Question: I need help with filling out this spreadsheet 1 Time 2. 3 4 5 6 7 8 9 10 11 12 B SASMX US Equity

I need help with filling out this spreadsheet

I need help with filling out this spreadsheet

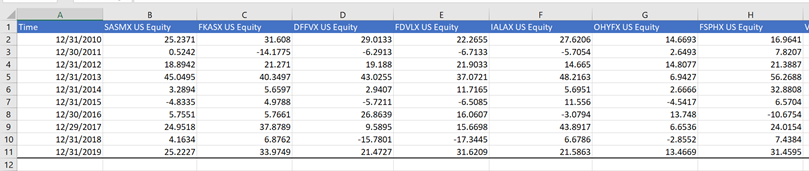

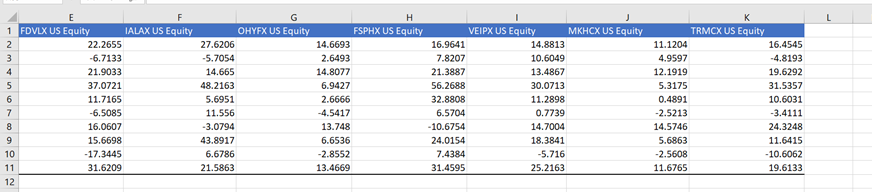

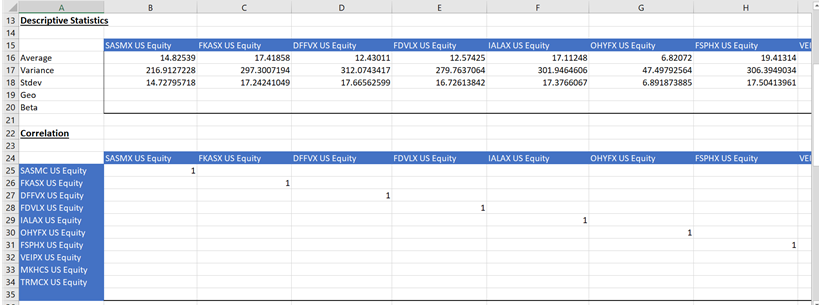

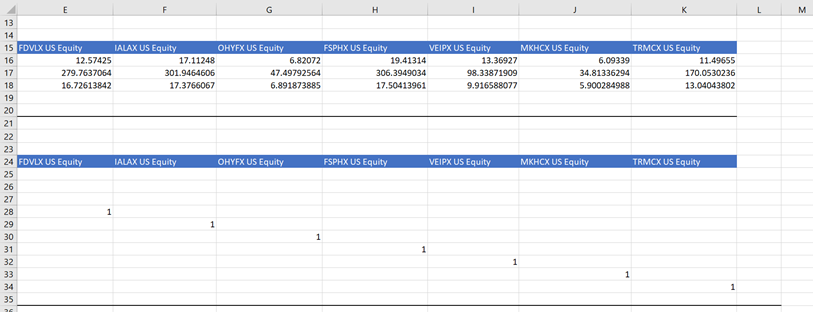

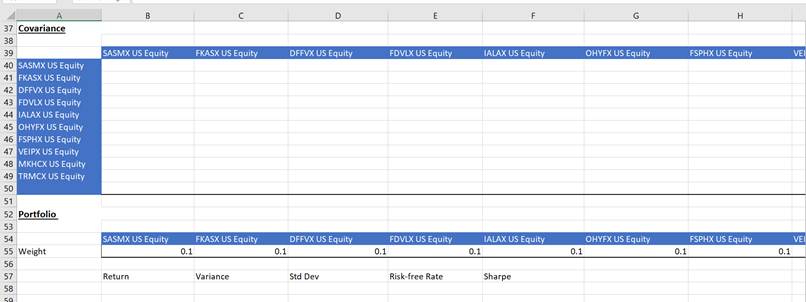

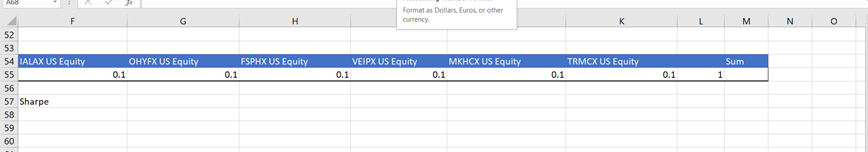

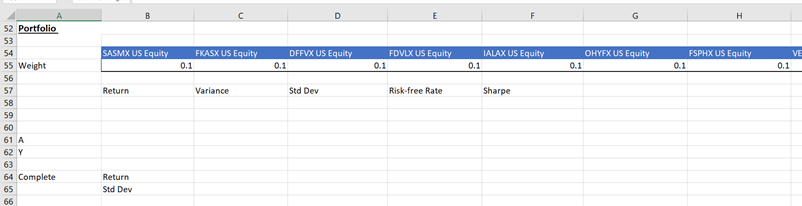

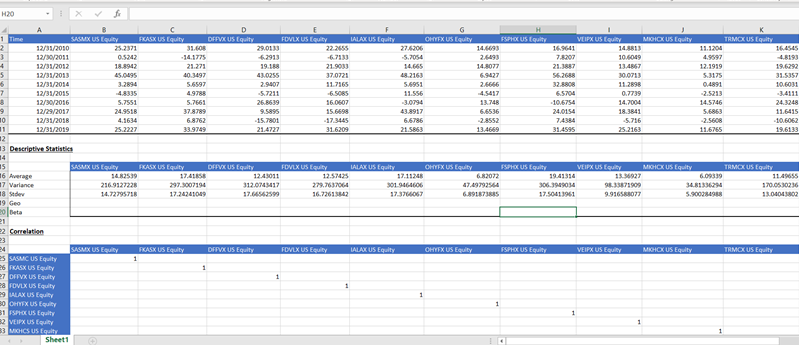

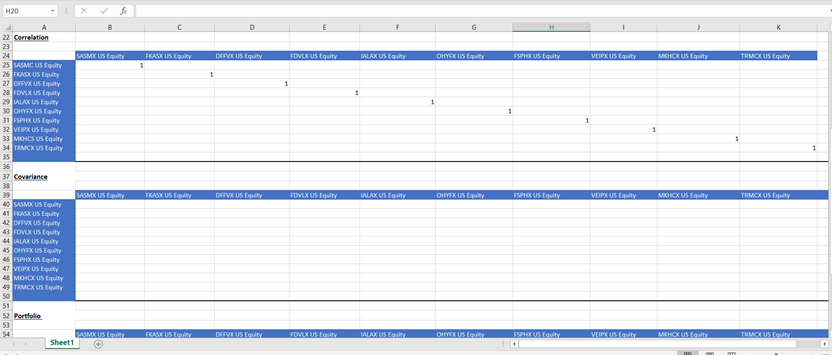

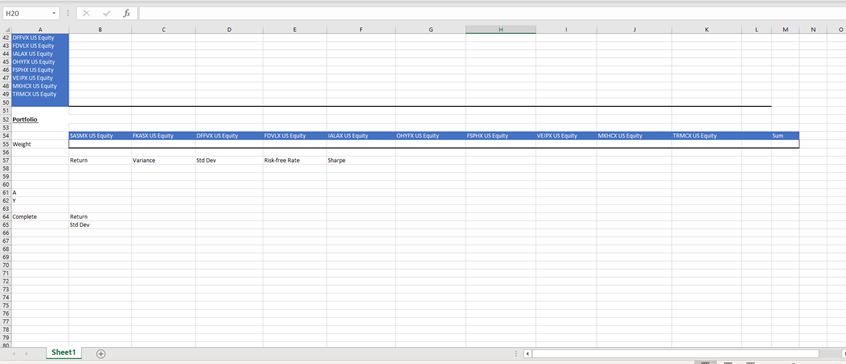

1 Time 2. 3 4 5 6 7 8 9 10 11 12 B SASMX US Equity FKASX US Equity DFFVX US Equity FDVLX US Equity IALAX US Equity 12/31/2010 25.2371 31.608 29.0133 22.2655 12/30/2011 0.5242 - 14.1775 -6.2913 -6.7133 12/31/2012 18.8942 21.271 19.188 21.9033 12/31/2013 45.0495 40.3497 43.0255 37.0721 12/31/2014 3.2894 5.6597 2.9407 11.7165 12/31/2015 -4.8335 4.9788 -5.7211 -6.5085 12/30/2016 5.7551 5.7661 26.8639 16.0607 12/29/2017 24.9518 37.8789 9.5895 15.6698 12/31/2018 4.1634 6.8762 - 15.7801 - 17.3445 12/31/2019 25.2227 33.9749 21.4727 31.6209 G OHYFX US Equity 27.6206 -5.7054 14.665 48.2163 5.6951 11.556 -3.0794 43.8917 6.6786 21.5863 FSPHX US Equity 14.6693 16.9641 2.6493 7.8207 14.8077 21.3887 6.9427 56.2688 2.6666 32.8808 -4.5417 6.5704 13.748 -10.6754 6.6536 24.0154 -2.8552 7.4384 13.4669 31.4595 E 1 FDVLX US Equity IALAX US Equity 2 22.2655 3 -6.7133 4 21.9033 5 37.0721 6 11.7165 7 -6.5085 8 16.0607 9 15.6698 10 -17.3445 11 31.6209 12 G OHYFX US Equity 27.6206 -5.7054 14.665 48.2163 5.6951 11.556 -3.0794 43.8917 6.6786 21.5863 H FSPHX US Equity VEIPX US Equity MKHCX US Equity 14.6693 16.9641 14.8813 2.6493 7.8207 10.6049 14.8077 21.3887 13.4867 6.9427 56.2688 30.0713 2.6666 32.8808 11.2898 -4.5417 6.5704 0.7739 13.748 -10.6754 14.7004 6.6536 24.0154 18.3841 -2.8552 7.4384 -5.716 13.4669 31.4595 25.2163 TRMCX US Equity 11.1204 16.4545 4.9597 -4.8193 12.1919 19.6292 5.3175 31.5357 0.4891 10.6031 -2.5213 -3.4111 14.5746 24.3248 5.6863 11.6415 -2.5608 -10.6062 11.6765 19.6133 B D E G H 13 Descriptive Statistics 14 SASMX US Equity FKASX US Equity DFFVX US Equity 15 IALAX US Equity VEI FDVLX US Equity OHYFX US Equity FSPHX US Equity 14.82539 16 Average 17.41858 12.43011 12.57425 17.11248 6.82072 19,41314 17 Variance 216.9127228 297.3007194 312.0743417 279.7637064 301.9464606 47.49792564 306.3949034 18 Stdev 14.72795718 17.24241049 17.66562599 16.72613842 17.3766067 6.891873885 17.50413961 19 Geo 20 Beta 21 22 Correlation 23 24 SASMX US Equity FKASX US Equity DFFVX US Equity FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VEI 25 SASMC US Equity 1 26 FKASX US Equity 1 27 DFFVX US Equity 1 28 FDVLX US Equity 1 1 29 IALAX US Equity 1 30 OHYFX US Equity 1 31 FSPHX US Equity 32 VEIPX US Equity 33 MKHCS US Equity 34 TRMCX US Equity 35 L M E H 13 14 15 FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VEIPX US Equity MKHCX US Equity TRMCX US Equity 16 12.57425 17.11248 6.82072 19.41314 13.36927 6.09339 11.49655 17 279.7637064 301.9464606 47.49792564 306.3949034 98.33871909 34.81336294 170.0530236 18 16.72613842 17.3766067 6.891873885 17.50413961 9.916588077 5.900284988 13.04043802 19 20 21 22 23 24 FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VEIPX US Equity MKHCX US Equity TRMCX US Equity 25 26 27 28 1 29 1 30 1 31 1 32 1 33 1 34 1 35 B D E F G H SASMX US Equity FKASX US Equity DFFVX US Equity FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VEI 37 Covariance 38 39 40 SASMX US Equity 41 FKASX US Equity 42 DFFVX US Equity 43 FDVLX US Equity 44 IALAX US Equity 45 OHYFX US Equity 46 FSPHX US Equity 47 VEIPX US Equity 48 MKHCX US Equity 49 TRMCX US Equity 50 51 52 Portfolio 53 54 55 Weight 56 57 58 SASMX US Equity FKASX US Equity DFFVX US Equity FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VEI 0.1 0.1 0.1 0.1 0.1 0.1 0.1 Return Variance Std Dev Risk-free Rate Sharpe 59 Abo Formatas Dollars, Euros, or other Currency H K M N o VEIPX US Equity MKHCX US Equity OHYFX US Equity 0.1 FSPHX US Equity 0.1 TRMCX US Equity 0.1 Sum 1 0.1 0.1 0.1 52 53 54 IALAX US Equity 55 56 57 Sharpe 58 59 60 B D E F G H SASMX US Equity FKASX US Equity FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VE DFFVX US Equity 0.1 0.1 0.1 0.1 0.1 0.1 0.1 Return Variance Std Dev Risk-free Rate Sharpe 52 Portfolio 53 54 55 Weight 56 57 58 59 60 61 A 62 Y 63 64 Complete 65 66 Return Std Dev H20 MOIXUS Equity TRMOUS Equity A 1 Time SAMX USE 2 12/31/2010 > 12/30/2011 4 12/31/2012 5 12/31/2013 12/31/2014 7 12/31/2015 12/30/2016 9 12/29/2017 00 12/31/2018 11 12/31/2019 12 13 Descriptive Statistica D G FASX US Equity DFFUS Equity FOVLX US Equity IALAKUS Equity OHTEX US Equity SPIKUS Equity VEIFXUS IS 25.2371 31.608 29.0133 22.2655 27.6206 16.9641 0.5242 -14.1775 -5.7054 2.6493 7.8207 18.8942 21.271 19.1 21.9033 14.8077 21.382 45.0095 40. 1497 43.0255 370723 49.2163 5626 3.2894 5.6597 2.9407 11.7165 5.6951 2.6666 -48115 4.9780 5.7211 -6.5085 11.556 4.5417 6.5704 5.7951 5.7661 26.0539 16.0607 -3.0794 13.748 -106754 24.951B 37 8789 9.5895 15.6698 43.8917 6,6536 24.0154 6.8762 15.7801 - 17.3445 6.6786 -2.8552 25.2227 33.9749 21.4727 31.6209 21.5853 13.4649 31.4545 19.6292 31.5357 10.6031 10.6049 11.4857 30.0713 11.2898 0.7739 14.2004 18.3841 -5.716 25. 2163 4.9597 12.1919 5.3175 0.4891 -2.5213 14.5746 5.6863 24.3248 11.6415 10.6062 19.6133 11.6765 15 6 Average 17 Variance 18 de 19 Geo 20 Beta SASMX US Euty FKASX US Equity DEFVXUS Egally FONLX Us Equity IALAKUS Equity OHTEX US Equity ESPROKUS Equity VEIFXUS Luty MICHOX US Equity TAMOUS Equity 14.62539 17.45656 12.43011 12.57425 17.11248 6.62072 19.49314 13.927 6.09339 216,9127228 297.5007194 312.0M3417 279.7637064 3019464606 47.49792564 3063999034 34.813 170.0530236 14.72795718 17.24241049 16.72615342 17.3766067 6.891873885 9.916580072 5.90084938 13.040402 Correlation FKASX US Equity DFVXUS Egy FDMX US Equity IALAXUS Equity OHVEX US Equity FSPROUS Equity VEIFX US Equity MOUS Equity TRMOUS Equity 1 1 24 SASMX US Equity ES SASMC US Equity es FKASK US Equity 27 DFFVX US Equity 28 FOVLX US Equity 9 LAX US Equity BOOTEX US Equity 31FSPROUS Equity B2 VEIFX US EQUITY 33 MHCS US Equity Sheet1 1 1 1 1 1 H20 f SASMX US Equity FKASKUS Equity DESVX US Equity FDVLX US Equity IALAX US Equity OHYEXUS Equity FSPHXUS Equity VEIPXUS Equity MHCX US Equity TRMEXUS Equity 1 22 Correlation 23 24 25 SASMC US Equity 26 FKASKUS Equity 27 DFVX US Equity 28 FOVUXUS Equity 29 IALAX US Equity 30 OHYEX US Equity 31 FSP XUS Equity 32 VEIPX USER 33 MHCS US Equity 34 TRMCX US Equity 35 1 1 1 1 37 Covariance FRASX US Equity DEFVX US Equity FOMEXUS Equity LALAX US Equity OHYEXUS Equity FSPIKUS Equity VUIPX US Equity MIX US Equity TRMOX US Equity SASMX US County 40 SASMUS EY 41 FKASKUS Equity 42 DRIVX US Equity 43 FOVEX Us Equity 44 IALAX USER 45 OHYEXUS Equity 46 FSPHX US Equity 47 VIPX US Equity 43 MHCUS Equity 49 TRMOX US Equity 50 51 52 Portfolio 53 SASMX USE Sheet1 FKASKUS Equity DEIVAUS Fauty FOMUXUS Eody IALAX US Eur OHYEX US Equity ESPHORUS Equity VEIPX US Cody MICHOX USE TRMOX Cody H20 f M N O 42 DFPVXUS Equity 43 FOVUXUS 44 ALAKUS Equity 45 OHEX USE 46 SPUS Equity 47 VEXUS Equity MOROUS Equity 10 TRMOGUS 52 SASME USE FABX US Equity DRIVXUS EQUEY FOVUXUS Equity DALAX USE CHYFXUS Equity FSHOKUSEY VEIFXUS EQUE MOHOUSE TRMOLUS Equity 54 55 Weigte 56 57 Retur Variance 5d Dev Risk free Rate Sharpe 50 39 00 61 A 62 64 Complete 66 Retur Sed Dev 73 T 7 77 78 Sheet1 1 Time 2. 3 4 5 6 7 8 9 10 11 12 B SASMX US Equity FKASX US Equity DFFVX US Equity FDVLX US Equity IALAX US Equity 12/31/2010 25.2371 31.608 29.0133 22.2655 12/30/2011 0.5242 - 14.1775 -6.2913 -6.7133 12/31/2012 18.8942 21.271 19.188 21.9033 12/31/2013 45.0495 40.3497 43.0255 37.0721 12/31/2014 3.2894 5.6597 2.9407 11.7165 12/31/2015 -4.8335 4.9788 -5.7211 -6.5085 12/30/2016 5.7551 5.7661 26.8639 16.0607 12/29/2017 24.9518 37.8789 9.5895 15.6698 12/31/2018 4.1634 6.8762 - 15.7801 - 17.3445 12/31/2019 25.2227 33.9749 21.4727 31.6209 G OHYFX US Equity 27.6206 -5.7054 14.665 48.2163 5.6951 11.556 -3.0794 43.8917 6.6786 21.5863 FSPHX US Equity 14.6693 16.9641 2.6493 7.8207 14.8077 21.3887 6.9427 56.2688 2.6666 32.8808 -4.5417 6.5704 13.748 -10.6754 6.6536 24.0154 -2.8552 7.4384 13.4669 31.4595 E 1 FDVLX US Equity IALAX US Equity 2 22.2655 3 -6.7133 4 21.9033 5 37.0721 6 11.7165 7 -6.5085 8 16.0607 9 15.6698 10 -17.3445 11 31.6209 12 G OHYFX US Equity 27.6206 -5.7054 14.665 48.2163 5.6951 11.556 -3.0794 43.8917 6.6786 21.5863 H FSPHX US Equity VEIPX US Equity MKHCX US Equity 14.6693 16.9641 14.8813 2.6493 7.8207 10.6049 14.8077 21.3887 13.4867 6.9427 56.2688 30.0713 2.6666 32.8808 11.2898 -4.5417 6.5704 0.7739 13.748 -10.6754 14.7004 6.6536 24.0154 18.3841 -2.8552 7.4384 -5.716 13.4669 31.4595 25.2163 TRMCX US Equity 11.1204 16.4545 4.9597 -4.8193 12.1919 19.6292 5.3175 31.5357 0.4891 10.6031 -2.5213 -3.4111 14.5746 24.3248 5.6863 11.6415 -2.5608 -10.6062 11.6765 19.6133 B D E G H 13 Descriptive Statistics 14 SASMX US Equity FKASX US Equity DFFVX US Equity 15 IALAX US Equity VEI FDVLX US Equity OHYFX US Equity FSPHX US Equity 14.82539 16 Average 17.41858 12.43011 12.57425 17.11248 6.82072 19,41314 17 Variance 216.9127228 297.3007194 312.0743417 279.7637064 301.9464606 47.49792564 306.3949034 18 Stdev 14.72795718 17.24241049 17.66562599 16.72613842 17.3766067 6.891873885 17.50413961 19 Geo 20 Beta 21 22 Correlation 23 24 SASMX US Equity FKASX US Equity DFFVX US Equity FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VEI 25 SASMC US Equity 1 26 FKASX US Equity 1 27 DFFVX US Equity 1 28 FDVLX US Equity 1 1 29 IALAX US Equity 1 30 OHYFX US Equity 1 31 FSPHX US Equity 32 VEIPX US Equity 33 MKHCS US Equity 34 TRMCX US Equity 35 L M E H 13 14 15 FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VEIPX US Equity MKHCX US Equity TRMCX US Equity 16 12.57425 17.11248 6.82072 19.41314 13.36927 6.09339 11.49655 17 279.7637064 301.9464606 47.49792564 306.3949034 98.33871909 34.81336294 170.0530236 18 16.72613842 17.3766067 6.891873885 17.50413961 9.916588077 5.900284988 13.04043802 19 20 21 22 23 24 FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VEIPX US Equity MKHCX US Equity TRMCX US Equity 25 26 27 28 1 29 1 30 1 31 1 32 1 33 1 34 1 35 B D E F G H SASMX US Equity FKASX US Equity DFFVX US Equity FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VEI 37 Covariance 38 39 40 SASMX US Equity 41 FKASX US Equity 42 DFFVX US Equity 43 FDVLX US Equity 44 IALAX US Equity 45 OHYFX US Equity 46 FSPHX US Equity 47 VEIPX US Equity 48 MKHCX US Equity 49 TRMCX US Equity 50 51 52 Portfolio 53 54 55 Weight 56 57 58 SASMX US Equity FKASX US Equity DFFVX US Equity FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VEI 0.1 0.1 0.1 0.1 0.1 0.1 0.1 Return Variance Std Dev Risk-free Rate Sharpe 59 Abo Formatas Dollars, Euros, or other Currency H K M N o VEIPX US Equity MKHCX US Equity OHYFX US Equity 0.1 FSPHX US Equity 0.1 TRMCX US Equity 0.1 Sum 1 0.1 0.1 0.1 52 53 54 IALAX US Equity 55 56 57 Sharpe 58 59 60 B D E F G H SASMX US Equity FKASX US Equity FDVLX US Equity IALAX US Equity OHYFX US Equity FSPHX US Equity VE DFFVX US Equity 0.1 0.1 0.1 0.1 0.1 0.1 0.1 Return Variance Std Dev Risk-free Rate Sharpe 52 Portfolio 53 54 55 Weight 56 57 58 59 60 61 A 62 Y 63 64 Complete 65 66 Return Std Dev H20 MOIXUS Equity TRMOUS Equity A 1 Time SAMX USE 2 12/31/2010 > 12/30/2011 4 12/31/2012 5 12/31/2013 12/31/2014 7 12/31/2015 12/30/2016 9 12/29/2017 00 12/31/2018 11 12/31/2019 12 13 Descriptive Statistica D G FASX US Equity DFFUS Equity FOVLX US Equity IALAKUS Equity OHTEX US Equity SPIKUS Equity VEIFXUS IS 25.2371 31.608 29.0133 22.2655 27.6206 16.9641 0.5242 -14.1775 -5.7054 2.6493 7.8207 18.8942 21.271 19.1 21.9033 14.8077 21.382 45.0095 40. 1497 43.0255 370723 49.2163 5626 3.2894 5.6597 2.9407 11.7165 5.6951 2.6666 -48115 4.9780 5.7211 -6.5085 11.556 4.5417 6.5704 5.7951 5.7661 26.0539 16.0607 -3.0794 13.748 -106754 24.951B 37 8789 9.5895 15.6698 43.8917 6,6536 24.0154 6.8762 15.7801 - 17.3445 6.6786 -2.8552 25.2227 33.9749 21.4727 31.6209 21.5853 13.4649 31.4545 19.6292 31.5357 10.6031 10.6049 11.4857 30.0713 11.2898 0.7739 14.2004 18.3841 -5.716 25. 2163 4.9597 12.1919 5.3175 0.4891 -2.5213 14.5746 5.6863 24.3248 11.6415 10.6062 19.6133 11.6765 15 6 Average 17 Variance 18 de 19 Geo 20 Beta SASMX US Euty FKASX US Equity DEFVXUS Egally FONLX Us Equity IALAKUS Equity OHTEX US Equity ESPROKUS Equity VEIFXUS Luty MICHOX US Equity TAMOUS Equity 14.62539 17.45656 12.43011 12.57425 17.11248 6.62072 19.49314 13.927 6.09339 216,9127228 297.5007194 312.0M3417 279.7637064 3019464606 47.49792564 3063999034 34.813 170.0530236 14.72795718 17.24241049 16.72615342 17.3766067 6.891873885 9.916580072 5.90084938 13.040402 Correlation FKASX US Equity DFVXUS Egy FDMX US Equity IALAXUS Equity OHVEX US Equity FSPROUS Equity VEIFX US Equity MOUS Equity TRMOUS Equity 1 1 24 SASMX US Equity ES SASMC US Equity es FKASK US Equity 27 DFFVX US Equity 28 FOVLX US Equity 9 LAX US Equity BOOTEX US Equity 31FSPROUS Equity B2 VEIFX US EQUITY 33 MHCS US Equity Sheet1 1 1 1 1 1 H20 f SASMX US Equity FKASKUS Equity DESVX US Equity FDVLX US Equity IALAX US Equity OHYEXUS Equity FSPHXUS Equity VEIPXUS Equity MHCX US Equity TRMEXUS Equity 1 22 Correlation 23 24 25 SASMC US Equity 26 FKASKUS Equity 27 DFVX US Equity 28 FOVUXUS Equity 29 IALAX US Equity 30 OHYEX US Equity 31 FSP XUS Equity 32 VEIPX USER 33 MHCS US Equity 34 TRMCX US Equity 35 1 1 1 1 37 Covariance FRASX US Equity DEFVX US Equity FOMEXUS Equity LALAX US Equity OHYEXUS Equity FSPIKUS Equity VUIPX US Equity MIX US Equity TRMOX US Equity SASMX US County 40 SASMUS EY 41 FKASKUS Equity 42 DRIVX US Equity 43 FOVEX Us Equity 44 IALAX USER 45 OHYEXUS Equity 46 FSPHX US Equity 47 VIPX US Equity 43 MHCUS Equity 49 TRMOX US Equity 50 51 52 Portfolio 53 SASMX USE Sheet1 FKASKUS Equity DEIVAUS Fauty FOMUXUS Eody IALAX US Eur OHYEX US Equity ESPHORUS Equity VEIPX US Cody MICHOX USE TRMOX Cody H20 f M N O 42 DFPVXUS Equity 43 FOVUXUS 44 ALAKUS Equity 45 OHEX USE 46 SPUS Equity 47 VEXUS Equity MOROUS Equity 10 TRMOGUS 52 SASME USE FABX US Equity DRIVXUS EQUEY FOVUXUS Equity DALAX USE CHYFXUS Equity FSHOKUSEY VEIFXUS EQUE MOHOUSE TRMOLUS Equity 54 55 Weigte 56 57 Retur Variance 5d Dev Risk free Rate Sharpe 50 39 00 61 A 62 64 Complete 66 Retur Sed Dev 73 T 7 77 78 Sheet1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts