Question: i need help with how you got the amount for Amortizaton. i need help with how you got the EBT. I need help with how

i need help with how you got the amount for Amortizaton.

i need help with how you got the EBT.

I need help with how you got the taxes(25%) and the EAT

I WILL NEED STEP BY STEP EXPLANATION PLUS ANSWER THANKS.

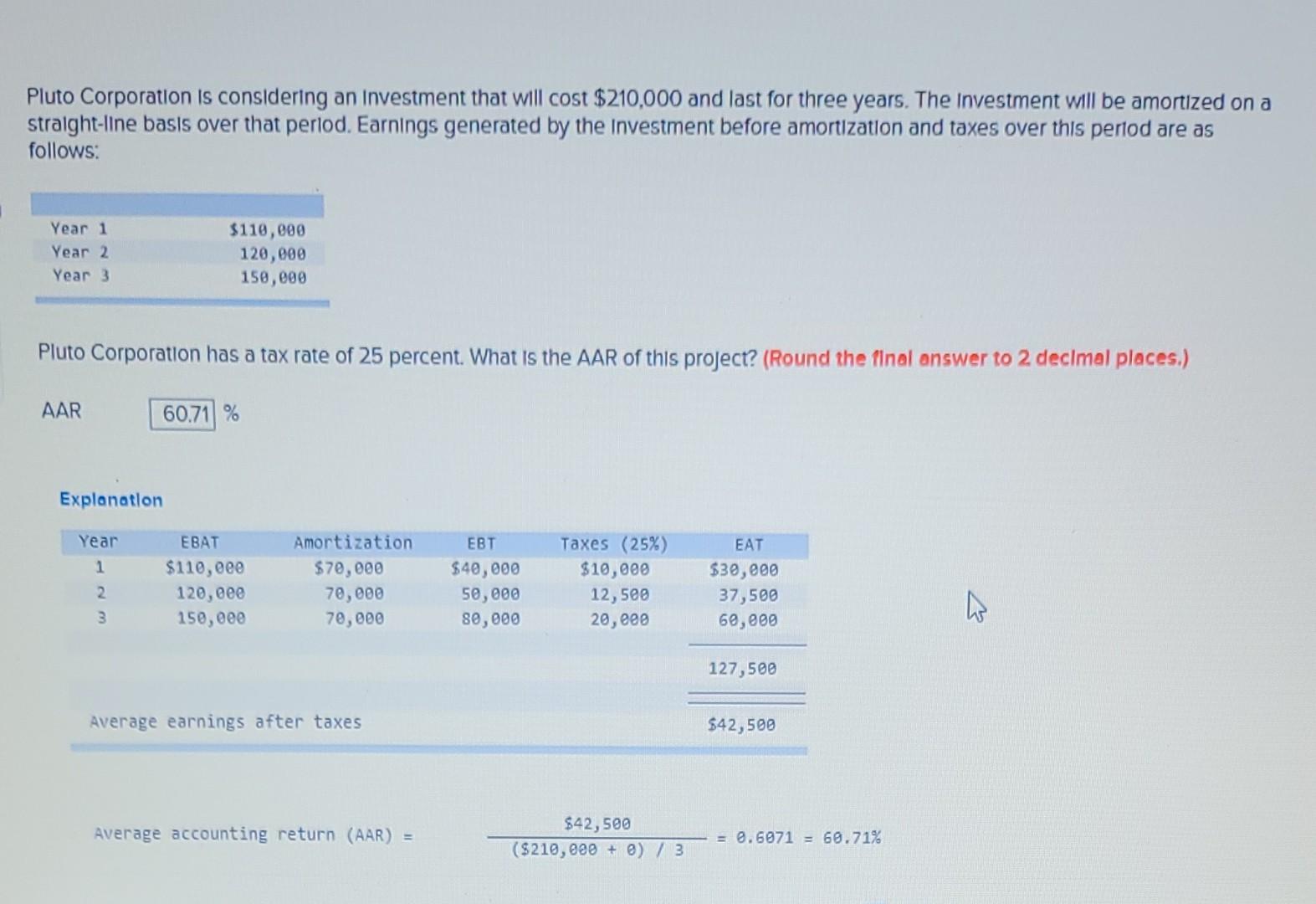

Pluto Corporation is considering an Investment that will cost $210,000 and last for three years. The Investment will be amortized on a straight-line basis over that period. Earnings generated by the Investment before amortization and taxes over this period are as follows: Year 1 Year 2 Year 3 $110,000 120,000 150,000 Pluto Corporation has a tax rate of 25 percent. What is the AAR of this project? (Round the final answer to 2 decimal places.) AAR 60.71 % Explanation Year 1 EBAT $110, eee 120, eee 150, eee Amortization $70,000 70,000 70,000 EBT $40,000 50,000 80,000 Taxes (25%) $10,000 12,500 20, eee EAT $30,000 37,500 60,000 2 3 W 127,500 Average earnings after taxes $42,500 Average accounting return (AAR) $42,500 ($210,000 + ) / 3 = 0.6071 = 60.71%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts