Question: I need help with line 11 on schedule A form 1040 Comprehensive Problem 5-1 James Dangelf (birthdate August 2, 1977) is a single taxpayer. Jim's

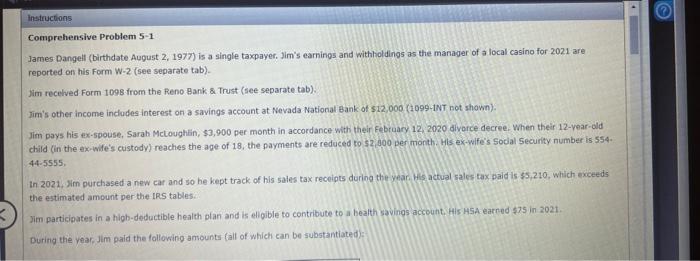

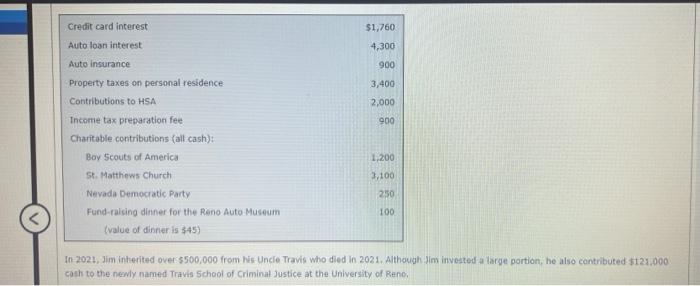

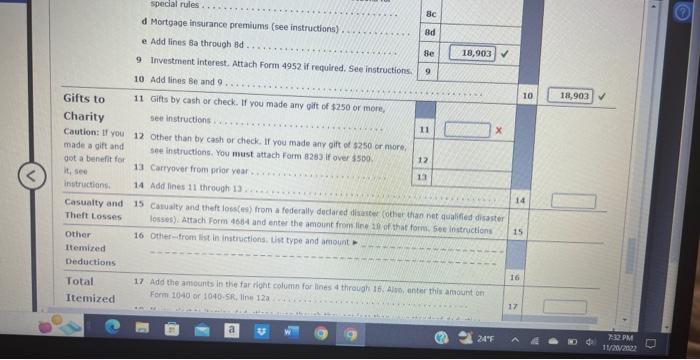

Comprehensive Problem 5-1 James Dangelf (birthdate August 2, 1977) is a single taxpayer. Jim's earnings and withholdings as the manader of a local casino for 2021 are reported on his Form W-2 (see separate tab). Jim recelved Form 1098 from the Reno Barik \& Trust (see separate tab). Jim's other income inclades interest on a savings account at Nevada National Bank of 512,000(20991NT not shown). Jim pays his ex-spouse, Sarah Mcloughtin, $3,900 per month in accordance with their February 12,2020 divorce decree. When their 12 -year-did child (in the ex-wife's custody) reaches the age of 18 , the payments are reduced to 52,000 per month. His ex-wife's 50 thal 5 ecurity number is 554 . 44.5555. In 2021, Jim purchased a new cat and so he kept track of his sates tax receipts during the year, His actual sales tax paid is 55,210 , which exceeds the estimated amount per the IRS tables. Jim participates in a high-deductible health plan and is ell gible to contribute to a bealth savings account. His H5A earred 575 in 2021. Dutitig the year. Jim paid the following amounts (all of which can be substantiated): In 2021, Jim interited over $500,000 from Nis Uncle Travis who died in 2021. Atthough jim invested a large portion, he also contributed 3121,000 cash to the newly named Travis School of Criminal Justice at the University of Reno, d Mortgage insurance premiums (see instructions). e. Add lines Ba through fid. 9 Investrment interest, Attach Form 4952 if requlred, See instructions. 10 Add lines Be and 9. Gifts to 11 Gitts by cash or check. If you made any gitt of $250 or more, Caution: If you 12 Other than by cash or check, If you made any oift of $250 or niore, got a benefit fot - see instructions. You must attach form 8283 if over s500. it, see 13 Carryover from prior yoar. Itemized Deductions Total 17 Add the amounts in the far dight columin for lines 4 through i6. Also, anter this amount on: Itemized Form 1040 or 1040.5 in, 11 in 12a Comprehensive Problem 5-1 James Dangelf (birthdate August 2, 1977) is a single taxpayer. Jim's earnings and withholdings as the manader of a local casino for 2021 are reported on his Form W-2 (see separate tab). Jim recelved Form 1098 from the Reno Barik \& Trust (see separate tab). Jim's other income inclades interest on a savings account at Nevada National Bank of 512,000(20991NT not shown). Jim pays his ex-spouse, Sarah Mcloughtin, $3,900 per month in accordance with their February 12,2020 divorce decree. When their 12 -year-did child (in the ex-wife's custody) reaches the age of 18 , the payments are reduced to 52,000 per month. His ex-wife's 50 thal 5 ecurity number is 554 . 44.5555. In 2021, Jim purchased a new cat and so he kept track of his sates tax receipts during the year, His actual sales tax paid is 55,210 , which exceeds the estimated amount per the IRS tables. Jim participates in a high-deductible health plan and is ell gible to contribute to a bealth savings account. His H5A earred 575 in 2021. Dutitig the year. Jim paid the following amounts (all of which can be substantiated): In 2021, Jim interited over $500,000 from Nis Uncle Travis who died in 2021. Atthough jim invested a large portion, he also contributed 3121,000 cash to the newly named Travis School of Criminal Justice at the University of Reno, d Mortgage insurance premiums (see instructions). e. Add lines Ba through fid. 9 Investrment interest, Attach Form 4952 if requlred, See instructions. 10 Add lines Be and 9. Gifts to 11 Gitts by cash or check. If you made any gitt of $250 or more, Caution: If you 12 Other than by cash or check, If you made any oift of $250 or niore, got a benefit fot - see instructions. You must attach form 8283 if over s500. it, see 13 Carryover from prior yoar. Itemized Deductions Total 17 Add the amounts in the far dight columin for lines 4 through i6. Also, anter this amount on: Itemized Form 1040 or 1040.5 in, 11 in 12a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts