Question: **I NEED HELP WITH CALCULATING THE AMORTIZATION EXPENSE FOR YEARS 1 & 3 ONLY** Problem 15-25 (Algo) Operating lease; uneven lease payments [LO15-4, 15-7] On

**I NEED HELP WITH CALCULATING THE AMORTIZATION EXPENSE FOR YEARS 1 & 3 ONLY**

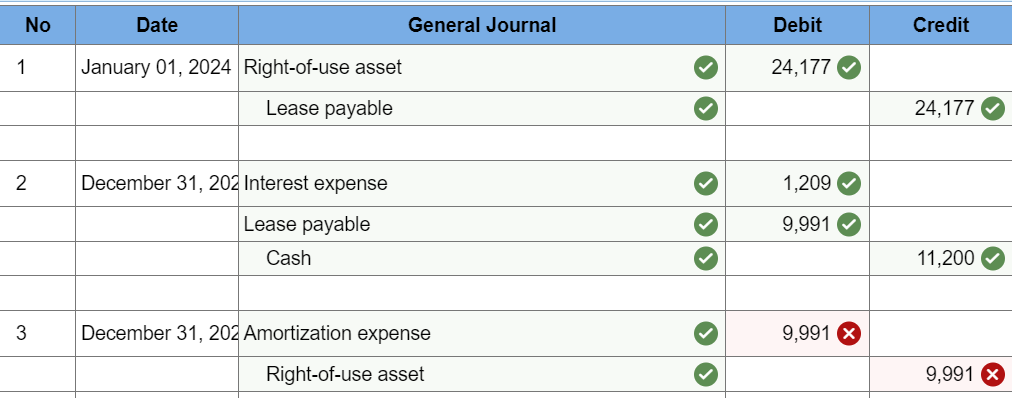

Problem 15-25 (Algo) Operating lease; uneven lease payments [LO15-4, 15-7]

On January 1, 2024, Harlon Consulting entered into a three-year lease for new office space agreeing to lease payments of: $11,200 in 2024, $8,800 in 2025 and $6,400 in 2026. Payments are due on December 31 of each year with the first payment being made on December 31, 2024. Harlon is aware that the lessor used a 5% interest rate when calculating lease payments.

Required:

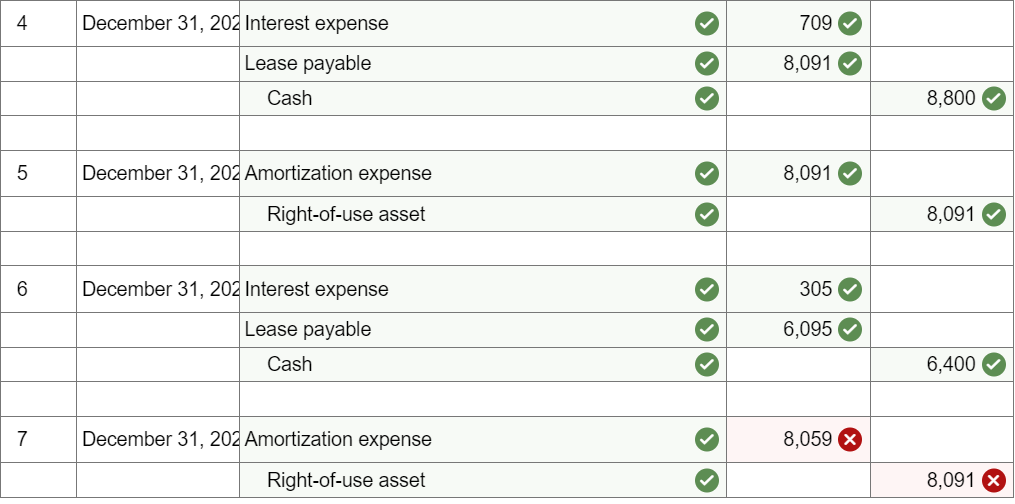

1-4. Prepare the appropriate entries for Harlon Consulting on January 1, 2024, December 31, 2024, 2025 and 2026 to record the lease.

Note: Use tables, Excel, or a financial calculator. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to nearest whole dollar. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

**I NEED HELP WITH CALCULATING THE AMORTIZATION EXPENSE FOR YEARS 1 & 3 ONLY**

**I NEED HELP WITH CALCULATING THE AMORTIZATION EXPENSE FOR YEARS 1 & 3 ONLY**PLEASE EXPLAIN

\begin{tabular}{|c|c|c|c|c|c|} \hline No & Date & \multicolumn{2}{|c|}{ General Journal } & Debit & Credit \\ \hline \multirow[t]{2}{*}{1} & January 01, 2024 & Right-of-use asset & & 24,177 & \\ \hline & & Lease payable & 2 & & 24,177 \\ \hline \multirow[t]{3}{*}{2} & December 31, 202 & Interest expense & & 1,209 & \\ \hline & & Lease payable & & 9,991 & \\ \hline & & Cash & & & 11,200 \\ \hline \multirow[t]{2}{*}{3} & December 31, 202 & Amortization expense & & 9,991 & \\ \hline & & Right-of-use asset & 2 & & 9,991 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline 4 & December 31, 202 & Interest expense & & 709 & \\ \hline & & Lease payable & 2 & 8,091 & \\ \hline & & Cash & 2 & & 8,800 \\ \hline 5 & December 31, 202 & Amortization expense & & 8,091 & \\ \hline & & Right-of-use asset & 2 & & 8,091 \\ \hline 6 & December 31, 202 & Interest expense & & 305 & \\ \hline & & Lease payable & 2 & 6,095 & \\ \hline & & Cash & 2 & & 6,400 \\ \hline 7 & December 31, 202 & Amortization expense & & 8,059 & \\ \hline & & Right-of-use asset & 2 & & 8,091 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts