Question: I need help with finding Absorption Income statement for the month of May 2017. and number 2! Exercises riable and absorption costing, explaining operating-income differences.

I need help with finding Absorption Income statement for the month of May 2017. and number 2!

I need help with finding Absorption Income statement for the month of May 2017. and number 2!

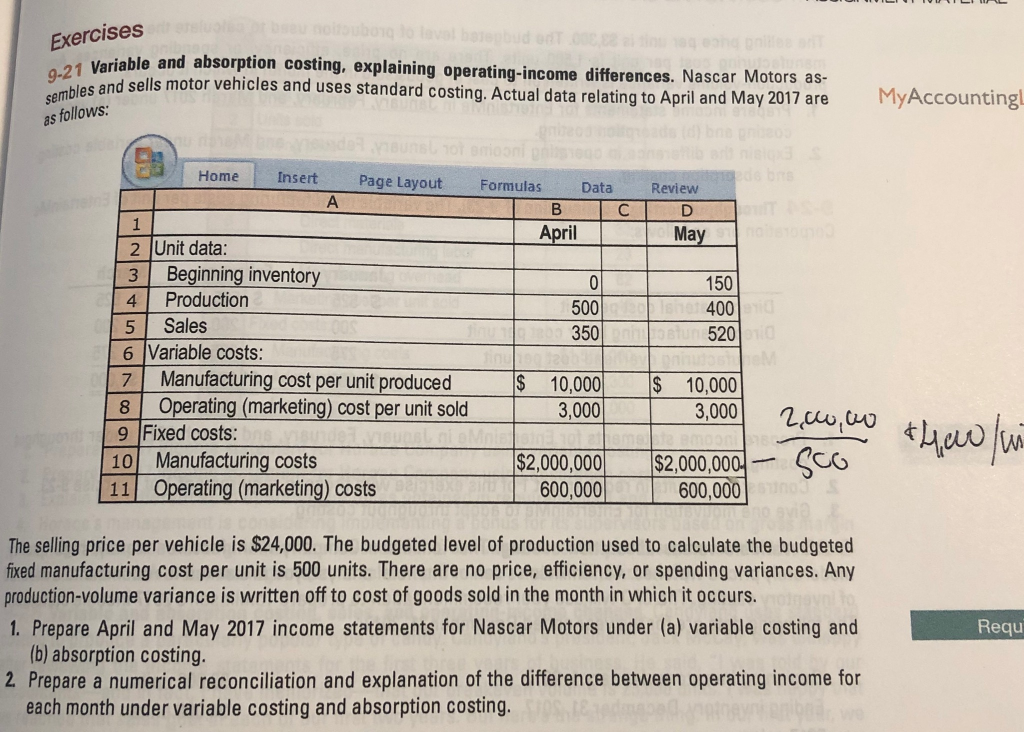

Exercises riable and absorption costing, explaining operating-income differences. Nascar Motors as- 9- 9mbiles and sells motor vehicles and uses standard costing. Actual data relating to April and May 2017 are MyAccounting as follows: Home Insert Page Layout Formulas Data Review April 2 Unit data 3 Beginning inventor 4 Production 5 Sales 6 Variable costs: 7 Manufacturing cost per unit produced 8 Operating (marketing) cost per unit sold 9 Fixed costs 500 350 150 400 520 10,000 10,000 3,000 $2,000,000 $2,000,000 So 10 Manufacturing costs 11 Operating (marketing) costs 600,000 600,000 The selling price per vehicle is $24,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 500 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. 1. Prepare April and May 2017 income statements for Nascar Motors under (a) variable costing and Requ (b) absorption costing. 2 Prepare a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts