Question: I need help with my assignment please (The following information applies to the questions displayed below.] In December 2014, Custom Mfg. established its predetermined overhead

I need help with my assignment please

![the questions displayed below.] In December 2014, Custom Mfg. established its predetermined](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6a59e544b3_70966e6a59daffbf.jpg)

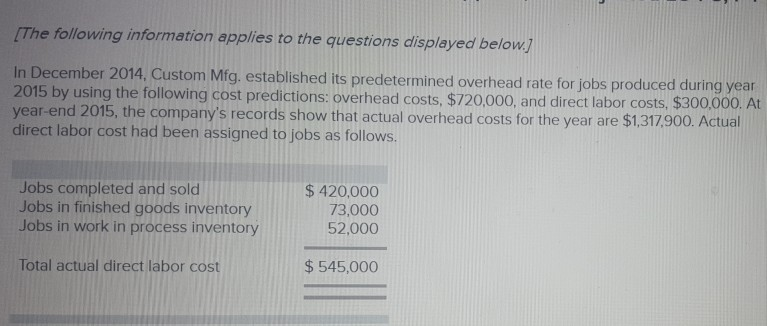

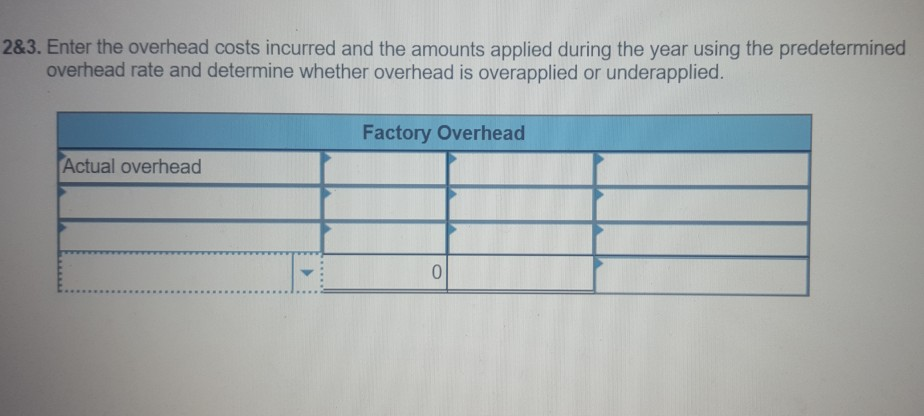

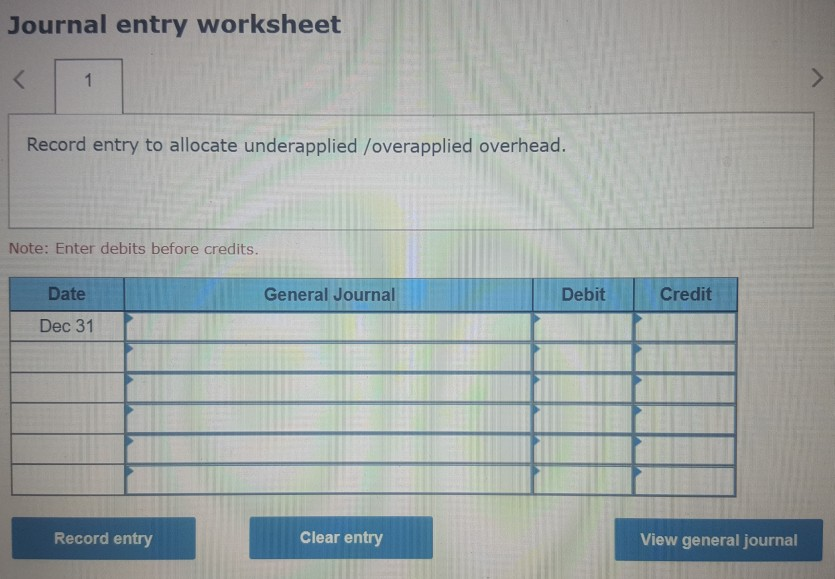

(The following information applies to the questions displayed below.] In December 2014, Custom Mfg. established its predetermined overhead rate for jobs produced during year 2015 by using the following cost predictions: overhead costs, $720,000, and direct labor costs, $300,000. At year-end 2015, the company's records show that actual overhead costs for the year are $1,317,900. Actual direct labor cost had been assigned to jobs as follows. Jobs completed and sold Jobs in finished goods inventory Jobs in work in process inventory $ 420,000 73,000 52,000 Total actual direct labor cost $ 545,000 1. Determine the predetermined overhead rate for year 2015. Overhead Rate I Choose Denominator: Overhead Rate Choose Numerator: Estimated overhead costs 1 Estimated direct labor costs = Overhead rate 2&3. Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. Factory Overhead Actual overhead Journal entry worksheet Record entry to allocate underapplied /overapplied overhead. Note: Enter debits before credits. General Journal Credit Date Dec 31 Debit PA Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts