Question: I need help with part c please. 7.5. A real-estate development firm, Peterson and Johnson, is considering five possible development projects. Using units of millions

I need help with part c please.

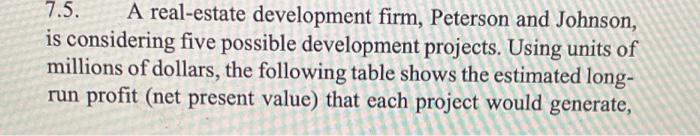

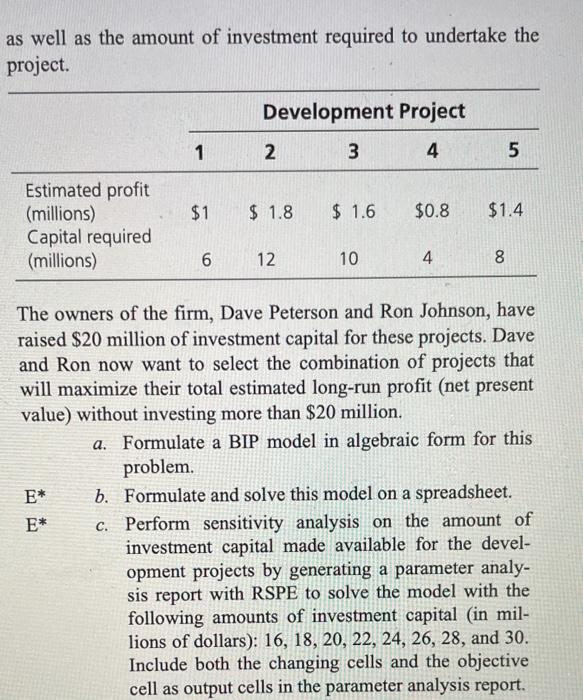

7.5. A real-estate development firm, Peterson and Johnson, is considering five possible development projects. Using units of millions of dollars, the following table shows the estimated long- run profit (net present value) that each project would generate, as well as the amount of investment required to undertake the project. Development Project 1 2 3 4 5 $1 $ 1.8 $ 1.6 $0.8 $1.4 Estimated profit (millions) Capital required (millions) 6 12 10 4 8 The owners of the firm, Dave Peterson and Ron Johnson, have raised $20 million of investment capital for these projects. Dave and Ron now want to select the combination of projects that will maximize their total estimated long-run profit (net present value) without investing more than $20 million. a. Formulate a BIP model in algebraic form for this problem. E* b. Formulate and solve this model on a spreadsheet. E* c. Perform sensitivity analysis on the amount of investment capital made available for the devel- opment projects by generating a parameter analy- sis report with RSPE to solve the model with the following amounts of investment capital in mil- lions of dollars): 16, 18, 20, 22, 24, 26, 28, and 30. Include both the changing cells and the objective cell as output cells in the parameter analysis report

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock