Question: I need help with number 4, I need the statement of cash flow. Income statement I have attached. Instructions: Using the July 31, 2020 adjusted

I need help with number 4, I need the statement of cash flow. Income statement I have attached.

Instructions: Using the July 31, 2020 adjusted trial balance information complete a multi-step income statement. Round all amounts to the nearest cent. Follow the below format notes, the rest is up to the student. Note that grades are also based on organization, formula use, and clarity of financial statement. Other requirements are:

| Income Statement | ||

| For the Year Ended July 31, 2020 | ||

| Sales | $3,975,725.00 | |

| Cost of Goods Sold | $1,509,195.00 | |

| Gross Profit | $2,466,530.00 | |

| Operating Expenses: | ||

| Wages Expense | $799,500.00 | |

| Salaries Expense | $229,000.00 | |

| Marketing Expense | $75,000.00 | |

| Travel and Entertainment Expense | $85,600.00 | |

| Bad Debt Expense | $9,900.00 | |

| Property Tax Expense | $150,000.00 | |

| Office Maintenance & Repair Expense | $30,000.00 | |

| Legal Expense | $5,400.00 | |

| Insurance Expense | $3,500.00 | |

| Miscellaneous Expense | $53,925.00 | |

| Office Supplies Expense | $735.00 | |

| Telecommunication Expense | $10,000.00 | |

| Depreciation Expense - Building | $87,500.00 | |

| Depreciation Expense - Equipment | $6,000.00 | |

| Depreciation Expense - Office Furniture | $11,750.00 | |

| Total Operating Expenses | $1,557,810.00 | |

| Income from Operations | $908,720.00 | |

| Other Income | ||

| Rent Income | $12,000.00 | |

| Gain on Sale of Equity Investment Securities - Trading | $35,000.00 | $47,000.00 |

| Other Expenses: | ||

| Interest Expense | $(61,000.00) | |

| Loss on Sale of Held to Maturity Investment | $(30,250.00) | $91,250.00 |

| Net Income | $864,470.00 | |

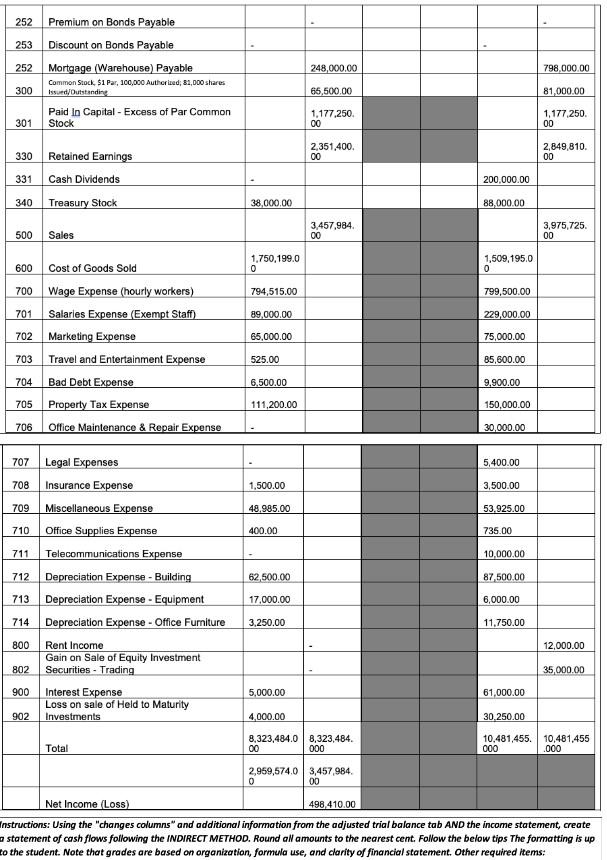

| a. Only use accounts that have changes or cash flows | |||

| b. Include proper report title | |||

| c. Not all rows or columns need to be used. Formulas MUST be used when necessary. | |||

| TIPS PLEASE READ: | |||

| 1. Correct selection of "Increase" or "Decrease" in accounts must be used as part of the label where applicable | |||

| 2. Correct use of "cash paid" or "cash received" must be used where applicable | |||

| 3. Subtotals for each section MUST be properly identified as cash "used in" or "provided by" | |||

| 4. All changes utilize CASH. There ARE GAINS AND LOSSES from investments that must be included in operating activities | |||

| 5. Net change in cash + beginning cash balance (from a adjusted trial balance July 2019 column) must equal ending cash balance and be included at the bottom of this statement. |

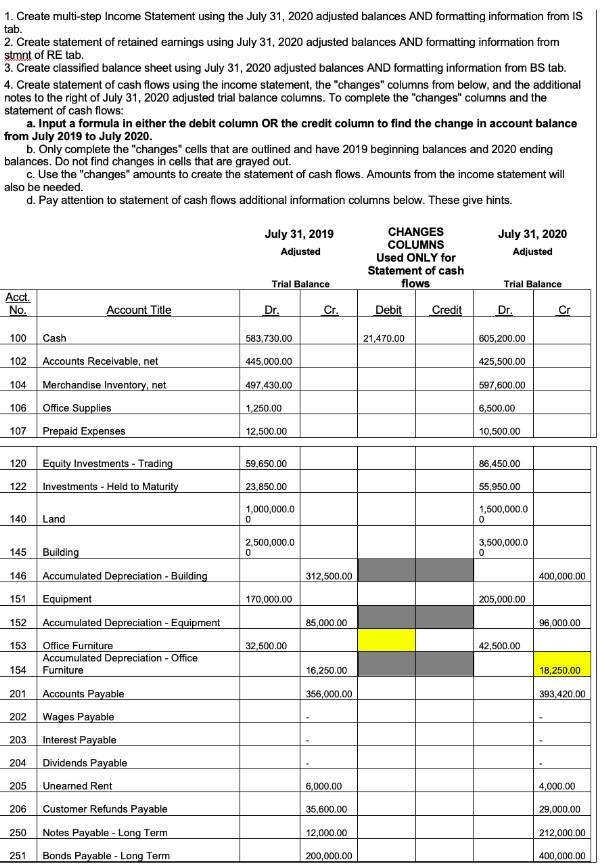

1. Create multi-step Income Statement using the July 31, 2020 adjusted balances AND formatting information from IS tab. 2. Create statement of retained earnings using July 31, 2020 adjusted balances AND formatting information from stmnt of RE tab. 3. Create classified balance sheet using July 31, 2020 adjusted balances AND formatting information from BS tab. 4. Create statement of cash flows using the income statement, the "changes" columns from below, and the additional notes to the right of July 31,2020 adjusted trial balance columns. To complete the "changes" columns and the statement of cash flows: a. Input a formula in either the debit column OR the credit column to find the change in account balance from July 2019 to July 2020. b. Only complete the "changes" cells that are outlined and have 2019 beginning balances and 2020 ending balances. Do not find changes in cells that are grayed out. c. Use the "changes" amounts to create the statement of cash flows. Amounts from the income statement will also be needed. d. Pay attention to statement of cash flows additional information columns below. These give hints. to the student. Note that grades are based on organization, formula use, and clarity of financial statement. Other required items

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts