Question: I need help with a-c please Lacy is a single taxpayer. In 2022 , her taxable income is $44,400. What is her tax liability in

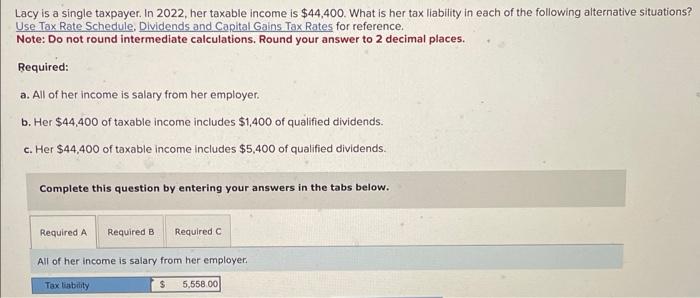

Lacy is a single taxpayer. In 2022 , her taxable income is $44,400. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Required: a. All of her income is salary from her employer. b. Her $44,400 of taxable income includes $1,400 of qualified dividends. c. Her $44,400 of taxable income includes $5,400 of qualified dividends. Complete this question by entering your answers in the tabs below. All of her income is salary from her employer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts