Question: I need help with homework A. What is the expected return on this stock given the following information? A. -8.07 percent B. -7.69 percent C.

I need help with homework

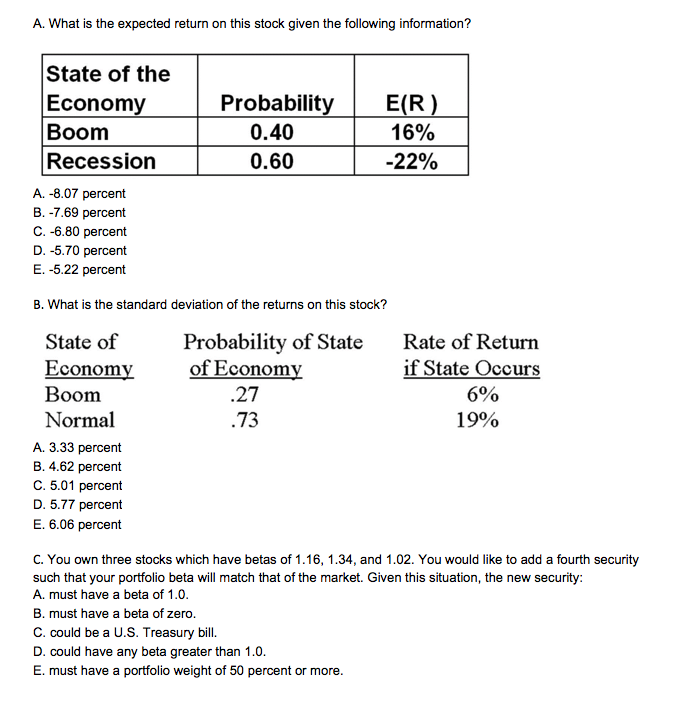

A. What is the expected return on this stock given the following information? A. -8.07 percent B. -7.69 percent C. -6.80 percent D. -5.70 percent E. -5.22 percent B. What is the standard deviation of the returns on this stock? A. 3.33 percent B. 4.62 percent C. 5.01 percent D. 5.77 percent E. 6.06 percent C. You own three stocks which have betas of 1.16, 1 34, and 1.02. You would like to add a fourth security such that your portfolio beta will match that of the market. Given this situation, the new security: A. must have a beta of 1.0. B. must have a beta of zero. C. could be a U.S. Treasury bill. D. could have any beta greater than 1.0. E. must have a portfolio weight of 50 percent or more

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts