Question: I need help with journalizing the following exercise. The subject is Intermediate Accounting 3 . Thanks in advance! Practice exercise 1 . The City of

I need help with journalizing the following exercise. The subject is Intermediate Accounting Thanks in advance!

Practice exercise

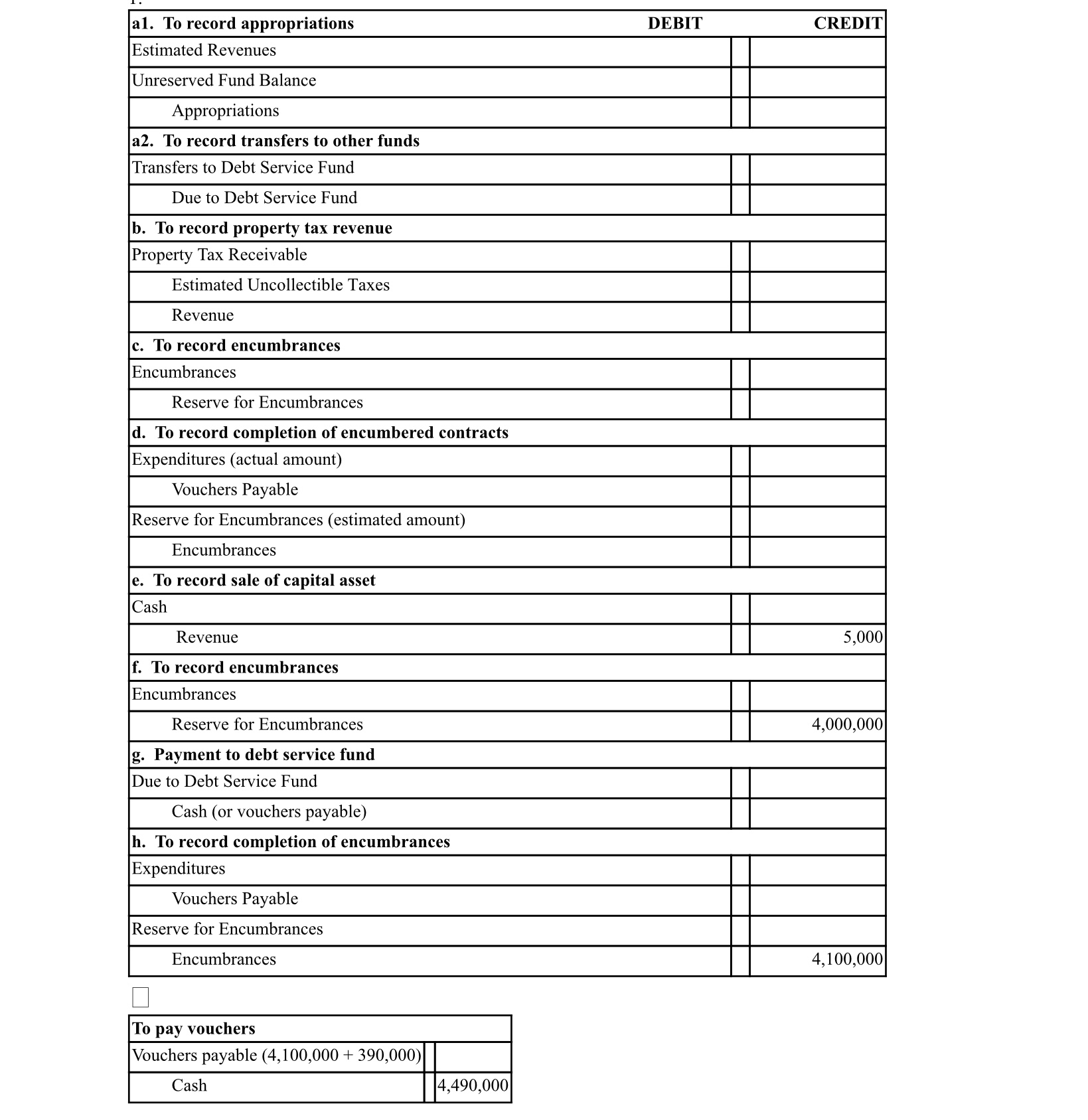

The City of Ridgeway had the following transactions for Journalize the transactions in the General Fund.

a The budget is approved. Tax levies and additional revenues are expected to be $Expenditures of $ are authorized, along with a $ payment to be made to the Debt Service Fund.

b The appraised value of property in the city is $ million. The tax rate is $ per $ of assessed valuation and percent of the taxes levied are not expected to be collected.

c Equipment estimated to cost $ is ordered.

d Half of the above equipment is received and an invoice for $ is approved for payment.

e An old city truck is sold for $ The truck had cost $ years ago and was estimated to have a life of years at that time

f Encumbrances of $ million were made.

g Payment is made to the debt service fund.

h Expenditures of $ million were made on the encumbrances from f above.

j The vouchers payable were paid.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock