Question: I need help with Part 9 and 10 the closing entries and the Post closing trial balance Palisade Creek Co. Post-Closing Trial Balance May 31,

I need help with Part 9 and 10 the closing entries and the Post closing trial balance

-

Palisade Creek Co. Post-Closing Trial Balance May 31, 20Y6 Debit Credit Cash Accounts Receivable Inventory Estimated Returns Inventory Prepaid Insurance Store Supplies Store Equipment Accumulated Depreciation-Store Equipment Accounts Payable Salaries Payable Customers Refunds Payable Common Stock Retained Earnings

Journalize the closing entries. Then post the journal to the general ledger you created in part 1. Indicate closed accounts by inserting a line in both the balance columns opposite the closing entry. Insert the new balance in the retained earnings account.

If an amount box does not require an entry, leave it blank.

| Date | Description | Post. Ref. | Debit | Credit |

|---|---|---|---|---|

| May 31 | Cash | |||

| May 31 | ||||

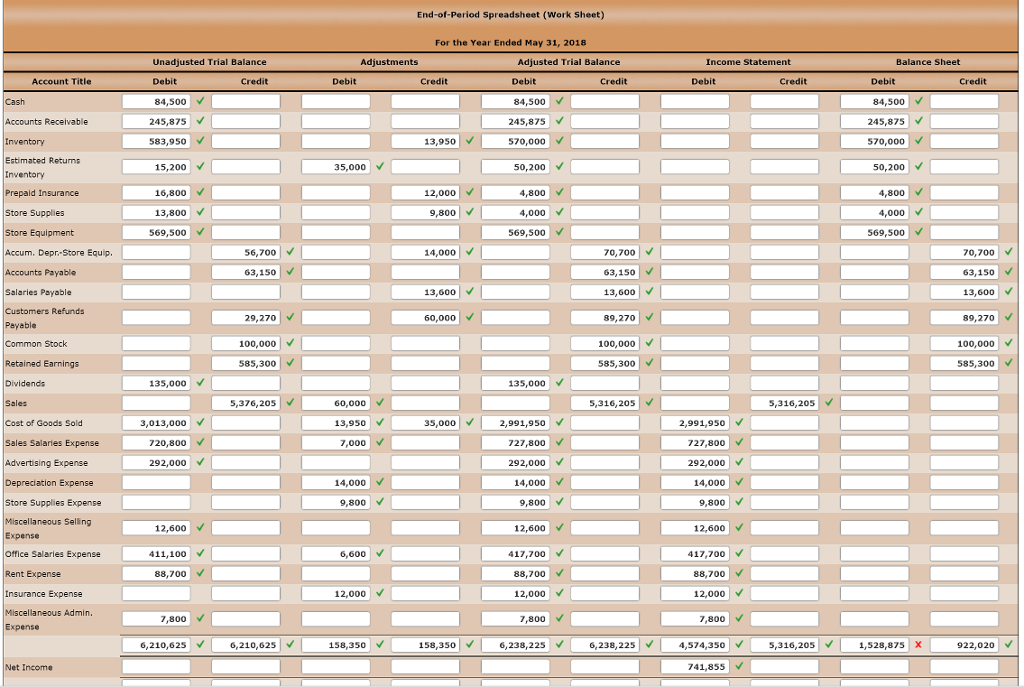

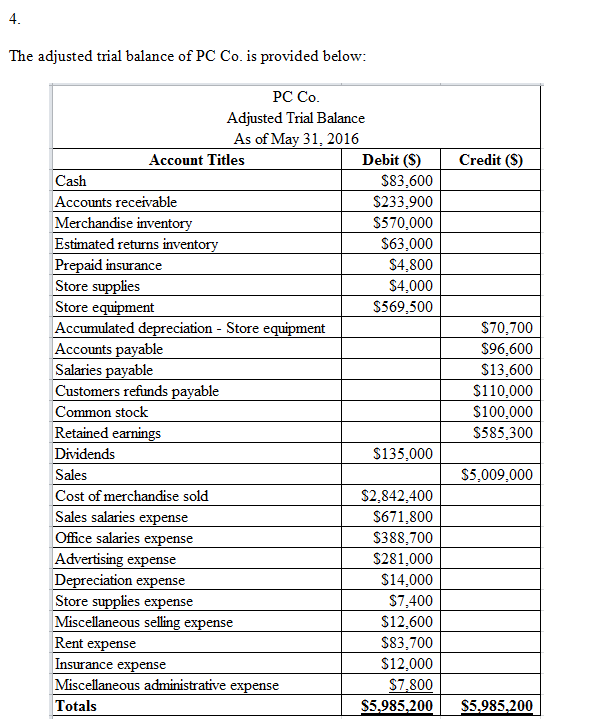

End-of-Period Spreadsheet (Work Sheet) Unadjusted Trial Balance Debit Credit For the Year Ended May 31, 2018 Adjustments Adjusted Trial Balance Debit Credit Debit Credit Balance Sheet Income Statement Debit Credit Account Title Debit Credit Cash 84,500 84,500 Accounts Receivable 84,500 245,875 583,950 245,875 245,875 Inventory 13,950 570,000 570,000 Estimated Returns Inventory 15,2007 | 35,000 V 50,200 50,200 Prepaid Insurance 16,800 12,000 4,800 4,800 Store Supplies 13,800 9,800 4,000 4,000 Store Equipment 569,500 569,500 569,500 Accum. Depr.-Store Equip. 14,000 70,700 56,700 63,150 Accounts Payable 70,700 63,150 13,600 63,1507 Salaries Payable 13,600 13,600 29,270 60,000 89,270 89,270 Customers Refunds Payable Common Stock Retained Earnings 100,000 100,000 585,300 100,000 585,300 585,300 Dividends 135,000 135,000 Sales 5,376, 205 60,000 5,316, 205 5,316, 205 Cost of Goods Sold 13,950 35,000 2,991,950 3,013,000 720,800 2,991,950 727,800 Sales Salaries Expense 7,000 727,800 Advertising Expense 292,000 292,000 292,000 Depreciation Expense 14,000 14,000 V 14,000 9,800 9,800 9,800 Store Supplies Expense Miscellaneous Selling Expense 12,600 | 12,600 / 12,600 Office Salaries Expense 411,100 6,600 417,700 417,700 Rent Expense 88,700 88,700 88,700 Insurance Expense 12,000 12,000 12,000 Miscellaneous Admin. Expense 7,800 7,800 7,800 6,210,625 6 ,210,625 158,350 158,350 6,238,225 6,238,225 5,316,205 1,528,875 X 922,020 4,574,350 741,855 Net Income The adjusted trial balance of PC Co. is provided below: Credit (S) PC Co. Adjusted Trial Balance As of May 31, 2016 Account Titles Debit ($) Cash $83.600 Accounts receivable $233,900 Merchandise inventory $570,000 Estimated returns inventory $63.000 Prepaid insurance $4.800 Store supplies $4.000 Store equipment $569.500 Accumulated depreciation - Store equipment Accounts payable Salaries payable Customers refunds payable Common stock Retained earnings Dividends $135,000 Sales Cost of merchandise sold $2.842.400 Sales salaries expense $671,800 Office salaries expense $388.700 Advertising expense $281.000 Depreciation expense $14.000 Store supplies expense $7.400 Miscellaneous selling expense $12.600 Rent expense $83.700 Insurance expense $12.000 Miscellaneous administrative expense $7.800 Totals $5,985,200 $70.700 $96,600 $13.600 $110.000 $100,000 $585,300 $5,009,000 $5,985,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts