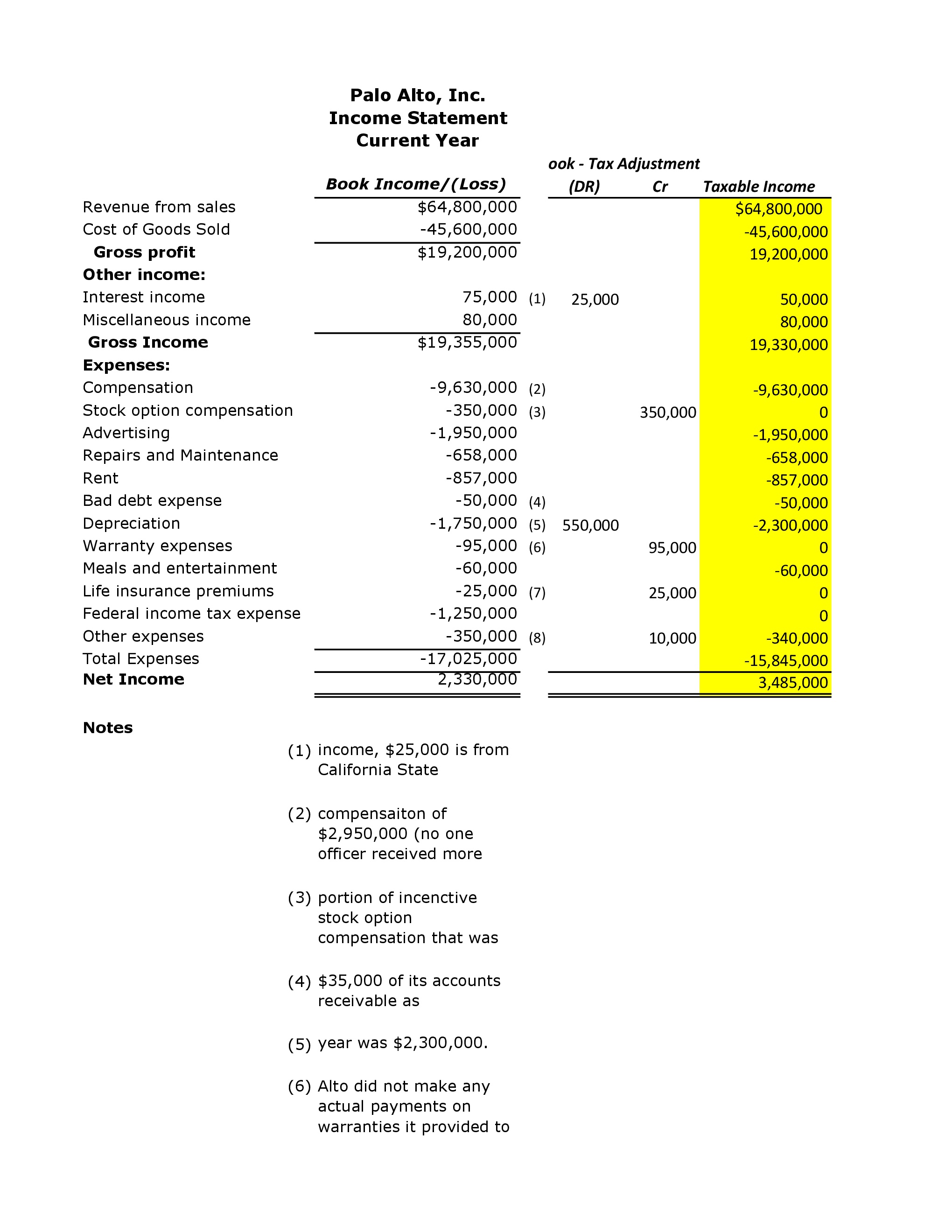

Question: I need help with assignment based on the book income to taxable income reconciliation use the attached spreadsheet to complete Palo Alto's Schedule M-1. Based

I need help with assignment based on the book income to taxable income reconciliation use the attached spreadsheet to complete Palo Alto's Schedule M-1. Based on the highlighted section fill the Schedule M-1 Sheet using recent tax laws

Revenue from sales Cost of Goods Sold Gross profit Other income: Interest income Miscellaneous income Gross Income Expenses: Compensation Stock option compensation Advertising Repairs and Maintenance Rent Bad debt expense Depreciation Warranty expenses Meals and entertainment Life insurance premiums Federal income tax expense Other expenses Total Expenses Net Income Notes Palo Alto, Inc. Income Statement Current Year Book Income/(Loss) $64,800,000 -45,600,000 $19,200,000 75,000 80,000 $19,355,000 -9,630,000 -350,000 -1,950,000 658,000 -857,000 -50,000 -1,750,000 -95,000 -60,000 -25,000 -1,250,000 -350,000 -17,025,000 2'33 Eli ii (1) income, $25,000 is from California State (2) compensaiton of $2,950,000 (no one officer received more (3) portion of incenctive stock option compensation that was (4) $35,000 of its accounts receivable as (5) year was $2,300,000. (6) Alto did not make any actual payments on warranties it provided to (1) (2) (3) (4) (5) (6) (7) (8) aok - Tax Adjustment (DR) 25,000 550,000 Cr 350,000 95,000 25,000 10,000 Taxable Income $64,800,000 -45, 600,000 19, 200,000 50,000 80,000 19,330,000 -9,630,000 0 -1,950,000 -658,000 -857,000 -50,000 -2,300,000 0 -60,000 0 0 -340,000 -15,845,000 3,485,000