Question: I need help with my homework, presentation matters for financial statements. For example, acronyms and abbreviations are not acceptable for financial statements. The statements are

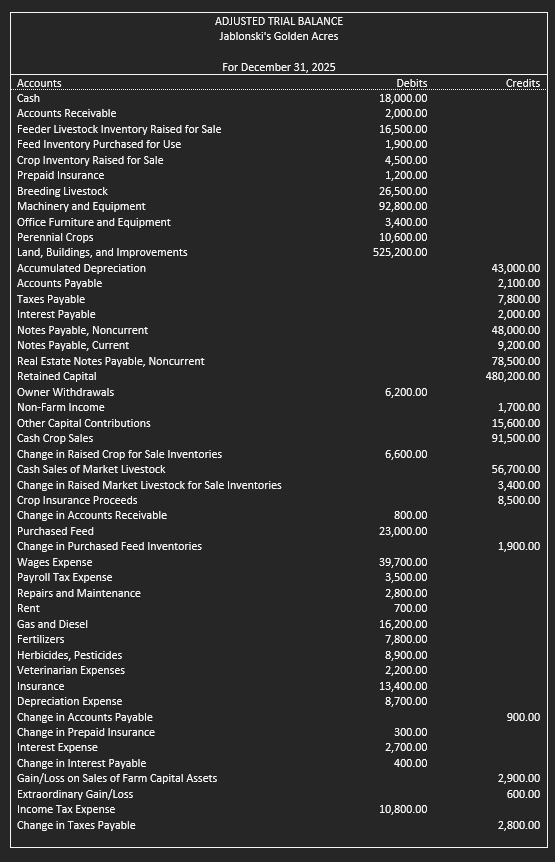

I need help with my homework, presentation matters for financial statements. For example, acronyms and abbreviations are not acceptable for financial statements. The statements are required to be neat, organized, easytoread, and easytofollow. The formats presented in class are good ones to follow but are by no means the only acceptable format Using the attached Adjusted Trial Balance, prepare Jablonskis Golden Acres financial statements for the end of the year. They use the accrual adjusted approach for their financial recordkeeping. Each individual statement will fit on its own page. It is required that you do so for this assignment. A Income Statement for points B Statement of Owner Equity for points C Balance Sheet for December points It is expected that proper formatting will be used in regard to the document title, headings, subtotals, etc. Improper formatting will lose points. You are putting together financial statements, not just determining net income or owner equity. Special notes for managing liabilities on the Balance Sheet: For the Balance Sheet, it is necessary to properly report the correct current and noncurrent liabilities values, particularly regarding loans. Read the following carefully; Balance Sheet values for notes payable are discussed. The ledger balance via the Adjusted Trial Balance for Notes Payable, Current is $ The ledger balance via the Adjusted Trial Balance for Notes Payable, Noncurrent is $ Of that total, $ is due within the next twelve months and $ is due after the next twelve months. The ledger balance via the Adjusted Trial Balance for Real Estate Notes Payable, Noncurrent is $ Of that total, $ is due within the next twelve months and $ is due after the next twelve months. For the current liabilities on the Balance Sheet, it is necessary to include the current portion of longterm debt ie the payments that are due within the next twelve months under current liabilities. Since these are loan payments due within one year, they are included on the Balance Sheet with the lineitem called: Current Portion of Longterm Debt.In this case, a lineitem is something added to a financial statement that is not a direct account balance The value for Current Portion of Longterm Debt is $ and will be included with current liabilities on the Balance Sheet. This adjustment requires that the value of Notes Payable, Noncurrent and Real Estate Notes Payable, Noncurrent reported on the Balance Sheet be adjusted as well. The Balance Sheet values for them are: Notes Payable, Noncurrent $ Real Estate Notes Payable, Noncurrent $ The other liability account values are not affected by these adjustments and the ledger balances as reported on the Adjusted Trial Balance are presented on the Balance Sheet.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock