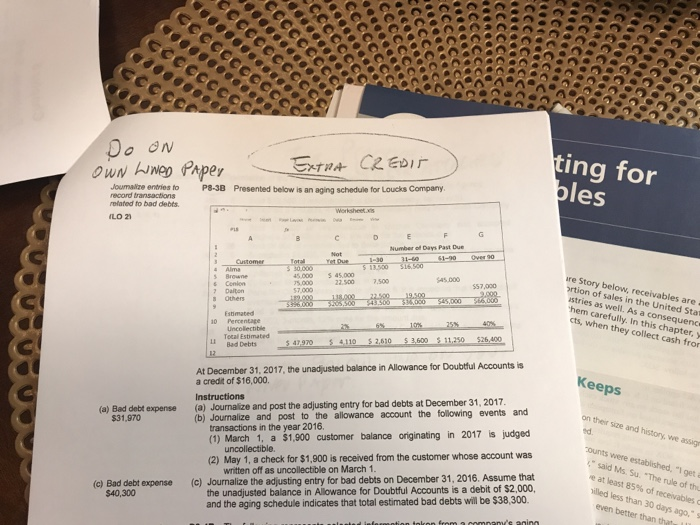

Question: i need help with P8-3B. Please explain how you get the answers. ting for les P8-3B Presented below is an aging schedule for Loucks Company

ting for les P8-3B Presented below is an aging schedule for Loucks Company Joumalize entries to refated to bad debts Number o Days Past Due 45,000 rtion of sales in the United Stat stries as well. As a c hem carefully. In this chapter cts, when they collect cash fror 5 45,000 $57,000 s Browne s Conion LI Bad Debts At December 31, 2017, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $16,000. Keeps (a) Journalize and post the adjusting entry for bad debts at December 31, 2017 (b) Journalize and post to the allowance account the following events and on their size and history, we assign expense transactions in the year 2016 (1) March 1, a $1,900 customer balance originating in 2017 is judged (2) May 1, a check for $1,900 is received from the customer whose account was $31,970 (c) Journalize the adjusting entry for bad debts on December 31, 2016. Assume that the unadjusted balance in Allowance for Doubtful Accounts is a debit of $2,000, said Ms. Su. "The rule of th at least 85% of receivables illed less than 30 days ago, written off as uncollectible on March 1 (c) Bad debt expense $40,300 and the aging schedule indicates that total estimated bad debts will be $38,300. ting for les P8-3B Presented below is an aging schedule for Loucks Company Joumalize entries to refated to bad debts Number o Days Past Due 45,000 rtion of sales in the United Stat stries as well. As a c hem carefully. In this chapter cts, when they collect cash fror 5 45,000 $57,000 s Browne s Conion LI Bad Debts At December 31, 2017, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $16,000. Keeps (a) Journalize and post the adjusting entry for bad debts at December 31, 2017 (b) Journalize and post to the allowance account the following events and on their size and history, we assign expense transactions in the year 2016 (1) March 1, a $1,900 customer balance originating in 2017 is judged (2) May 1, a check for $1,900 is received from the customer whose account was $31,970 (c) Journalize the adjusting entry for bad debts on December 31, 2016. Assume that the unadjusted balance in Allowance for Doubtful Accounts is a debit of $2,000, said Ms. Su. "The rule of th at least 85% of receivables illed less than 30 days ago, written off as uncollectible on March 1 (c) Bad debt expense $40,300 and the aging schedule indicates that total estimated bad debts will be $38,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts