Question: I need help with all. I am confused. Plz help me fill in all blanks Excel Activity: Evaluating Risk and Return Bartman Industries's and Reynolds

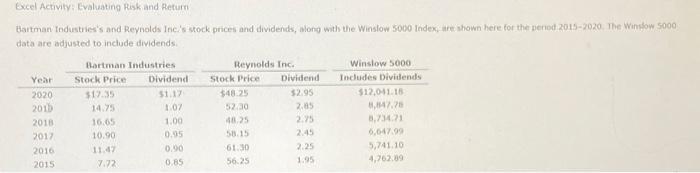

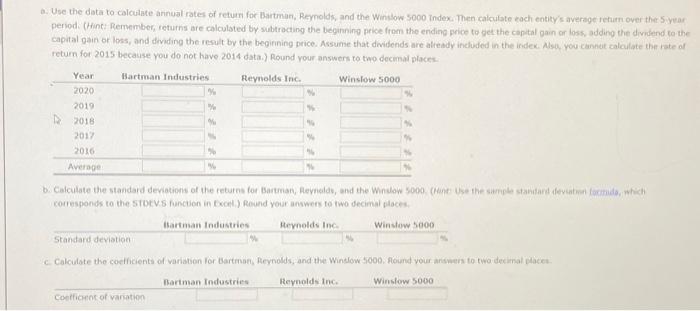

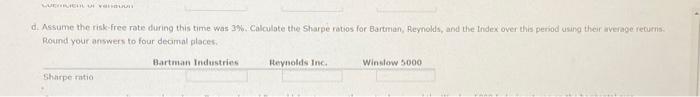

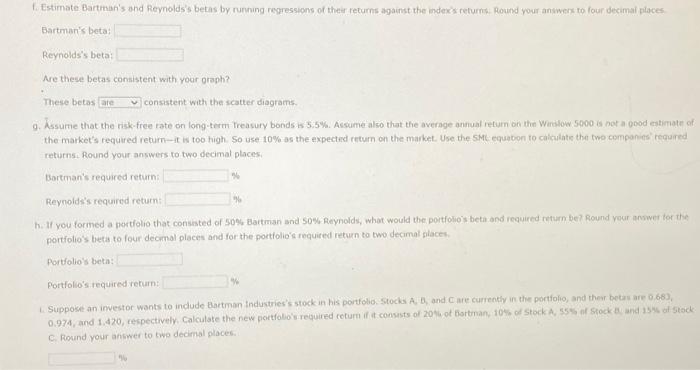

Excel Activity: Evaluating Risk and Return Bartman Industries's and Reynolds Inc's stock prices and dividends, wlong with the Winslow 5000 Index; are shown here for the penod 2015 -2020. The Wankow 5000 data are adjusted to include dividends: Bartman's beta: Reynolds's beta: Are these betas consistent with your oraph? These betas consistent with the scatter diagrams. 9. Assume that the risk-free tate on long-term treasury bonds is 3.5%. Assume also that the average annual retum on thin Winalow 5000 is not a good estimate of the market's required return-it is too high. So use 10% as the expected return on the market. Use the sMt equabon to calculate the two companies' requred returnsi Round your answers to two decimal places. Bortman's required return: Revnolds's required return: h. If you formed a portfolio that consisted of 50% Bartman and 50% Reynolds, whot would the portfohos beta and required return be? Round vour arvwer for the portiolio's theta to four decinal places and for the portiolio's required return to two decimal places. Portfolio's beta: Portfolio's required return: 1. Suppose an investor wants to indude Bactman Industries's stock in his porfolio. Stocks A, 6, and C are currenthy in the portfolio, and thear betri are 0.683 , C. Round your antwer to two decimal places. a. Use the data to calculate annual rates of return for Bartmin, Reymolds, and the Winslow S000 Tndex. Then calculate each entity's average tefurn over the 5 iyear. period. (Hint: Rernember, returns are calculated by subtrocting the beginning price from the ending price to gee the capital gain or foss, adding the dividend to the capital gain or loss, and dividing the result by the begirning price. Assume that diwidends are aleady included in the index. Nsa, You canneut calculate the rate of return for 2015 because you do not have 2014 data.) Round your answers to two decimal places. corresponds to the stotv.s function in tecet.) Round your answers to two decimal places. d. Assume the risk-free rate during this time was 3%. Calculate the Sharpe ratios for Bartman, Reynolds, and the thidex over this period using their iverage returns: Round your answers to four decamal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts