Question: I need help with EXERCISE 6-5, please. Exercise 6-5 Perpetual: Gross profit effects of inventory methods A1 Use the data in Exercise 6-3 to compute

I need help with EXERCISE 6-5, please.

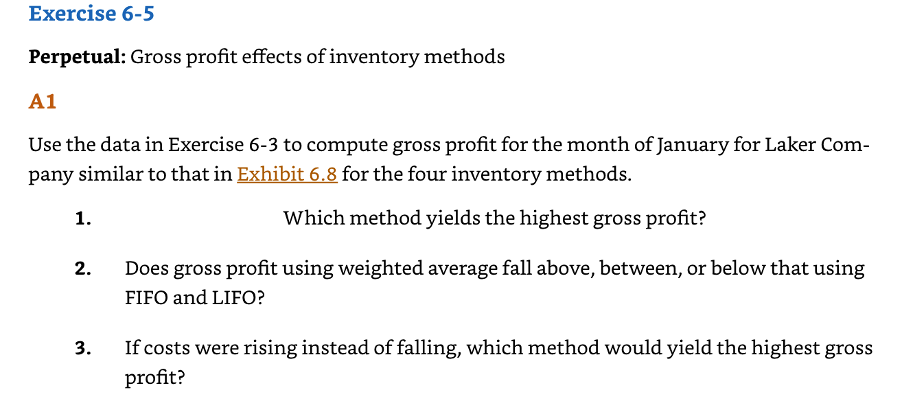

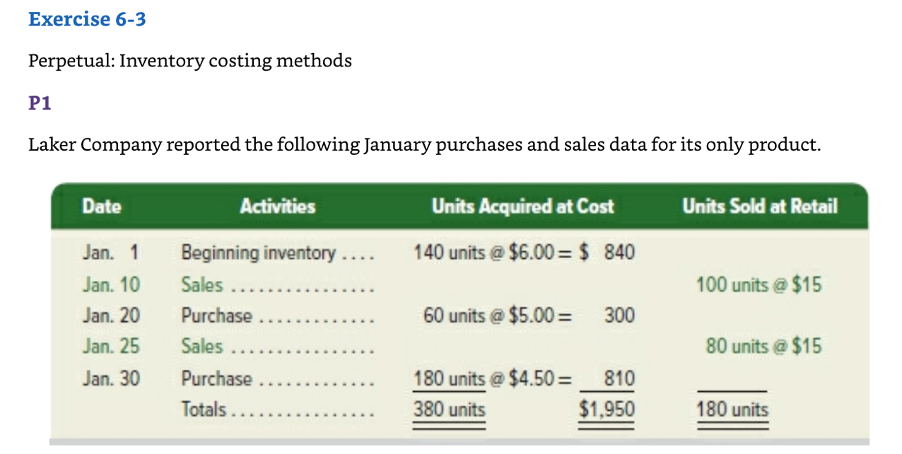

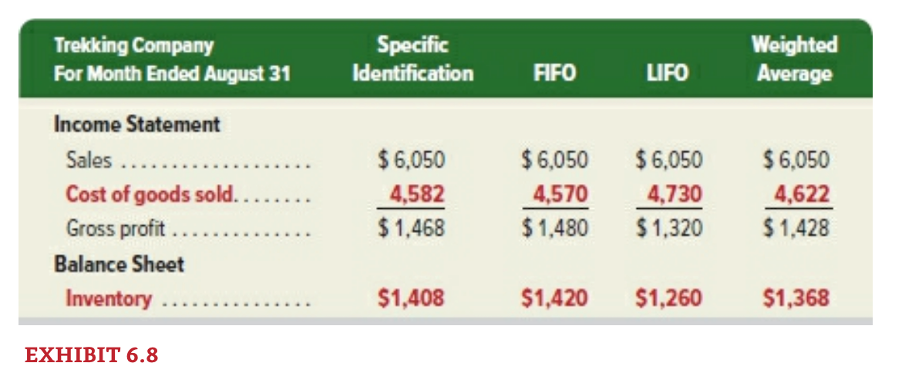

Exercise 6-5 Perpetual: Gross profit effects of inventory methods A1 Use the data in Exercise 6-3 to compute gross profit for the month of January for Laker Com- pany similar to that in Exhibit 6.8 for the four inventory methods. 1. Which method yields the highest gross profit? 2. Does gross profit using weighted average fall above, between, or below that using FIFO and LIFO? 3. If costs were rising instead of falling, which method would yield the highest gross profit? Exercise 6-3 Perpetual: Inventory costing methods P1 Laker Company reported the following January purchases and sales data for its only product. Date Activities Units Sold at Retail Units Acquired at Cost 140 units @ $6.00 = $ 840 100 units @ $15 Jan. 1 Jan. 10 Jan. 20 Jan. 25 Jan. 30 60 units @ $5.00= 300 Beginning inventory .... Sales. Purchase .. Sales .. Purchase Totals ... 80 units @ $15 180 units @ $4.50= 810 380 units $1.950 180 units Trekking Company For Month Ended August 31 Specific Identification Weighted Average FIFO LIFO Income Statement Sales ..... Cost of goods sold.... Gross profit ...... Balance Sheet Inventory $6,050 4,582 $1,468 $6,050 4,570 $1,480 $6,050 4,730 $1,320 $6,050 4,622 $1,428 $1,408 $1,420 $1,260 $1,368 EXHIBIT 6.8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts