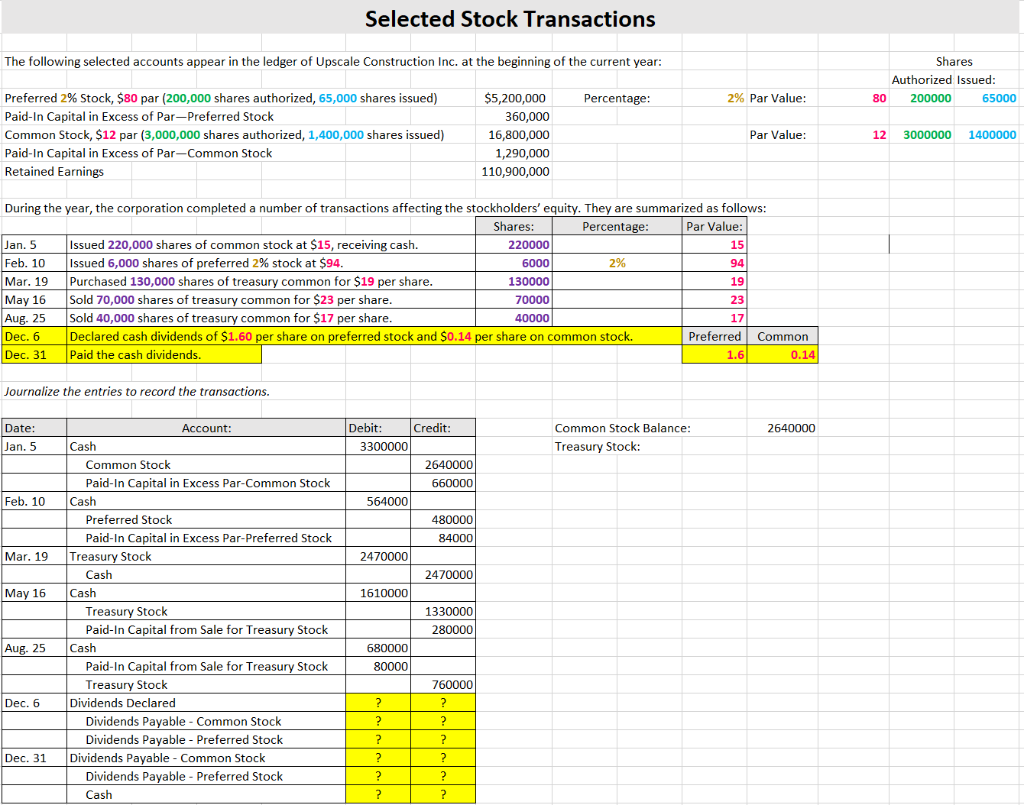

Question: I need help with finding out how Transactions for Dec. 6th and Dec. 13th should be journalized. Please include formulas used. Please refer to highlights.

I need help with finding out how Transactions for Dec. 6th and Dec. 13th should be journalized. Please include formulas used. Please refer to highlights.

Selected Stock Transactions The following selected accounts appear in the ledger of Upscale Construction Inc. at the beginning of the current year: Shares Authorized Issued: 80 200000 65000 Percentage: 2% Par Value: Preferred 2% Stock, $80 par (200,000 shares authorized, 65,000 shares issued) Paid-In Capital in Excess of Par-Preferred Stock Common Stock, $12 par (3,000,000 shares authorized, 1,400,000 shares issued) Paid-In Capital in Excess of Par-Common Stock Retained Earnings $5,200,000 360,000 16,800,000 1,290,000 110,900,000 Par Value: 12 3000000 1400000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: Shares: Percentage: Par Value: Jan. 5 Issued 220,000 shares of common stock at $15, receiving cash. 220000 15 Feb. 10 Issued 6,000 shares of preferred 2% stock at $94. 6000 2% 94 Mar. 19 Purchased 130,000 shares of treasury common for $19 per share. 130000 19 May 16 Sold 70,000 shares of treasury common for $23 per share. 70000 23 Aug. 25 Sold 40,000 shares of treasury common for $17 per share. 40000 17 Dec. 6 Declared cash dividends of $1.60 per share on preferred stock and $0.14 per share on common stock. Preferred Common Dec. 31 Paid the cash dividends. 1.6 0.14 Journalize the entries to record the transactions. 2640000 Date: Jan. 5 Common Stock Balance: Treasury Stock: Feb. 10 Debit: Credit: 3300000 2640000 6600001 564000 480000 84000 2470000 2470000 1610000 1330000 280000 680000 80000 Mar. 19 Account: Cash Common Stock Paid-In Capital in Excess Par-Common Stock Cash Preferred Stock Paid-In Capital in Excess Par-Preferred Stock Treasury Stock Cash Cash Treasury Stock Paid-In Capital from Sale for Treasury Stock Cash Paid-In Capital from Sale for Treasury Stock Treasury Stock Dividends Declared Dividends Payable - Common Stock Dividends Payable - Preferred Stock Dividends Payable - Common Stock Dividends Payable - Preferred Stock Cash May 16 Aug. 25 Dec. 6 ? ? ? 760000 ? ? ? ? Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts