Question: I need help with part C. The answer isn't 0 either Problem 15-45 (b) (LO. 4) Sterling, whose wife died in 2020, listed their personal

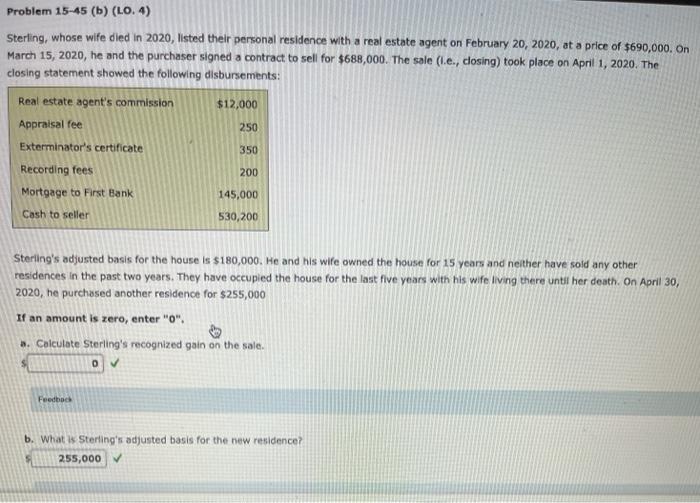

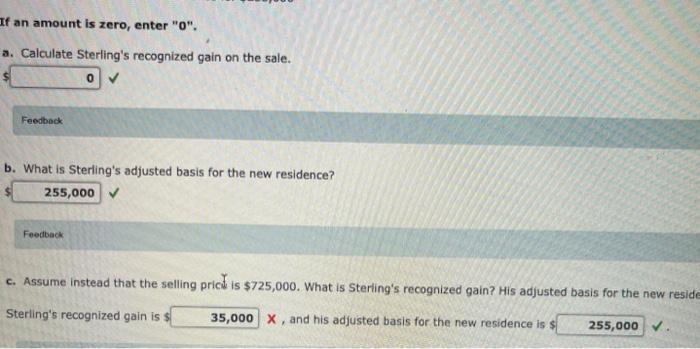

Problem 15-45 (b) (LO. 4) Sterling, whose wife died in 2020, listed their personal residence with a real estate agent on February 20, 2020, at a price of $690,000. On March 15, 2020, he and the purchaser signed a contract to sell for $688,000. The sale (l.e., closing) took place on April 1, 2020. The closing statement showed the following disbursements: $12,000 Real estate agent's commission Appraisal fee Exterminator's certificate 250 350 Recording fees 200 145,000 Mortgage to First Bank Cash to seller 530,200 Sterling's adjusted basis for the house is $180,000. He and his wife owned the house for 15 years and neither have sold any other residences in the past two years. They have occupied the house for the last five years with his wife living there until her death. On April 30, 2020, he purchased another residence for $255,000 If an amount is zero, enter "O". 5. Calculate Sterling's recognized gain on the sale. 0 Feedback b. What is Sterling's adjusted basis for the new residence? 255,000 If an amount is zero, enter "O". a. Calculate Sterling's recognized gain on the sale. o Feedback b. What is Sterling's adjusted basis for the new residence? 255,000 Feedback c. Assume instead that the selling price is $725,000. What is Sterling's recognized gain? His adjusted basis for the new reside Sterling's recognized gain is $ 35,000 x, and his adjusted basis for the new residence is $ 255,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts