Question: i need help with E through H please. i included answers to the first few questions 5. A firm can sell 15,000 units per year

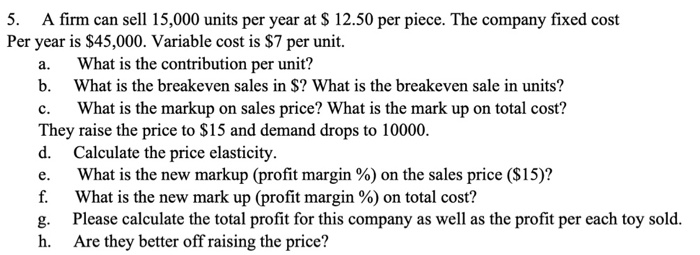

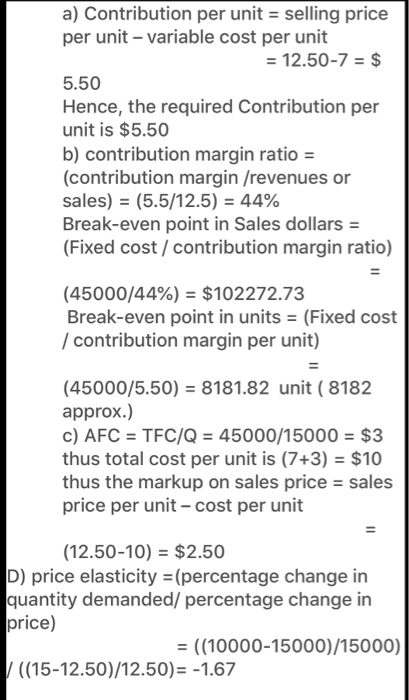

5. A firm can sell 15,000 units per year at $ 12.50 per piece. The company fixed cost Per year is $45,000. Variable cost is $7 per unit. a. What is the contribution per unit? b. What is the breakeven sales in $? What is the breakeven sale in units? c. What is the markup on sales price? What is the mark up on total cost? They raise the price to $15 and demand drops to 10000. d. Calculate the price elasticity. e. What is the new markup (profit margin %) on the sales price ($15)? f. What is the new mark up (profit margin %) on total cost? Please calculate the total profit for this company as well as the profit per each toy sold. h. Are they better off raising the price? a) Contribution per unit = selling price per unit - variable cost per unit = 12.50-7 = $ 5.50 Hence, the required Contribution per unit is $5.50 b) contribution margin ratio = (contribution margin /revenues or sales) = (5.5/12.5) = 44% Break-even point in Sales dollars = (Fixed cost / contribution margin ratio) (45000/44%) = $102272.73 Break-even point in units = (Fixed cost / contribution margin per unit) (45000/5.50) = 8181.82 unit ( 8182 approx.) c) AFC = TFC/Q = 45000/15000 = $3 thus total cost per unit is (7+3) = $10 thus the markup on sales price = sales price per unit - cost per unit (12.50-10) = $2.50 D) price elasticity =(percentage change in quantity demanded/ percentage change in price) = ((10000-15000)/15000) ((15-12.50)/12.50)= -1.67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts