Question: I NEED Help with adjusting entries! I AM NOT SURE WHICH ACCOUNTS TO DEBIT OR CREDIT. C 1 1 . 1 0 . 2 Adjusting

I NEED Help with adjusting entries! I AM NOT SURE WHICH ACCOUNTS TO DEBIT OR CREDIT.

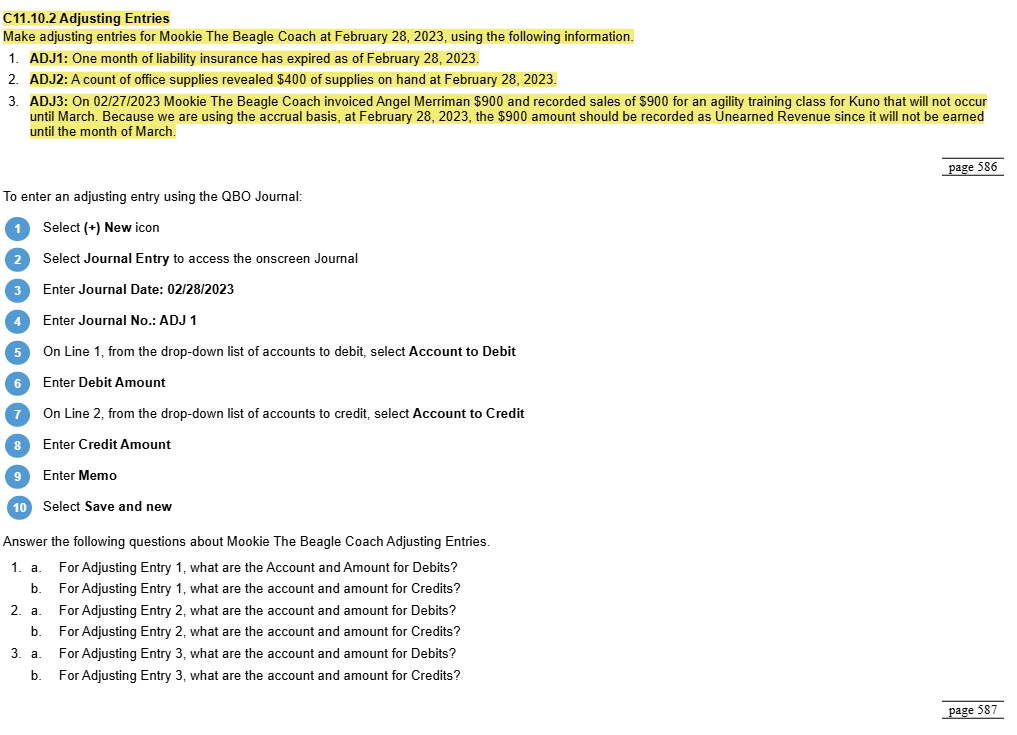

C Adjusting Entries Make adjusting entries for Mookie The Beagle Coach at February using the following information. ADJ: One month of liability insurance has expired as of February ADJ: A count of office supplies revealed $ of supplies on hand at February ADJ: On Mookie The Beagle Coach invoiced Angel Merriman $ and recorded sales of $ for an agility training class for Kuno that will not occur until March. Because we are using the accrual basis, at February the $ amount should be recorded as Unearned Revenue since it will not be earned until the month of March. To enter an adjusting entry using the QBO Journal: Select New icon Select Journal Entry to access the onscreen Journal Enter Journal Date: Enter Journal No: ADJ On Line from the dropdown list of accounts to debit, select Account to Debit Enter Debit Amount On Line from the dropdown list of accounts to credit, select Account to Credit Enter Credit Amount Enter Memo Select Save and new Answer the following questions about Mookie The Beagle Coach Adjusting Entries. a For Adjusting Entry what are the Account and Amount for Debits? b For Adjusting Entry what are the account and amount for Credits? a For Adjusting Entry what are the account and amount for Debits? b For Adjusting Entry what are the account and amount for Credits? a For Adjusting Entry what are the account and amount for Debits? b For Adjusting Entry what are the account and amount for Credits?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock