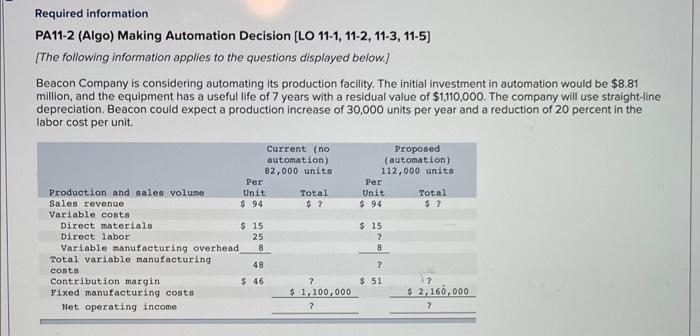

Question: I need help with part 3,4, and 5 please. Required information PA11-2 (Algo) Making Automation Decision [LO 11-1, 11-2, 11-3, 11-5] [The following information applies

![(Algo) Making Automation Decision [LO 11-1, 11-2, 11-3, 11-5] [The following information](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f786c23890b_92166f786c1cb252.jpg)

![applies to the questions displayed below] Beacon Company is considering automating its](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f786c2e75cd_92266f786c282836.jpg)

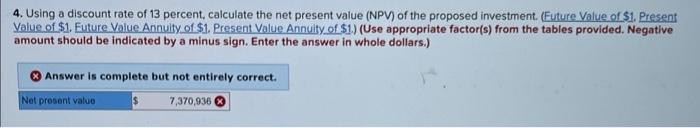

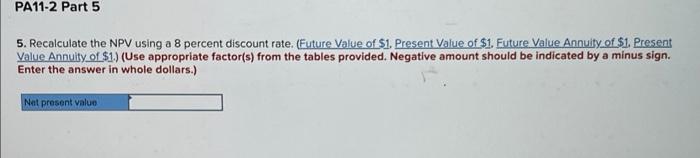

Required information PA11-2 (Algo) Making Automation Decision [LO 11-1, 11-2, 11-3, 11-5] [The following information applies to the questions displayed below] Beacon Company is considering automating its production facility. The initial investment in automation would be $8.81 million, and the equipment has a useful life of 7 years with a residual value of $1,110,000. The company will use straight-line depreciation. Beacon could expect a production increase of 30,000 units per year and a reduction of 20 percent in the labor cost per unit. Required: 1-a. Complete the following table showing the totals. (Enter your answers in whole dollars, not in millions.) 3. Determine the project's payback period. (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. 4. Using a discount rate of 13 percent, calculate the net present value (NPV) of the proposed investment. (Future Value of $1. Present Value of \$1. Future Value Annulty of \$1. Present Value Annuity. of \$1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Q Answer is complete but not entirely correct. 5. Recalculate the NPV using a 8 percent discount rate. (Future Value of $1. Present Value of $1. Future Value Annuify of $1. Present Value.Annuity of $1. ) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts