Question: I need help with both entries, the 500 is wrong, i dont now why Exercise 10-10 (Algo) Bond retirement by call option LO P4 Tyrell

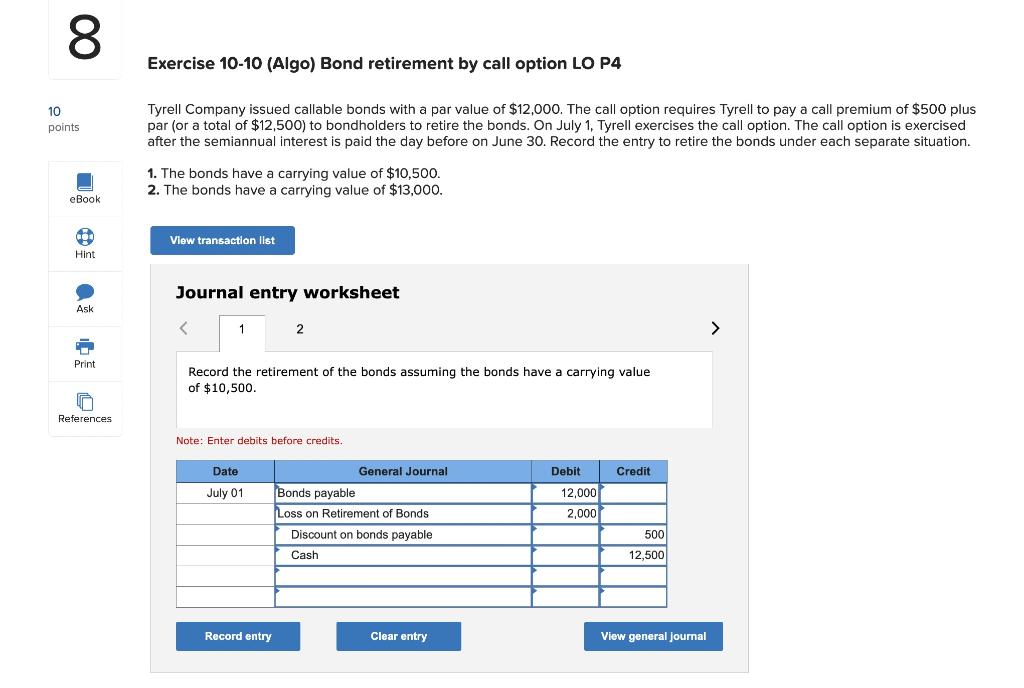

I need help with both entries, the 500 is wrong, i dont now why

Exercise 10-10 (Algo) Bond retirement by call option LO P4 Tyrell Company issued callable bonds with a par value of $12,000. The call option requires Tyrell to pay a call premium of $500 plus par (or a total of $12,500 ) to bondholders to retire the bonds. On July 1 , Tyrell exercises the call option. The call option is exercised after the semiannual interest is paid the day before on June 30 . Record the entry to retire the bonds under each separate situation. 1. The bonds have a carrying value of $10,500. 2. The bonds have a carrying value of $13,000. Journal entry worksheet Record the retirement of the bonds assuming the bonds have a carrying value of $10,500. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts