Question: I need help with part 8 specifically, but can you also check my work for 1-7? Glass House Corporation started a business in early 2023

I need help with part 8 specifically, but can you also check my work for 1-7?

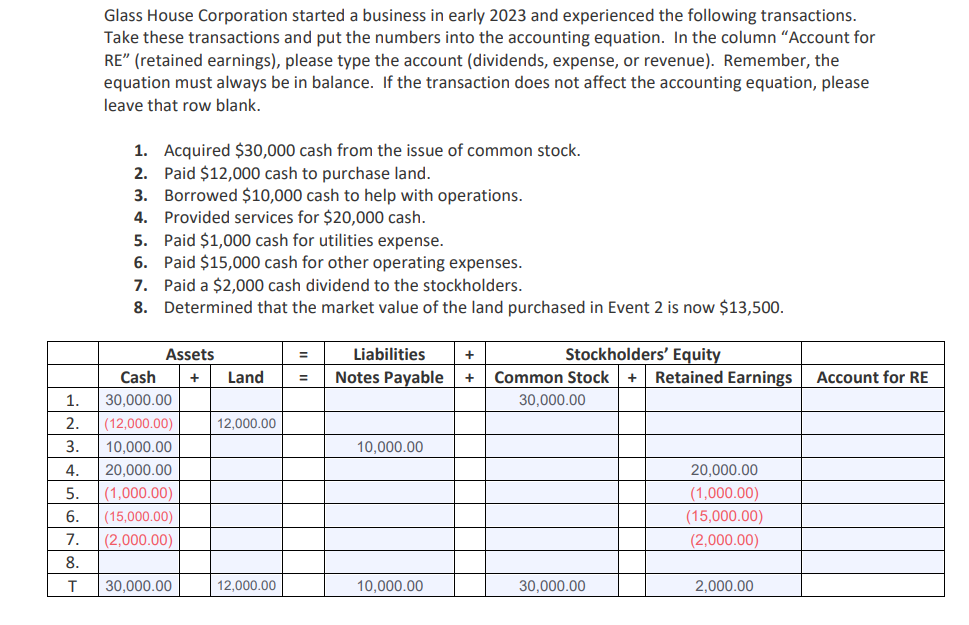

Glass House Corporation started a business in early 2023 and experienced the following transactions. Take these transactions and put the numbers into the accounting equation. In the column "Account for RE" (retained earnings), please type the account (dividends, expense, or revenue). Remember, the equation must always be in balance. If the transaction does not affect the accounting equation, please leave that row blank. 1. Acquired $30,000 cash from the issue of common stock. 2. Paid $12,000 cash to purchase land. 3. Borrowed $10,000 cash to help with operations. 4. Provided services for $20,000 cash. 5. Paid $1,000 cash for utilities expense. 6. Paid $15,000 cash for other operating expenses. 7. Paid a $2,000 cash dividend to the stockholders. 8. Determined that the market value of the land purchased in Event 2 is now $13,500. Glass House Corporation started a business in early 2023 and experienced the following transactions. Take these transactions and put the numbers into the accounting equation. In the column "Account for RE" (retained earnings), please type the account (dividends, expense, or revenue). Remember, the equation must always be in balance. If the transaction does not affect the accounting equation, please leave that row blank. 1. Acquired $30,000 cash from the issue of common stock. 2. Paid $12,000 cash to purchase land. 3. Borrowed $10,000 cash to help with operations. 4. Provided services for $20,000 cash. 5. Paid $1,000 cash for utilities expense. 6. Paid $15,000 cash for other operating expenses. 7. Paid a $2,000 cash dividend to the stockholders. 8. Determined that the market value of the land purchased in Event 2 is now $13,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts