Question: I need help with journal entry 6. On January 1, 2018, Displays Incorporated has the following account balances Debit Credit Accounts Cash Accounts Receivable Supplies

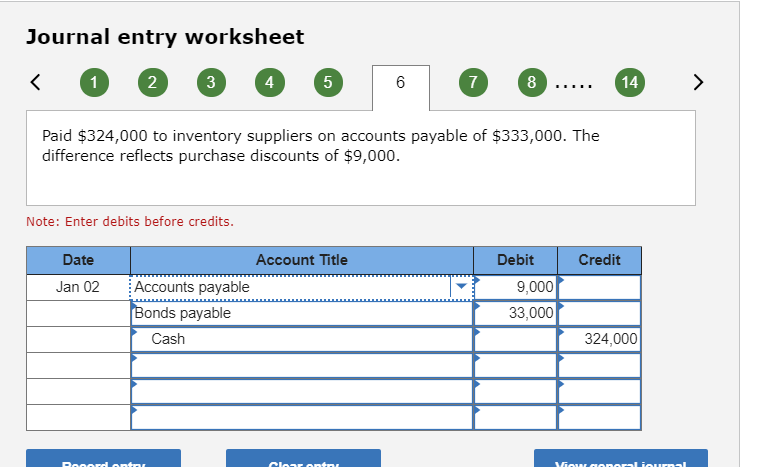

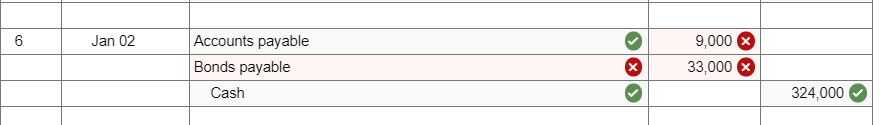

I need help with journal entry 6.

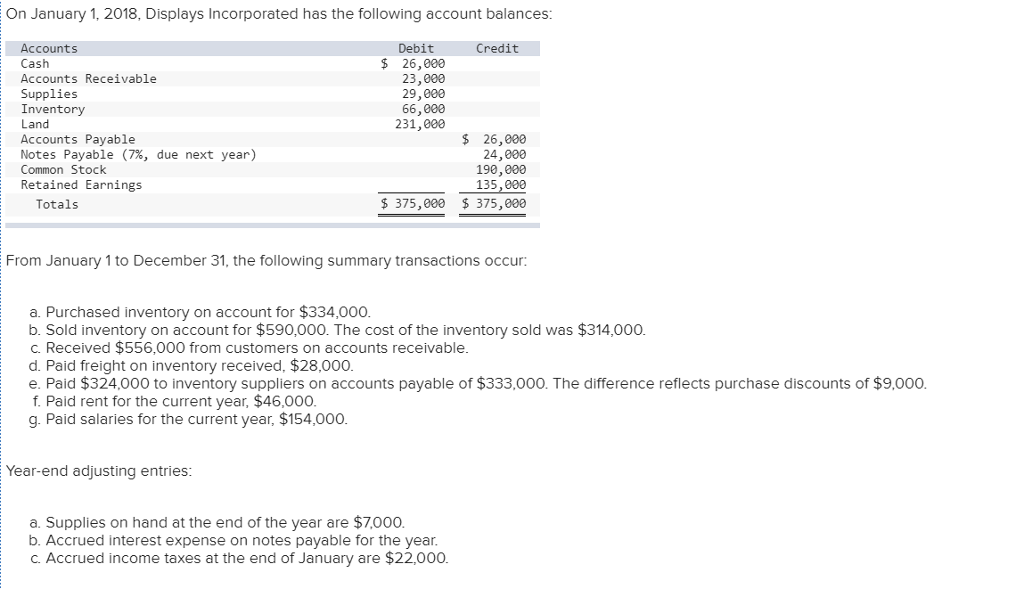

On January 1, 2018, Displays Incorporated has the following account balances Debit Credit Accounts Cash Accounts Receivable Supplies Inventory Land Accounts Payable Notes Payable (7%, due next year) Common Stock Retained Earnings $ 26,000 23,000 29,000 66,000 231,000 26,e00 24,000 190,000 135,800 $ 375,000 375,000 Totals From January 1 to December 31, the following summary transactions occur a. Purchased inventory on account for $334,000 b. Sold inventory on account for $590,000. The cost of the inventory sold was $314,000 C. Received $556,000 from customers on accounts receivable d. Paid freight on inventory received, $28,000 e. Paid $324,000 to inventory suppliers on accounts payable of $333,000. The difference reflects purchase discounts of $9,000 f. Paid rent for the current year, $46,000 g. Paid salaries for the current year, $154,000 Year-end adjusting entries a. Supplies on hand at the end of the year are $7,000 b. Accrued interest expense on notes payable for the year c. Accrued income taxes at the end of January are $22,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts