Question: I need help with letter c part. It's based on Analyzing and Reporting Inventory and please indicate your full solution. Thank you. Crane Enterprises purchased

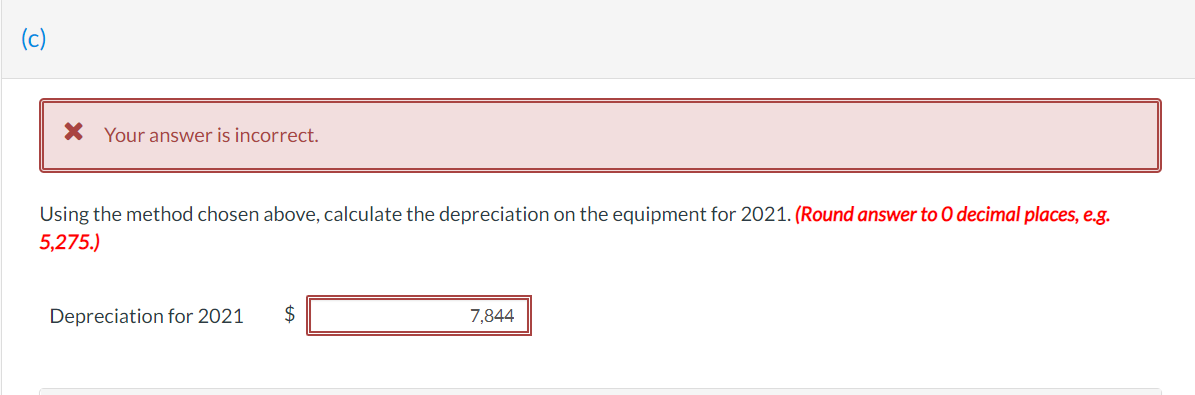

I need help with letter c part. It's based on Analyzing and Reporting Inventory and please indicate your full solution. Thank you.

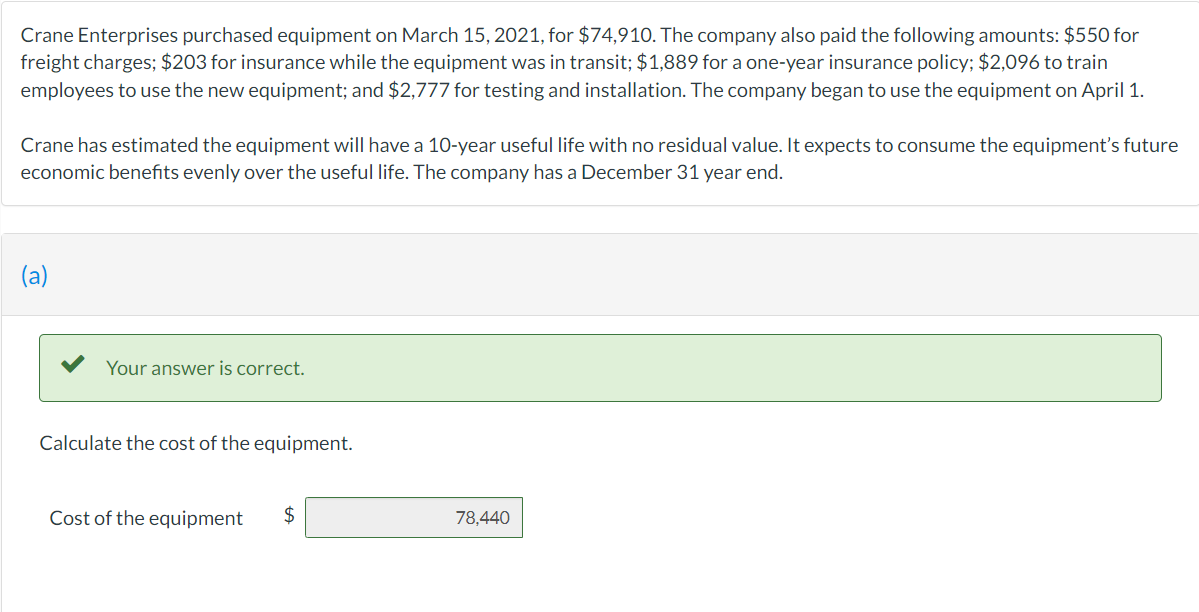

Crane Enterprises purchased equipment on March 15, 2021, for $74,910. The company also paid the following amounts: $550 for freight charges; $203 for insurance while the equipment was in transit; $1,889 for a one-year insurance policy; $2,096 to train employees to use the new equipment; and $2,777 for testing and installation. The company began to use the equipment on April 1. Crane has estimated the equipment will have a 10-year useful life with no residual value. It expects to consume the equipment's future economic benefits evenly over the useful life. The company has a December 31 year end. (a) Your answer is correct. Calculate the cost of the equipment. Cost of the equipment $ 78,440 (b) Your Answer Correct Answer (Used) Your answer is correct. Which depreciation method should the company use? Straight-line method eTextbook and Media Solution (c) * Your answer is incorrect. Using the method chosen above, calculate the depreciation on the equipment for 2021. (Round answer to O decimal places, e.g. 5,275.) Depreciation for 2021 $ 7,844

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts