Question: I need help with ( b ) & ( c ) please. Carla Vista Company was incorporated in Delaware in 2 0 1 7 .

I need help with b & c please.

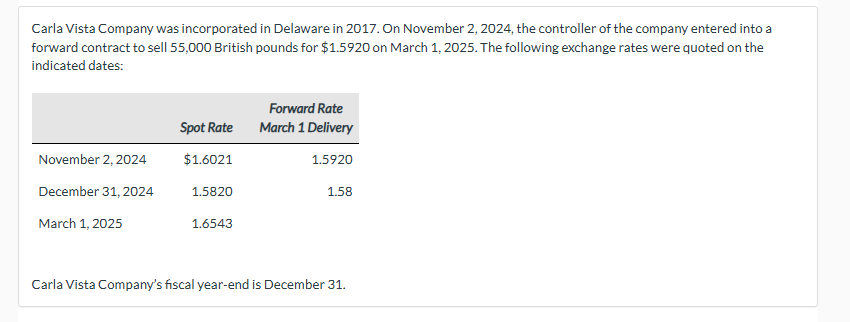

Carla Vista Company was incorporated in Delaware in On November the controller of the company entered into a

forward contract to sell British pounds for $ on March The following exchange rates were quoted on the

indicated dates:

Carla Vista Company's fiscal yearend is December

Assume that the forward contract was entered into as a hedge against an exposed foreign currency receivable balance in the

amount of Prepare the journal entries that would be made by Carla Vista Company on the dates listed below. Credit

account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No entry" for

the account titles and enter for the amounts. Round answers to decimal places, eg List all debit entries before credit entries.

November to record the sale of the goods on account for and to record the forward contract.

December to adjust the accounts related to the exposed asset and forward contract at fiscal yearend.

March to adjust the accounts related to the exposed asset and forward contract and to record the settlement of the

receivable and delivery of the pounds to the exchange dealer.

Sales

To record sales

Dollars Receivable from Exchange Dealer

FC Payable to Exchange Dealer

To record the forward contract

Transaction Loss

Accounts Receivable

To record gain or loss on accounts receivable

To record gain or loss on foreign currency

Transaction Gain

To record gain or loss on accounts receivable

FC Payable to Exchange Dealer

To record gain or loss on foreign currency

Accounts Receivable

To record settlement of accounts receivable

FC Payable to Exchange Dealer

Dollars Receivable from Exchange Dealer

To record receipt from exchange dealer and payment

of foreign currency

b

Assume that the controller indicated on November that the forward contract was acquired as a hedge of a future foreign

currency transaction that is a commitment of Carla Vista to sell inventory for on March Carla Vista Company

designates this hedge as a fair value hedge of an unrecognized firm commitment. Prepare the journal entries related to the

forward contract and commitment to sell inventory that would be made by Carla Vista Company on November December

and March Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required,

select No entry" for the account titles and enter for the amounts. Round answers to decimal places, eg List all debit entries

before credit entries.

c

Assume that the contract was entered into to speculate in future exchange rate fluctuations. Prepare the journal entries that

would be made by Carla Vista Company on November December and March Credit account titles are automatically

indented when the amount is entered. Do not indent manually. If no entry is required, select No entry" for the account

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock