Question: I need help with Form 4797 please lines 13, 18b, A, 20, 21, 22 thank you Fundamentals Of Taxation 2020 Edition This one is more

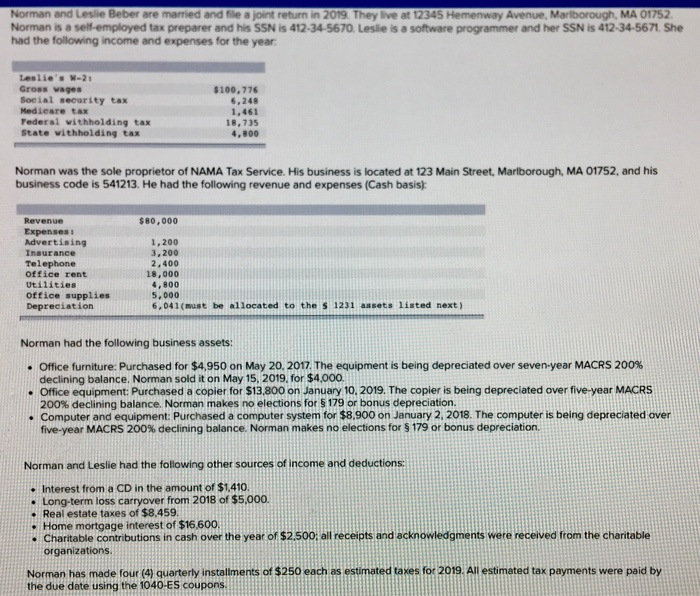

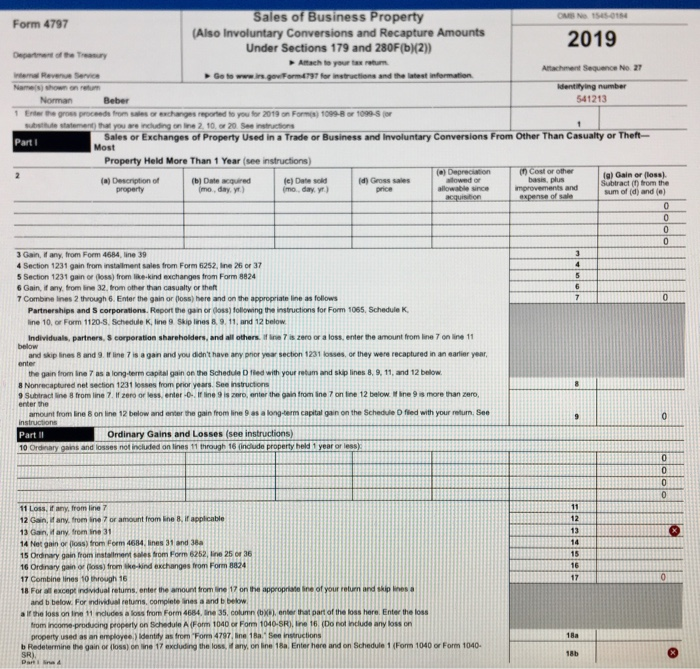

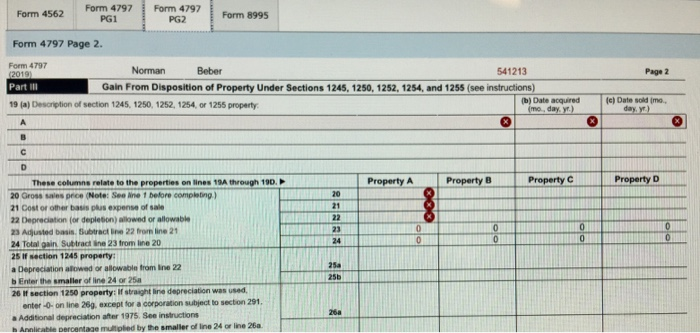

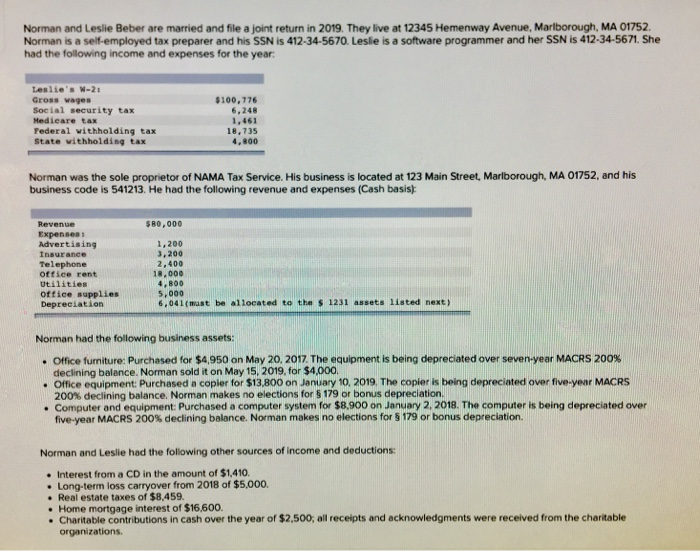

Norman and Leslie Beber are married and file a joint return in 2019. They live at 12345 Hemenway Avenue, Marlborough, MA 01752 Norman is a self-employed tax preparer and his SSN is 412-34-5670. Leslie is a software programmer and her SSN is 412-34-5671. She had the following income and expenses for the year Leslie's W-25 Gross wages Social security tax Medicare tax Federal withholding tax State withholding tax $100,776 6,240 1.461 18,735 Norman was the sole proprietor of NAMA Tax Service. His business is located at 123 Main Street, Marlborough, MA 01752. and his business code is 541213. He had the following revenue and expenses (Cash basis: $80,000 Revenue Expenses Advertising Insurance Telephone office rent Utilities office supplies Depreciation 1,200 3.200 2.400 18,000 4,800 5,000 6,041(must be allocated to the S 1231 assets listed next) Norman had the following business assets: Office furniture: Purchased for $4,950 on May 20, 2017. The equipment is being depreciated over seven-year MACRS 200% declining balance. Norman sold it on May 15, 2019, for $4,000. Office equipment: Purchased a copier for $13,800 on January 10, 2019. The copler is being depreciated over five-year MACRS 200% declining balance. Norman makes no elections for $179 or bonus depreciation. Computer and equipment: Purchased a computer system for $8.900 on January 2, 2018. The computer is being depreciated aver five-year MACRS 200% declining balance. Norman makes no elections for $ 179 or bonus depreciation Norman and Leslie had the following other sources of income and deductions Interest from a CD in the amount of $1.410. Long-term loss carryover from 2018 of $5,000. Real estate taxes of $8,459. Home mortgage interest of $16.600. Charitable contributions in cash over the year of $2,500: all receipts and acknowledgments were received from the charitable organizations. Norman has made four (4) quarterly installments of $250 each as estimated taxes for 2019. All estimated tax payments were paid by the due date using the 1040-ES coupons. 2019 Sales of Business Property ON SOT Form 4797 (Also involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Department of the Treasury Attach to your tax return Warna Revenue Service Attachment Sequence No. 27 Go to www.in.govForm 797 for instructions and the latest information Nam honorum Identifying number Norman Beber 541213 1 Enter the gros proceeds from wes or exchanges reported to you for 2019 on Forms 1099-B or 1090-s for S e tement that you wancing online 2. 10. 20. See instructions Parti Sales or Exchanges of Property Used in a Trade or Business and involuntary Conversions From Other Than Casualty or Theft- Most Property Held More Than 1 Year e instructions) (a) Depreciation in Cost or other (a) Description of (b) Datequired al Gain or loss. c) Date d) Grosses wowed or basis, plus Subtract() from the property mo, day, y) imo. day. ) price allowance provements and sum of (d) and (e) acquisition expense of sale 3 Gain, if any, from Form 4684 line 39 4 Section 1231 gain from installment sales from Form 5252, Ine 26 of 37 5 Section 1231 gain or loss) from like kind exchanges from Form 8824 6 Gain, if any, from line 32. from other than casualty or theft 7 Combine lines 2 through 6. Enter the gain or loss) here and on the appropriate line as follows Partnerships and corporations. Report the gain or loss) following the instructions for Form 1065, Schedule K. line 10, or Form 1120-S, Schedule Kline Skip les 8 9 11 and 12 below Individuals, partners, corporation shareholders, and all others. If line 7 is zero or a loss, enter the amount from line 7 on line 11 below and skip lines and 9. If line 7 is a gan and you didn't have any prior year section 1231 losses or they were recaptured in an earlier year, the gain from line 7 as a long term capital gain on the Schedule D lied with your relam and skip lines 8, 9, 11, and 12 below 8 Nonrecaptured net section 1231 loss from prior years. See Instructions 9 Subtract line from line 7. If zero or less entero. If line is , enter the intromine 7 on line 12 below. Wine 9 is more than zero, enter the amount from line 8 on line 12 below and enter the gain from lineas a long-term capital gun on the Schedule D fied with your return. See instructions Part II Ordinary Gains and Losses (see instructions) 10 Ordinary gains and losses not included on lines 11 through 16 include property held 1 year or less 11 Loss, if any, from line 7 12 Gain, if any, from ine 7 or amount from in B, if applicable 13 Gan, if any from ine 31 14 Net gain or loss) from Form 4684. Ines 31 and 38a 15 Ordinary gain from installment soles from Form 6252, line 25 or 36 16 Ordinary gain oploss) from the kind exchanges from Form 3824 17 Combine lines 10 through 16 18 For W i ndividual retums. enter the amount from line 17 on the of your retum and below. For individual retums, complete ines a and below If the loss on line 11 ncludes a loss from Form4684. Ine 35,column (6 ) enter the part of the boss her. Enter the loss from income prodong properly on Schedule (Form 1040 Form 1040-SR. In 16. Droidery property used as a ployee) identity as from Form 4787. In the tructions Redetermine the gain or loss) on the 17 excluding the lows, why, on ne 18, Enter here and on Schedule 1 Form 1040 Dari Form 1040 SR) Form 4562 Form 4797 PG1 Form 4797 PG2 Form 8995 Form 4797 Page 2 Page 2 Form 4797 (2019) Norman Beber 541213 Part III Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 (see instructions) (b) Date acquired 19 (a) Description of section 1245, 1250, 1252, 1254, or 1255 property ime, day. y.) (c) Date soldimo, | | D Property A Property B Property C Property D 21 22 HO These columns relate to the properties on lines 19A through 190. 20 Gross sales price (Note: See ine 1 before completing) 21 Cost or other basis plus expense of sale 22 Depreciation for depletion) allowed or allowable 23 Adjusted basis Subtractine 22 from line 21 24 Total gain. Subtractine 23 trom ine 20 25 If section 1245 property a Depreciation allowed or allowable from line 22 Enter the smaller of line 24 or 25a 26 if section 1250 property: If straight line depreciation was used enter -- on line 269, except for a corporation subject to section 291. Additional depreciation after 1975. See Instructions Anahe percentage multiplied by the smaller of line 24 or line 260. Cruz Deschamps | Niswander|Prendergast | Schisler Fundamentals of Taxation 2020 EDITION 1040 Mc Graw Surgent TaxACT Hill Norman and Leslie Beber are married and file a joint return in 2019. They live at 12345 Hemenway Avenue, Marlborough, MA 01752. Norman is a self-employed tax preparer and his SSN is 412-34-5670. Leslie is a software programmer and her SSN is 412-34-5671. She had the following income and expenses for the year Leslie's W-2 Gross wages Social security tax Medieare tax Federal withholding tax State withholding tax $100,776 6.248 1.461 18,735 4.800 Norman was the sole proprietor of NAMA Tax Service. His business is located at 123 Main Street, Marlborough, MA 01752, and his business code is 541213. He had the following revenue and expenses (Cash basis $80,000 Revenue Expenses Advertising Insurance Telephone office rent Utilities office supplies Depreciation 1.200 3,200 2.400 18,000 4.800 5,000 6,041(must be allocated to the S 1231 assets listed next) Norman had the following business assets: Office furniture: Purchased for $4,950 on May 20, 2017. The equipment is being depreciated over seven year MACRS 200% declining balance. Norman sold it on May 15, 2019, for $4,000. Office equipment Purchased a copier for $13,800 on January 10, 2019. The copier is being depreciated over five-year MACRS 200% declining balance. Norman makes no elections for $179 or bonus depreciation. . Computer and equipment Purchased a computer system for $8.900 on January 2, 2018. The computer is being depreciated over five-year MACRS 200% declining balance. Norman makes no elections for 5 179 or bonus depreciation. Norman and Leslie had the following other sources of income and deductions: Interest from a CD in the amount of $1.410. Long-term loss carryover from 2018 of $5,000. Real estate taxes of $8.459. Home mortgage interest of $16,600. Charitable contributions in cash over the year of $2,500, all receipts and acknowledgments were received from the charitable organizations Norman and Leslie Beber are married and file a joint return in 2019. They live at 12345 Hemenway Avenue, Marlborough, MA 01752 Norman is a self-employed tax preparer and his SSN is 412-34-5670. Leslie is a software programmer and her SSN is 412-34-5671. She had the following income and expenses for the year Leslie's W-25 Gross wages Social security tax Medicare tax Federal withholding tax State withholding tax $100,776 6,240 1.461 18,735 Norman was the sole proprietor of NAMA Tax Service. His business is located at 123 Main Street, Marlborough, MA 01752. and his business code is 541213. He had the following revenue and expenses (Cash basis: $80,000 Revenue Expenses Advertising Insurance Telephone office rent Utilities office supplies Depreciation 1,200 3.200 2.400 18,000 4,800 5,000 6,041(must be allocated to the S 1231 assets listed next) Norman had the following business assets: Office furniture: Purchased for $4,950 on May 20, 2017. The equipment is being depreciated over seven-year MACRS 200% declining balance. Norman sold it on May 15, 2019, for $4,000. Office equipment: Purchased a copier for $13,800 on January 10, 2019. The copler is being depreciated over five-year MACRS 200% declining balance. Norman makes no elections for $179 or bonus depreciation. Computer and equipment: Purchased a computer system for $8.900 on January 2, 2018. The computer is being depreciated aver five-year MACRS 200% declining balance. Norman makes no elections for $ 179 or bonus depreciation Norman and Leslie had the following other sources of income and deductions Interest from a CD in the amount of $1.410. Long-term loss carryover from 2018 of $5,000. Real estate taxes of $8,459. Home mortgage interest of $16.600. Charitable contributions in cash over the year of $2,500: all receipts and acknowledgments were received from the charitable organizations. Norman has made four (4) quarterly installments of $250 each as estimated taxes for 2019. All estimated tax payments were paid by the due date using the 1040-ES coupons. 2019 Sales of Business Property ON SOT Form 4797 (Also involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Department of the Treasury Attach to your tax return Warna Revenue Service Attachment Sequence No. 27 Go to www.in.govForm 797 for instructions and the latest information Nam honorum Identifying number Norman Beber 541213 1 Enter the gros proceeds from wes or exchanges reported to you for 2019 on Forms 1099-B or 1090-s for S e tement that you wancing online 2. 10. 20. See instructions Parti Sales or Exchanges of Property Used in a Trade or Business and involuntary Conversions From Other Than Casualty or Theft- Most Property Held More Than 1 Year e instructions) (a) Depreciation in Cost or other (a) Description of (b) Datequired al Gain or loss. c) Date d) Grosses wowed or basis, plus Subtract() from the property mo, day, y) imo. day. ) price allowance provements and sum of (d) and (e) acquisition expense of sale 3 Gain, if any, from Form 4684 line 39 4 Section 1231 gain from installment sales from Form 5252, Ine 26 of 37 5 Section 1231 gain or loss) from like kind exchanges from Form 8824 6 Gain, if any, from line 32. from other than casualty or theft 7 Combine lines 2 through 6. Enter the gain or loss) here and on the appropriate line as follows Partnerships and corporations. Report the gain or loss) following the instructions for Form 1065, Schedule K. line 10, or Form 1120-S, Schedule Kline Skip les 8 9 11 and 12 below Individuals, partners, corporation shareholders, and all others. If line 7 is zero or a loss, enter the amount from line 7 on line 11 below and skip lines and 9. If line 7 is a gan and you didn't have any prior year section 1231 losses or they were recaptured in an earlier year, the gain from line 7 as a long term capital gain on the Schedule D lied with your relam and skip lines 8, 9, 11, and 12 below 8 Nonrecaptured net section 1231 loss from prior years. See Instructions 9 Subtract line from line 7. If zero or less entero. If line is , enter the intromine 7 on line 12 below. Wine 9 is more than zero, enter the amount from line 8 on line 12 below and enter the gain from lineas a long-term capital gun on the Schedule D fied with your return. See instructions Part II Ordinary Gains and Losses (see instructions) 10 Ordinary gains and losses not included on lines 11 through 16 include property held 1 year or less 11 Loss, if any, from line 7 12 Gain, if any, from ine 7 or amount from in B, if applicable 13 Gan, if any from ine 31 14 Net gain or loss) from Form 4684. Ines 31 and 38a 15 Ordinary gain from installment soles from Form 6252, line 25 or 36 16 Ordinary gain oploss) from the kind exchanges from Form 3824 17 Combine lines 10 through 16 18 For W i ndividual retums. enter the amount from line 17 on the of your retum and below. For individual retums, complete ines a and below If the loss on line 11 ncludes a loss from Form4684. Ine 35,column (6 ) enter the part of the boss her. Enter the loss from income prodong properly on Schedule (Form 1040 Form 1040-SR. In 16. Droidery property used as a ployee) identity as from Form 4787. In the tructions Redetermine the gain or loss) on the 17 excluding the lows, why, on ne 18, Enter here and on Schedule 1 Form 1040 Dari Form 1040 SR) Form 4562 Form 4797 PG1 Form 4797 PG2 Form 8995 Form 4797 Page 2 Page 2 Form 4797 (2019) Norman Beber 541213 Part III Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 (see instructions) (b) Date acquired 19 (a) Description of section 1245, 1250, 1252, 1254, or 1255 property ime, day. y.) (c) Date soldimo, | | D Property A Property B Property C Property D 21 22 HO These columns relate to the properties on lines 19A through 190. 20 Gross sales price (Note: See ine 1 before completing) 21 Cost or other basis plus expense of sale 22 Depreciation for depletion) allowed or allowable 23 Adjusted basis Subtractine 22 from line 21 24 Total gain. Subtractine 23 trom ine 20 25 If section 1245 property a Depreciation allowed or allowable from line 22 Enter the smaller of line 24 or 25a 26 if section 1250 property: If straight line depreciation was used enter -- on line 269, except for a corporation subject to section 291. Additional depreciation after 1975. See Instructions Anahe percentage multiplied by the smaller of line 24 or line 260. Cruz Deschamps | Niswander|Prendergast | Schisler Fundamentals of Taxation 2020 EDITION 1040 Mc Graw Surgent TaxACT Hill Norman and Leslie Beber are married and file a joint return in 2019. They live at 12345 Hemenway Avenue, Marlborough, MA 01752. Norman is a self-employed tax preparer and his SSN is 412-34-5670. Leslie is a software programmer and her SSN is 412-34-5671. She had the following income and expenses for the year Leslie's W-2 Gross wages Social security tax Medieare tax Federal withholding tax State withholding tax $100,776 6.248 1.461 18,735 4.800 Norman was the sole proprietor of NAMA Tax Service. His business is located at 123 Main Street, Marlborough, MA 01752, and his business code is 541213. He had the following revenue and expenses (Cash basis $80,000 Revenue Expenses Advertising Insurance Telephone office rent Utilities office supplies Depreciation 1.200 3,200 2.400 18,000 4.800 5,000 6,041(must be allocated to the S 1231 assets listed next) Norman had the following business assets: Office furniture: Purchased for $4,950 on May 20, 2017. The equipment is being depreciated over seven year MACRS 200% declining balance. Norman sold it on May 15, 2019, for $4,000. Office equipment Purchased a copier for $13,800 on January 10, 2019. The copier is being depreciated over five-year MACRS 200% declining balance. Norman makes no elections for $179 or bonus depreciation. . Computer and equipment Purchased a computer system for $8.900 on January 2, 2018. The computer is being depreciated over five-year MACRS 200% declining balance. Norman makes no elections for 5 179 or bonus depreciation. Norman and Leslie had the following other sources of income and deductions: Interest from a CD in the amount of $1.410. Long-term loss carryover from 2018 of $5,000. Real estate taxes of $8.459. Home mortgage interest of $16,600. Charitable contributions in cash over the year of $2,500, all receipts and acknowledgments were received from the charitable organizations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts