Question: I need help with C, please! D&R Corp. has annual revenues of $282,000, an average contribution margin ratio of 34%, and fixed expenses of $118,100.

I need help with C, please!

D&R Corp. has annual revenues of $282,000, an average contribution margin ratio of 34%, and fixed expenses of $118,100. Required:

- Management is considering adding a new product to the company's product line. The new item will have $9.4 of variable costs per unit. Calculate the selling price that will be required if this product is not to affect the average contribution margin ratio.

- If the new product adds an additional $29,600 to D&R's fixed expenses, how many units of the new product must be sold at the price calculated in part a to break even on the new product?

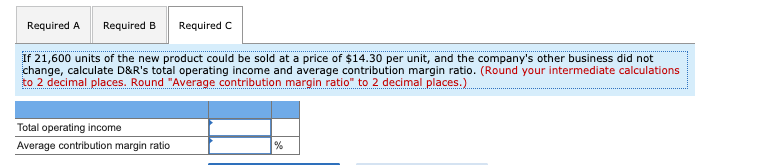

- If 21,600 units of the new product could be sold at a price of $14.3 per unit, and the company's other business did not change, calculate D&R's total operating income and average contribution margin ratio.

Required A Required B Required C If 21,600 units of the new product could be sold at a price of $14.30 per unit, and the company's other business did not change, calculate D&R's total operating income and average contribution margin ratio. (Round your intermediate calculations to 2 decimal places. Round "Average contribution margin ratio" to 2 decimal places.) Total operating income Average contribution margin ratio %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts