Question: I need help with form 4 5 6 2 line 1 1 . Thanks! Emily Jackson ( Social Security number 7 6 5 - 1

I need help with form line

Thanks!

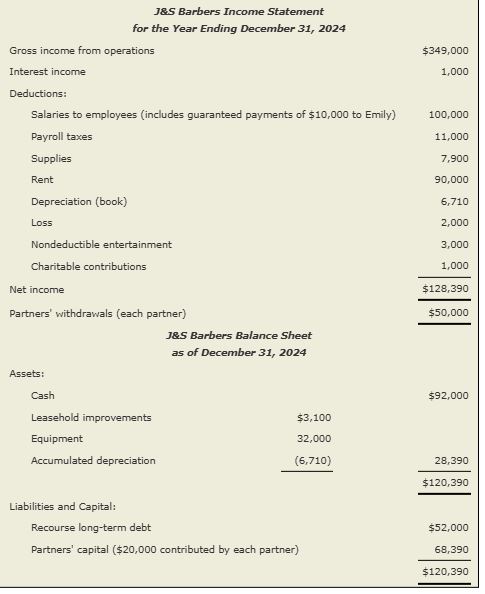

Emily Jackson Social Security number and James Stewart Social Security number are partners in a general partnership that owns and operates a barber shop. The partnership's first year of operation is Emily and James divide income and expenses equally. The partnership name is J&S Barbers, it is located at Lexington Avenue, New York, NY and its Federal ID number is The financial statements for the partnership are presented below. J&S Barbers Income Statement for the Year Ending December Gross income from operations$Interest incomeDeductions:Salaries to employees includes guaranteed payments of $ to EmilyPayroll taxesSuppliesRentDepreciation bookLossNondeductible entertainmentCharitable contributionsNet income$Partners' withdrawals each partner$J&S Barbers Balance Sheet as of December Assets:Cash$Leasehold improvements$EquipmentAccumulated depreciation$Liabilities and Capital:Recourse longterm debt$Partners' capital $ contributed by each partner$

J&S Barbers Income Statement

for the Year Ending December

J&S Barbers Balance Sheet

as of December

Leasehold improvements

$

Equipment

Accumulated depreciation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock