Question: I need help with my Finance HW, please include the steps as well. Thank you! Management of Cullumber, Inc., is currently evaluating three independent projects.

I need help with my Finance HW, please include the steps as well. Thank you!

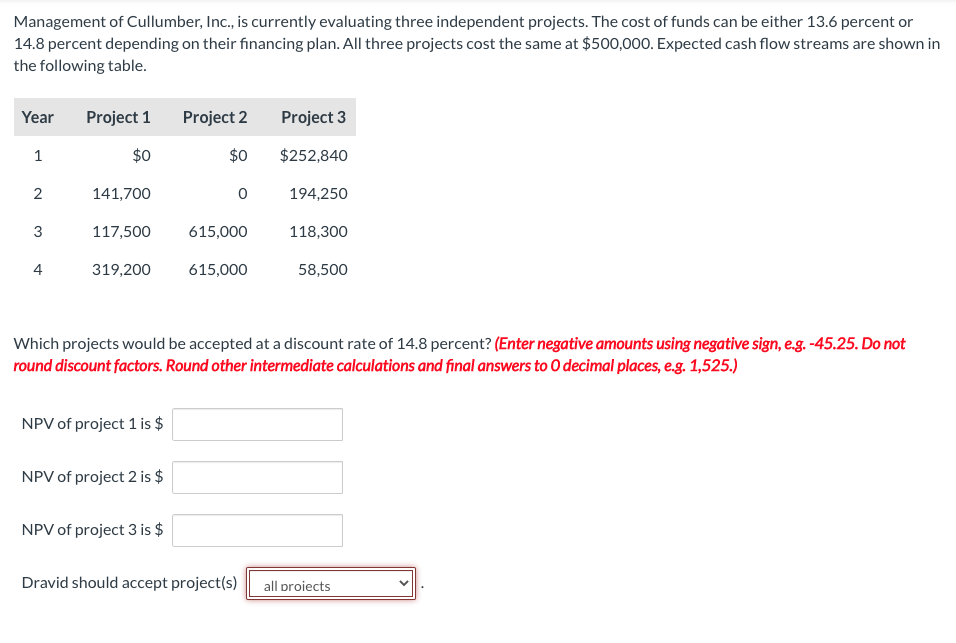

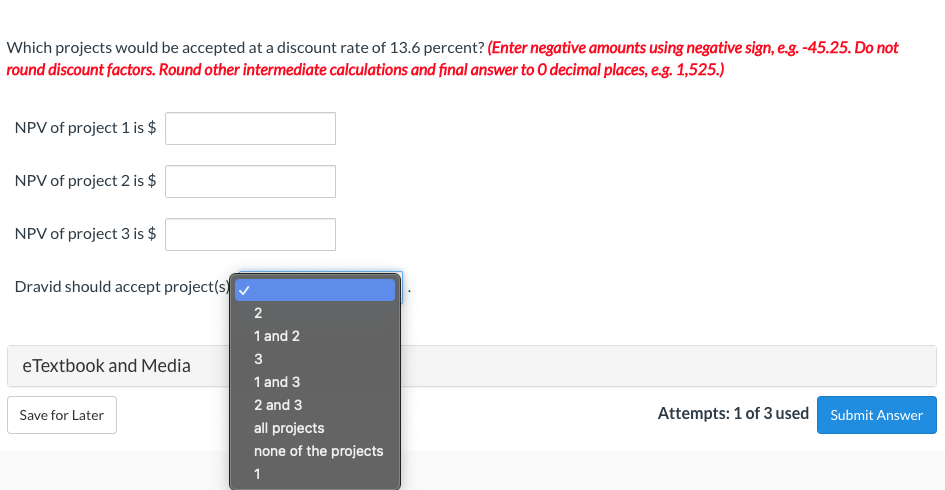

Management of Cullumber, Inc., is currently evaluating three independent projects. The cost of funds can be either 13.6 percent or 14.8 percent depending on their financing plan. All three projects cost the same at $500,000. Expected cash flow streams are shown in the following table. Which projects would be accepted at a discount rate of 14.8 percent? (Enter negative amounts using negative sign, e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answers to 0 decimal places, e.g. 1,525.) NPV of project 1 is $ NPV of project 2 is $ NPV of project 3 is $ Dravid should accept project(s) Which projects would be accepted at a discount rate of 13.6 percent? (Enter negative amounts using negative sign, e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) NPV of project 1 is $ NPV of project 2 is $ NPV of project 3 is $ Dravid should accept project(s) Attempts: 1 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts