Question: *****I need help with Form 8995. I have highlighted the boxes in yellow that I need help with.****** Beth R. Jordan lives at 2322 Skyview

*****I need help with Form 8995. I have highlighted the boxes in yellow that I need help with.******

Beth R. Jordan lives at 2322 Skyview Road, Mesa, AZ 85201. She is a tax accountant with Mesa Manufacturing Company, 1203 Western Avenue, Mesa, AZ 85201 (employer identification number 11-1111111). She also writes computer software programs for tax practitioners and has a part-time tax practice. Beth is single and has no dependents. Beth was born on July 4, 1973, and her Social Security number is 123-45-6785. She wants to contribute $3 to the Presidential Election Campaign Fund.

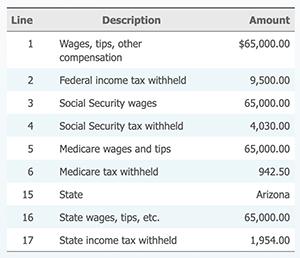

The following information is shown on Beth's Wage and Tax Statement (Form W-2) for 2019.

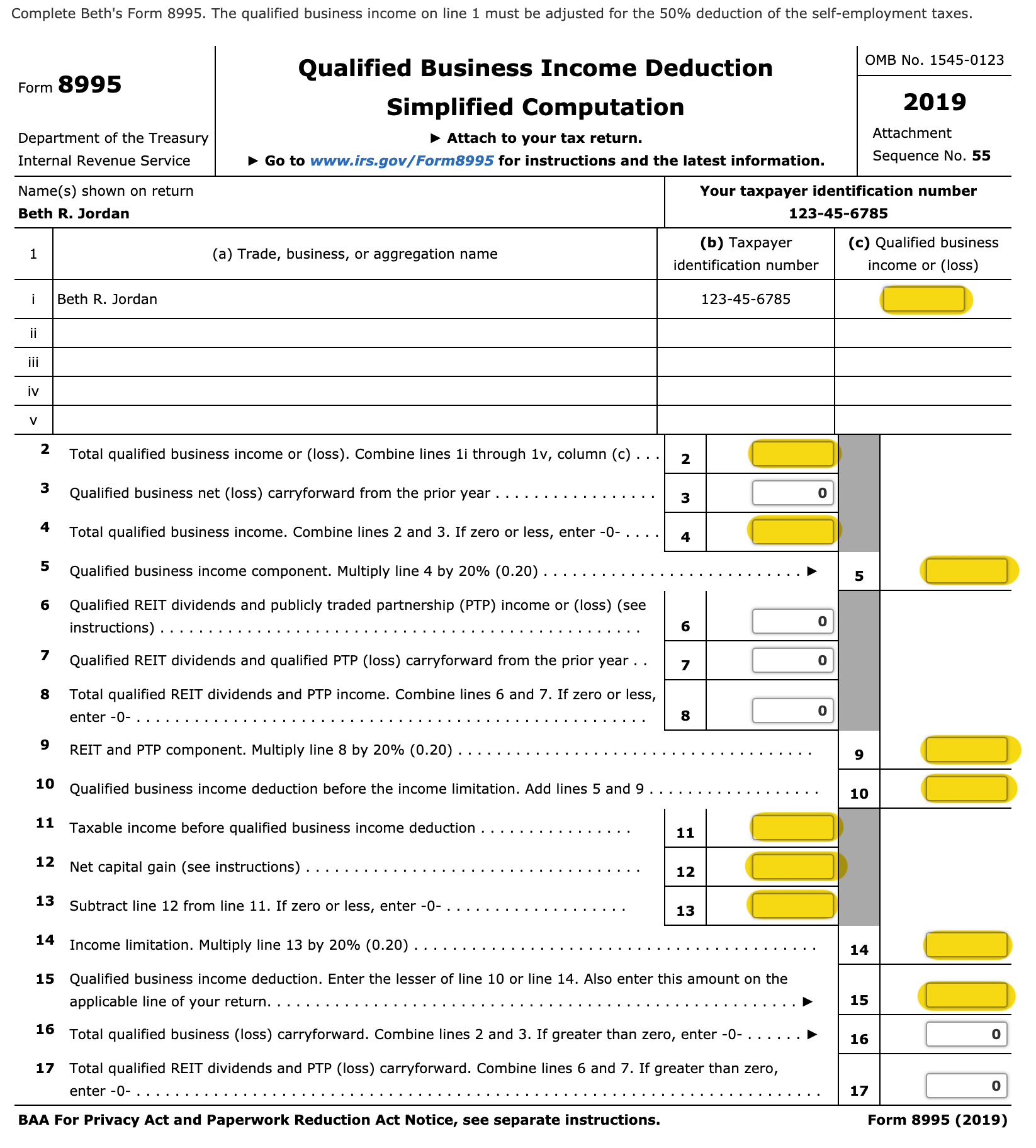

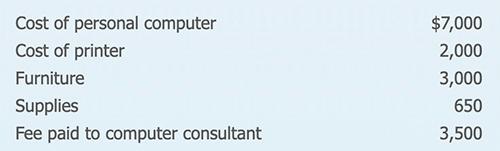

Complete Beth's Form 8995. The qualified business income on line 1 must be adjusted for the 50% deduction of the self-employment taxes. Qualified Business Income Deduction 0MB \"- 1545'0123 Form 8995 Simplied Computation 2019 Department of the Treasury b Attach to your tax return. Attachment Internal Revenue Service > Go to www.irs.gov/Form8995 for instructions and the latest information. Sequence \"0- 55 Name(s) shown on return Your taxpayer identification number Beth R. Jordan 123-45-6785 b Tax a er c ualied business 1 (a) Trade, business, or aggregation name ( ) p y ( ) Q identication number income or (loss) i Beth R. Jordan 123456785 C] iv . - 2 Total qualified business income or (loss). Combine lines 1i through 1v, column (c) . . . E 3 Qualied business net (loss) carryforward from the prior year ................. 3 4 Total qualified business income. Combine lines 2 and 3. If zero or less, enter 0 . . . . 4 5 Qualied business income component. Multiply line 4 by 20% (0.20) ........................... b a HE U 6 Qualied REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions) .................................................. 6 1:] 7 Qualied REIT dividends and qualified PTP (loss) carryforward from the prior year . . 7 lj] 8 Total qualified RElT dividends and FTP income. Combine lines 6 and 7. If zero or less, enter 0- ..................................................... 8 |:] 9 REIT and FTP component. Multiply line 3 by 20% (0.20) ..................................... n C] 1 Qualied business income deduction before the income limitation. Add lines 5 and 9 .................. H S 11 Taxable income before qualied business income deduction ................ 11 t: 12 Net capital gain (see instructions) ................................... 12 S 13 Subtract line 12 from line 11. If zero or less, enter 0 ................... 13 l:] 14 Income limitation. Multiply line 13 by 20% (0.20) .......................................... applicable line of your return ....................................................... b 15 Qualied business income deduction. Enter the lesser of line 10 or line 14. Also enter this amount on the E 15 Total qualified business (loss) carryforward. Combine lines 2 and 3. If greater than zero, enter -0- ...... b 17 Total qualified RElT dividends and FTP (loss) carryforward. Combine lines 6 and 7. If greater than zero, enter 0- ....................................................................... 17 EEUU BAA For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Form 8995 (2019) Line Description Amount Wages, tips, other $65,000.00 compensation 2 Federal income tax withheld 9,500.00 Social Security wages 65,000.00 A Social Security tax withheld 4,030.00 5 Medicare wages and tips 65,000.00 6 Medicare tax withheld 942.50 15 State Arizona 16 State wages, tips, etc. 65,000.00 17 State Income tax withheld 1,954.00Cost of personal computer $7,000 Cost of printer 2,000 Furniture 3,000 Supplies 650 Fee paid to computer consultant 3,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts