Question: i need help with figuring this question out Q) Suppose a fim has 32.70 million shares of common stock outstanding at a price of $42.89

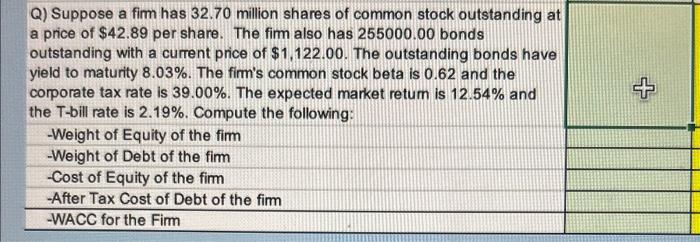

Q) Suppose a fim has 32.70 million shares of common stock outstanding at a price of $42.89 per share. The fim also has 255000.00 bonds outstanding with a current price of $1,122.00. The outstanding bonds have yield to maturity 8.03%. The firm's common stock beta is 0.62 and the corporate tax rate is 39.00%. The expected market retum is 12.54% and the T-bill rate is 2.19%. Compute the following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts