Question: I need help with accounting problem. Please, help me out. And, please use table for bank reconcilation As the accountant for the Stall Corporation, you

I need help with accounting problem. Please, help me out. And, please use table for bank reconcilation

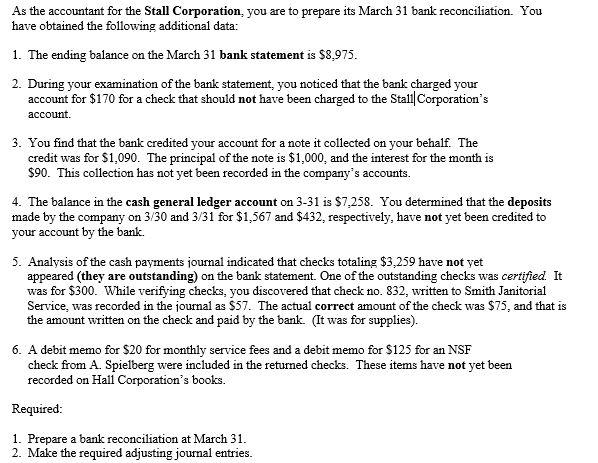

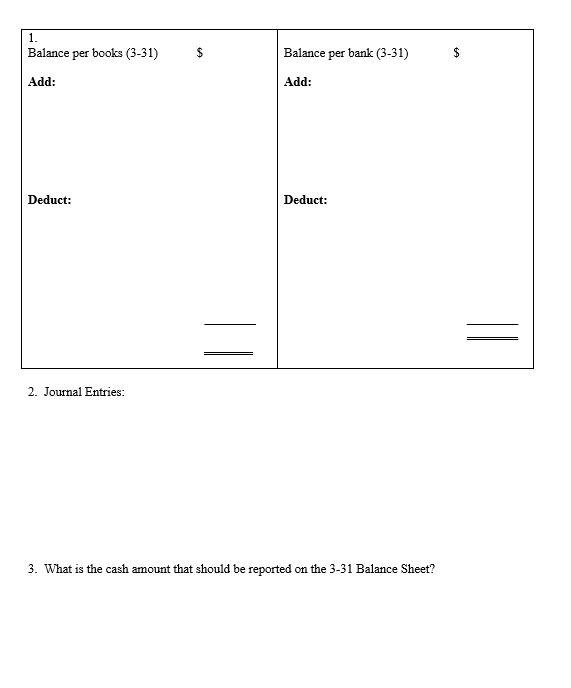

As the accountant for the Stall Corporation, you are to prepare its March 31 bank reconciliation. You have obtained the following additional data: 1. The ending balance on the March 31 bank statement is $8,975. 2. During your examination of the bank statement, you noticed that the bank charged your account for $170 for a check that should not have been charged to the Stall Corporation's account. 3. You find that the bank credited your account for a note it collected on your behalf. The credit was for $1,090. The principal of the note is $1,000, and the interest for the month is $90. This collection has not yet been recorded in the company's accounts. 4. The balance in the cash general ledger account on 3-31 is $7,258. You determined that the deposits made by the company on 3/30 and 3/31 for $1,567 and $432, respectively, have not yet been credited to your account by the bank. 5. Analysis of the cash payments journal indicated that checks totaling $3,259 have not yet appeared (they are outstanding) on the bank statement. One of the outstanding checks was certified. It was for $300. While verifying checks, you discovered that check no. 832, written to Smith Janitorial Service, was recorded in the journal as $57. The actual correct amount of the check was $75, and that is the amount written on the check and paid by the bank. (It was for supplies). 6. A debit memo for $20 for monthly service fees and a debit memo for $125 for an NSF check from A. Spielberg were included in the returned checks. These items have not yet been recorded on Hall Corporation's books. Required: 1. Prepare a bank reconciliation at March 31. 2. Make the required adjusting journal entries. 1. Balance per books (3-31) Balance per bank (3-31) Add: Add: Deduct: Deduct: 2. Journal Entries: 3. What is the cash amount that should be reported on the 3-31 Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts