Question: I need help with part d and e, please! The three different levels of government (federal, state, and local must impose taxes to carry out

I need help with part d and e, please!

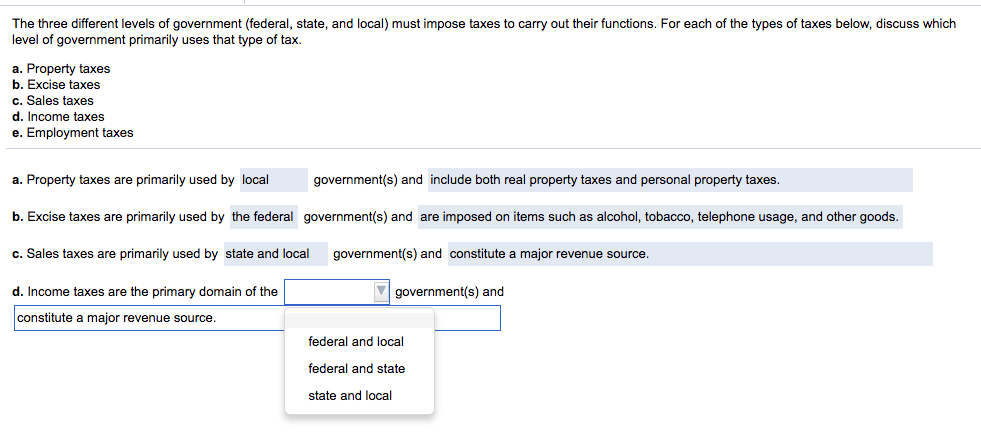

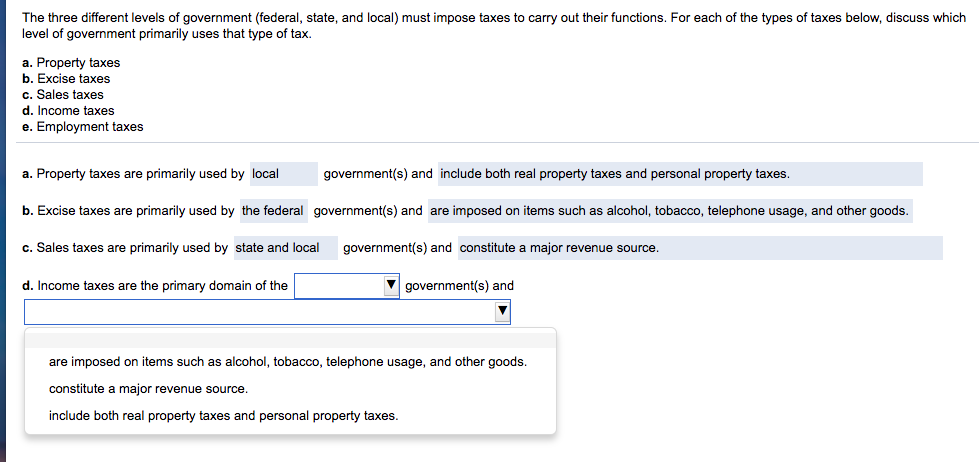

The three different levels of government (federal, state, and local must impose taxes to carry out their functions. For each of the types of taxes below, discuss which level of government primarily uses that type of tax a. Property taxes b. Excise taxes c. Sales taxes d. Income taxes e. Employment taxes government(s) and include both real property taxes and personal property taxes a. Property taxes are primarily used by local b. Excise taxes are primarily used by the federal govern nt(s) and are imposed on items such as alcohol, tobacco, telephone usage, and other goods mel c. Sales taxes are pr rily used by state and local government(s) and constitu rima e a major revenue Source d. Income taxes are the primary domain of the V government(s) and constitute a major revenue source. federal and local federal and state state and local

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts