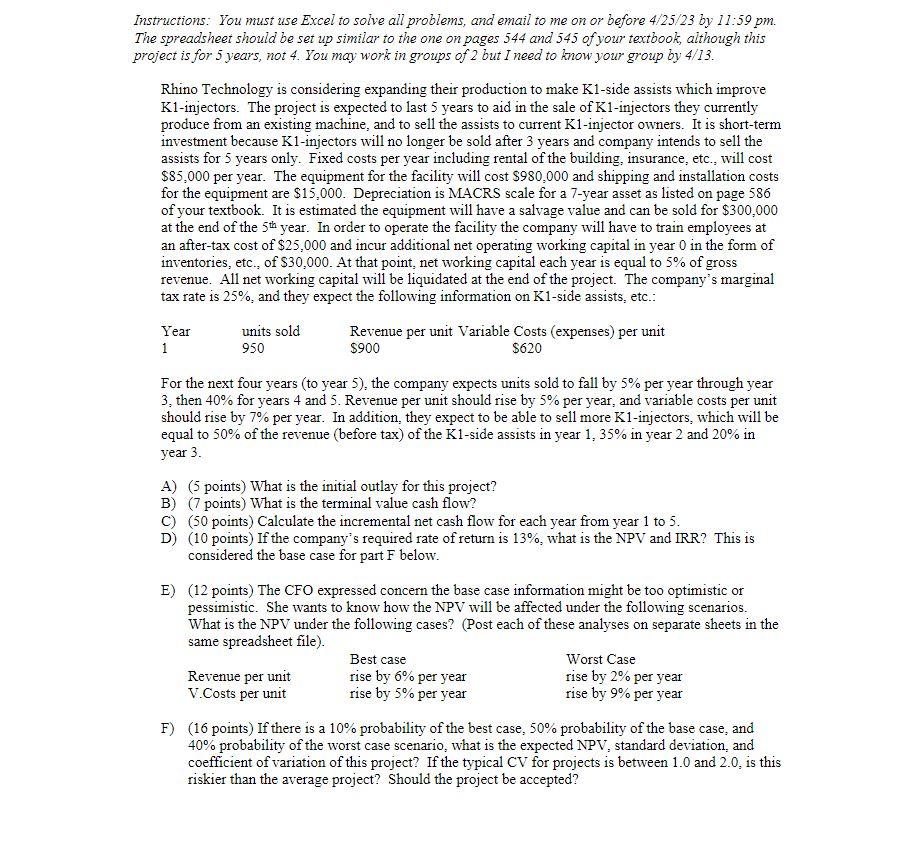

the spreadsheet should be set up similar to the one on pages 544 and 545 of your textbook, although this roject is for 5 years, not 4 . You may work in groups of 2 but I need to know your group by 4/13. Rhino Technology is considering expanding their production to make K1-side assists which improve K1-injectors. The project is expected to last 5 years to aid in the sale of K1-injectors they currently produce from an existing machine, and to sell the assists to current K1-injector owners. It is short-term investment because K1-injectors will no longer be sold after 3 years and company intends to sell the assists for 5 years only. Fixed costs per year including rental of the building, insurance, etc., will cost $85,000 per year. The equipment for the facility will cost $980,000 and shipping and installation costs for the equipment are $15,000. Depreciation is MACRS scale for a 7-year asset as listed on page 586 of your textbook. It is estimated the equipment will have a salvage value and can be sold for $300,000 at the end of the 5th year. In order to operate the facility the company will have to train employees at an after-tax cost of $25,000 and incur additional net operating working capital in year 0 in the form of inventories, etc., of $30,000. At that point, net working capital each year is equal to 5% of gross revenue. All net working capital will be liquidated at the end of the project. The company's marginal tax rate is 25%, and they expect the following information on K1-side assists, etc.: Year units sold Revenue per unit Variable Costs (expenses) per unit 1950$900 For the next four years (to year 5), the company expects units sold to fall by 5% per year through year 3 , then 40% for years 4 and 5 . Revenue per unit should rise by 5% per year, and variable costs per unit should rise by 7% per year. In addition, they expect to be able to sell more K1-injectors, which will be equal to 50% of the revenue (before tax) of the K1-side assists in year 1,35% in year 2 and 20% in year 3. A) (5 points) What is the initial outlay for this project? B) (7 points) What is the terminal value cash flow? C) (50 points) Calculate the incremental net cash flow for each year from year 1 to 5 . D) (10 points) If the company's required rate of return is 13%, what is the NPV and IRR? This is considered the base case for part F below. E) (12 points) The CFO expressed concern the base case information might be too optimistic or pessimistic. She wants to know how the NPV will be affected under the following scenarios. What is the NPV under the following cases? (Post each of these analyses on separate sheets in the same snreadsheet file) F) (16 points) If there is a 10% probability of the best case, 50% probability of the base case, and 40% probability of the worst case scenario, what is the expected NPV, standard deviation, and coefficient of variation of this project? If the typical CV for projects is between 1.0 and 2.0 , is this riskier than the average project? Should the project be accepted? the spreadsheet should be set up similar to the one on pages 544 and 545 of your textbook, although this roject is for 5 years, not 4 . You may work in groups of 2 but I need to know your group by 4/13. Rhino Technology is considering expanding their production to make K1-side assists which improve K1-injectors. The project is expected to last 5 years to aid in the sale of K1-injectors they currently produce from an existing machine, and to sell the assists to current K1-injector owners. It is short-term investment because K1-injectors will no longer be sold after 3 years and company intends to sell the assists for 5 years only. Fixed costs per year including rental of the building, insurance, etc., will cost $85,000 per year. The equipment for the facility will cost $980,000 and shipping and installation costs for the equipment are $15,000. Depreciation is MACRS scale for a 7-year asset as listed on page 586 of your textbook. It is estimated the equipment will have a salvage value and can be sold for $300,000 at the end of the 5th year. In order to operate the facility the company will have to train employees at an after-tax cost of $25,000 and incur additional net operating working capital in year 0 in the form of inventories, etc., of $30,000. At that point, net working capital each year is equal to 5% of gross revenue. All net working capital will be liquidated at the end of the project. The company's marginal tax rate is 25%, and they expect the following information on K1-side assists, etc.: Year units sold Revenue per unit Variable Costs (expenses) per unit 1950$900 For the next four years (to year 5), the company expects units sold to fall by 5% per year through year 3 , then 40% for years 4 and 5 . Revenue per unit should rise by 5% per year, and variable costs per unit should rise by 7% per year. In addition, they expect to be able to sell more K1-injectors, which will be equal to 50% of the revenue (before tax) of the K1-side assists in year 1,35% in year 2 and 20% in year 3. A) (5 points) What is the initial outlay for this project? B) (7 points) What is the terminal value cash flow? C) (50 points) Calculate the incremental net cash flow for each year from year 1 to 5 . D) (10 points) If the company's required rate of return is 13%, what is the NPV and IRR? This is considered the base case for part F below. E) (12 points) The CFO expressed concern the base case information might be too optimistic or pessimistic. She wants to know how the NPV will be affected under the following scenarios. What is the NPV under the following cases? (Post each of these analyses on separate sheets in the same snreadsheet file) F) (16 points) If there is a 10% probability of the best case, 50% probability of the base case, and 40% probability of the worst case scenario, what is the expected NPV, standard deviation, and coefficient of variation of this project? If the typical CV for projects is between 1.0 and 2.0 , is this riskier than the average project? Should the project be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts