Question: I need help with A,B and C. Please show work so I can fully understand thank you CawlCo makes three models of tasers. Information on

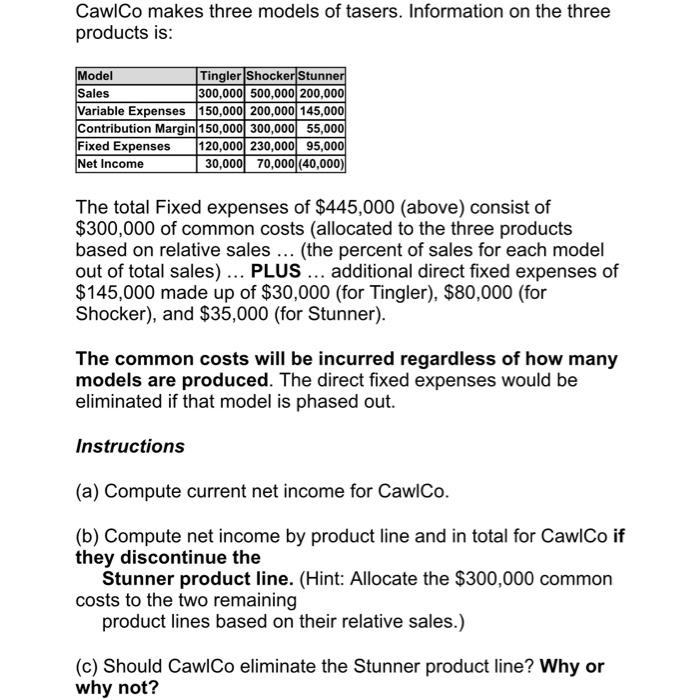

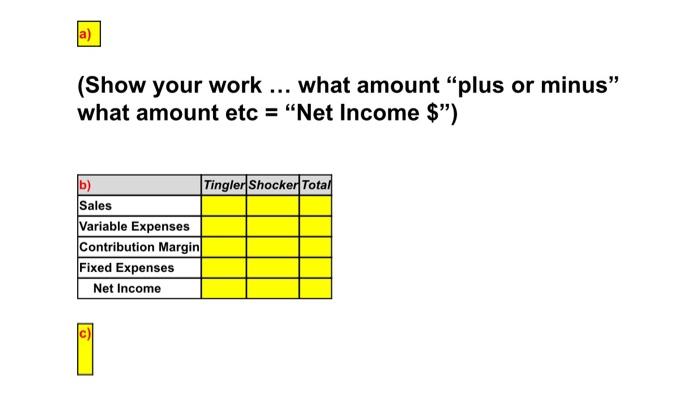

CawlCo makes three models of tasers. Information on the three products is: Model Tingler Shocker Stunner Sales 300,000 500,000 200,000 Variable Expenses 150,000 200,000 145,000 Contribution Margin 150,000 300,000 55,000 Fixed Expenses 120,000 230,000 95,000 Net Income 30,000 70,000 (40,000) The total Fixed expenses of $445,000 (above) consist of $300,000 of common costs (allocated to the three products based on relative sales ... (the percent of sales for each model out of total sales) ... PLUS ... additional direct fixed expenses of $145,000 made up of $30,000 (for Tingler), $80,000 (for Shocker), and $35,000 (for Stunner). The common costs will be incurred regardless of how many models are produced. The direct fixed expenses would be eliminated if that model is phased out. Instructions (a) Compute current net income for CawiCo. (b) Compute net income by product line and in total for CawiCo if they discontinue the Stunner product line. (Hint: Allocate the $300,000 common costs to the two remaining product lines based on their relative sales.) (c) Should CawiCo eliminate the Stunner product line? Why or why not? a) (Show your work ... what amount "plus or minus" what amount etc = "Net Income $") Tingler Shocker Total b) Sales Variable Expenses Contribution Margin Fixed Expenses Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts