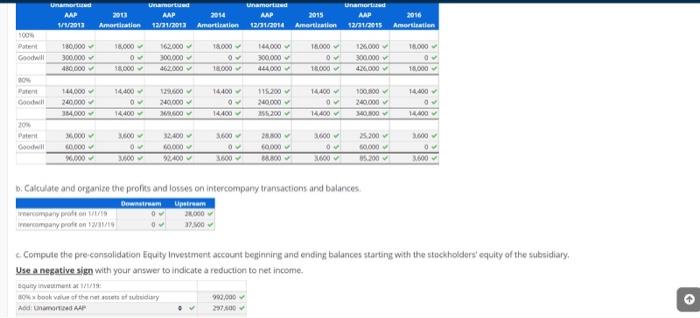

Question: I need help with parts C and E. part C : 80% x book value of the net assets of subsidiary (picture 4) part E

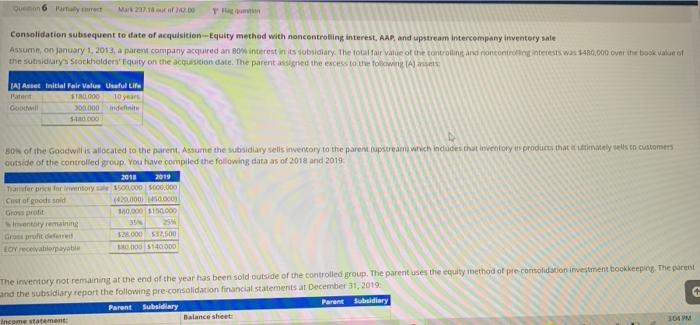

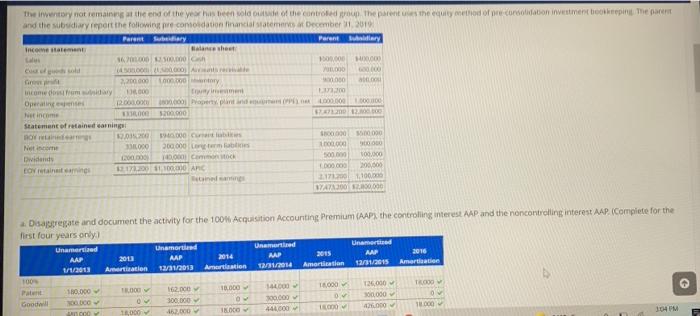

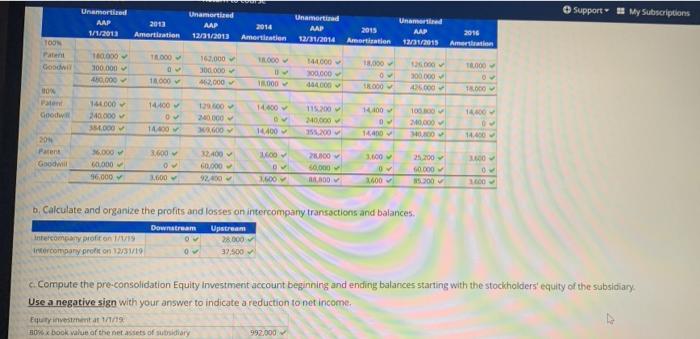

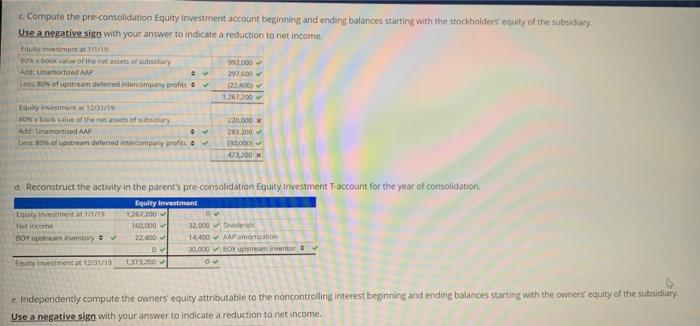

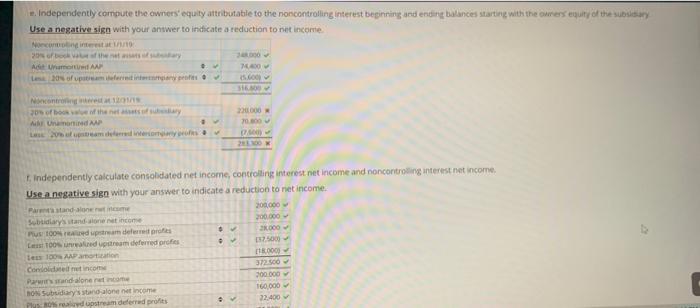

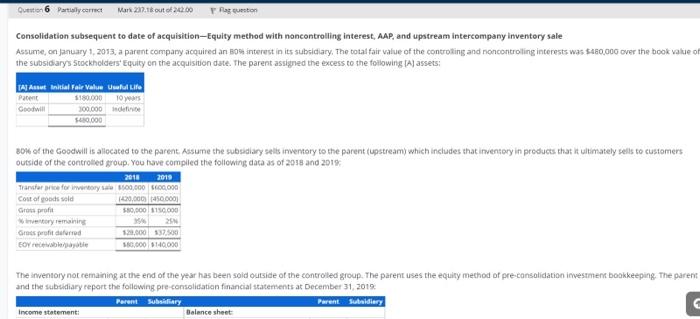

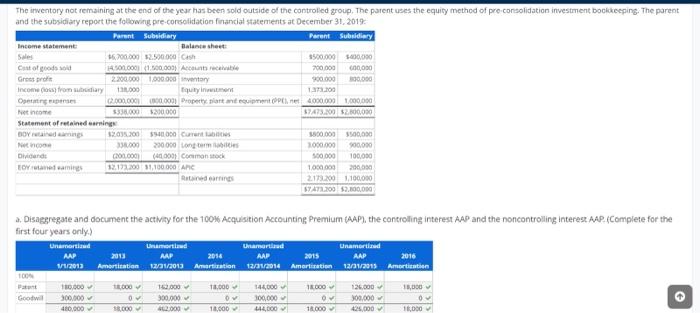

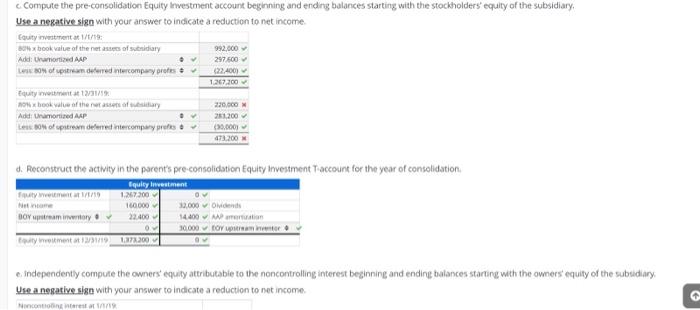

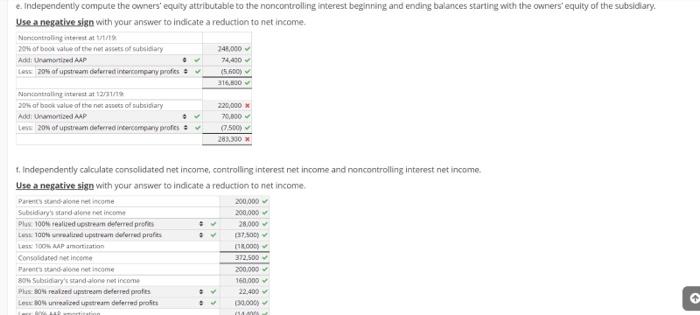

quemont Mar 0 TO Consolidation subsequent to date of acquisition-Equity method with no controlling interest, AAP and upstream intercompany Inventory sale Assure, on January 1, 2013, a parent company acquired an interest in its subsidiary. The total fair value of the controlling and nonconting interests was 1480,000 over the book value of the subsidiary Stockholders' Equity on the acquisition date. The parent anged the excess to the following JA Asset Initial Fair Value Uful Life ant STOC 10 years Gol 300.000 de -0.000 Bon of the Goodwill is allocated to the parent. Assume the subsidiary sells inventory to the parent upstream which includes that inventory is product that timely sells to customers outside of the controlled group. You have compiled the following data as of 2018 and 2019 2013 2019 Tanferre fornitore 1500000 600.000 Cost of goods sold 420.000SOCO Gross profit 10,000 110.000 mentory mining 30 Groot 128.000 $7,500 EOV receivable pay 000 $140.000 The inventory not remaining at the end of the year has been sold outside of the controlled group. The parent uses the equity method of pre-consolidation investment bookkeeping. The corent and the subsidiary report the following pre-consolidation financial statements at December 31, 2019, Parent Subsidiary Parent Subsidiary Income statement Balance sheet: JOM The wentary not remaining at the end of the year has been sold out of the control group. The parents the method of condition investment opin Team and the subsidiary report the following me comodation financial statements December 2010 Parent Subrary Parent Binary Income Harement Balance sheet w 6.000.000 1000 On je NO 2.200.000.000 income orary D. TO Operating 2.00 0.00 Pepind 1000000 DO Prince 5200.000 2. statement of retained earnings more 190.000 0 000 Netice BLOCO 300 000 mais 10.000 Dwind 0.0001 COCK 500 100.000 0.000 Oinating 12.11.2000 AC 200,000 nel 17. 1.100.000 WAT300.000.000 Disagregate and document the activity for the 100% Acquisition Accounting Premium (AAP) the controlling interest AAP and the noncontrolling interest AAP (Complete for the first four years only Unamerad Linamartland Ured Un mortid AAR 2013 AAP 2014 AAP 2015 AAP 2016 1/11/2013 Atten 12/31/2013 Amortation 1/2014 Americasian 12/31/2015 Amortier 100 Part 180,000 TROOD 162.000 10,000 144000 TR000 126.000 TODO Good 300.000 O O 300.000 162.000 18.00 44.000 1.000 DO 10 PM 000 10 Support My Subscriptions Unamortized AAP 1/1/2013 2013 Amortization Unamortized AAP 12/01/2013 2014 Amortistien Unamertinad AAP 12/01/2014 2015 Amortisation Unam AAP 12/31/2015 2016 Ameri TOON Patent Good TR000 10.000 100.000 GOO 163.000 300.000 2.000 144000 0 44000 18.000 0 . 300.000 1000 TOO O 12.000 18.000 10 14.000 14.00 Goodw 144000 240.000 31.00 129600 240.000 3600 115.00 20,000 351200 100 0 TAD 100 DOO 220,000 HO 14.00 D TAO 14400 14.40 30 Patens Goodwill 3.600 COO 36,000 000 96.000 2.400 60.000 92.400 2000 0.000 LOD 3.600 O 1600 21,200 0 000 150200 3600 0 1600 2.600 3.600 b. Calculate and organize the profits and losses on intercompany transactions and balances Downstream Upstream Intercompany profit on 1/19 28.000 Intercompany profit on 12/31/19 O 37,500 c.Compute the pre-consolidation Equity Investment account beginning and ending balances starting with the stockholders' equity of the subsidiary Use a negative sign with your answer to indicate a reduction to net income. Equity investment at 1/1/19 B0% x book value of the net assets of subsidiary 992.000 Compute the pre-consolidation Equity Investment account beginning and ending balances starting with the stockholders equity of the subsidiary Use a negative sign with your answer to indicate a reduction to net income tout esmentat 1/1/19 Oxbow of the netbal Subsidury 992.000 Add Un amortited AAP 297.000 Le Bon of upstream deferred Intercompany profit 22400) 1267200 quity investment 12/01/18 On book of the news of subsidiary 220000 Add: Unamed AAR 283300 Leo of upstream deferred intercompany profits 130,000 42200 X d. Reconstruct the activity in the parent's pre-consolidation Equity Investment T-account for the year of consolidation Eyesentat19 Net income BOY upotrementary Equity Investment 1,267,200 160,000 32,000 Didende 22.400 14.400 AAP amortization 0 30.000 to upstream inventor 1.371.200 0 Equity investment at 121/19 e Independently compute the owners' equity attributable to the noncontrolling interest beginning and ending balances starting with the owners equity of the subsidiary, Use a negative sign with your answer to indicate a reduction to net income. . Independently compute the owners' equity attributable to the no controlling interest beginning and ending balances starting with the owners equity of the subsidiary Use a negative sign with your answer to indicate a reduction to net income Noncontres yos of bother 3000 At Umar M is.com SED Not 30 of the 220.000 Und AP 70.000 Independently calculate consolidated net income, controlling interest net income and noncontrolling interest net income Use a negative sign with your answer to indicate a reduction to net income. Parandalone 200.000 Subtidarys and one income 200.000 Pusted upstream der 3.000 Los 100 pam deferredores 2.500 teus 100 AP action 000) Condade income 372.00 Parandalone come 300.000 NON Subsidiary's standalone net income 160.000 Plus Opstream deferred profits 22.400 : Quo6 Partly correct Mar 217.16 out of 22:00 T r urston | Consolidation subsequent to date of acquisition-Equity method with noncontrolling interest, AAP, and upstream intercompany inventory sale Assume, on January 1, 2013, a parent company acquired an Bos interest in its subsidiary. The total fair value of the controlling and noncontrolling interests was $480,00 over the book value of the subsidiarys Stockholders' Equity on the acquisition date. The parent assigned the excess to the following (A) assets; TA) Assut Initial Fair Value Uwlul Life Pacent 5180.000 Toys Goodwill 300.000 de 5480.000 30% of the Goodwill is allocated to the parent. Assume the subsidiary sells inventory to the parent (upstream) which includes that inventory in products that it ultimately sells to customers outside of the controlled group. You have compiled the following data as of 2018 and 2015 2018 2013 Transfer price for Inventory a 100,000,000 Cost of goods sold 1420,000 450.000 Gross profit 580,000 150.000 story remaining 25 mis profitarred reithayotis ) 550.000 $140.000 120,000 $3.500 The inventory not remaining at the end of the year has been sold outside of the controlled group. The parent uses the equity method of pre-consolidation investment bookkeeping. The parent and the subsidiary report the following pre-consolidation financial statements at December 31, 2018 Parent subsidiary Parent Subsidiary Income statement: Balance sheet The inventory not remaining at the end of the year has been sold outside of the controlled group. The parent uses the equity method of pre-consolidation investment bookkeeping. The parent and the subsidiary report the following pre-consolidation financial statements at December 31, 2019 Parent Subsidiary Parent Subsidiary Income statement Balance sheet: 16.700.000 2.500.000 Cash 350.000 500.000 Cost of goods B.com 1.500.000 Acrecibe 700.000 600,000 Gres pot 2.200.000 1.000.000 inventory 900.000 190.000 Income from diary 14.000 Tutin 132.00 O 2.000.000.000) Propertiesiant antrent Pet 2.000.000 1.000.000 Netcome 5338.000 5200000 17473.000 $2.000.000 Statement of retained cerning BOY S205.20000000 Current 00.000 500.000 Net 31.000 230.000 tonton 1.000.000 900.000 Divina 200.000.000) Common stock 500.000 100,000 Wanda 32,172,200 1,100.00 AC 1000000 200.000 neden 2.173.200 1.100.000 B7 A72200 52.000.000 1: Disaggregate and document the activity for the 100% Acquisition Accounting Premium (AAP), the controlling interest AAP and the noncontrolling interest AAP.(Complete for the Unamartired first four years only) Un amortid Unamortid Untamertad AAP AAP 2014 AAP 2015 11/2013 Amortitation 12/01/2013 Amortization 12/12/2014 Amortization 100 110.000 12.000 13.000 144,000 16.000 Goodwill 300.000 O 300.000 100,000 420.000 2.000 18,000 1000 18.000 12 2016 Amortisti 1,300 126.000 00.000 >> 425,000 16.000 Unamor AAP 111/2012 2001 Amortisation Unamor AAP 2014 12/21/2017 Amortisation namorad Un morta AAP 2015 AAP 12/11/2014 Amortization 12/21/2015 2016 Amortation 100% TB000 300.000 480.000 16.000 O 162.000 300.000 Goodwill 18.000 O 18.000 144000 300.000 18.000 0 18.000 126.000 300.000 42.000 18.000 O 18.000 204 Patent Goodwill 14,000 144,000 240.000 164.000 120.600 240.000 MONGOO 14400 O 14.400 115.200 240.000 2200 14400 O 14.400 100.00 240.000 4000 14.400 o 14400 DOWY 200 Part Goodwill 000 0000 0009 32.400 0.000 92400 AO 3600 O 3.600 2000 0.000 BRAROO 3600 Ov 5.200 60.000 05.200 3600 O 3.600 . b. Calculate and organize the profits and losses on intercompany transactions arid balances. Downstream Upstream roma 26.000 may proton 22.00 0 c. Compute the pre-consolidation Equity Investment account beginning and ending balances starting with the stockholders' equity of the subsidiary, Use a negative sign with your answer to indicate a reduction to net income. que investment / 30% book air of the names of diary 902.000 297.400 Adinamond AAP cCompute the pre-consolidation Equity Investment account beginning and ending balances starting with the stockholders' equity of the subsidiary Use a negative sign with your answer to indicate a reduction to net income Equity investment at 1/18 604xbook value of the net of subsidiary 992,000 Add: United AAP . 297500 LEBO of upstandered intercompany profeso 22.400) 127.200 Equity 131 Oxbook value of the retary 220,000 Addramorised AAP 201.200 Leux. BON of upstream deleret intercompany preso (3.000) 473200 d. Reconstruct the activity in the parent's pre-consolidation Equity Investment account for the year of consolidation Equity Investment fuity 1/10 Net BOY para inventory 1.267300 160.000 22.400 O 2.000 Odende 14.400 min 30.000. coupitian 9 met 137.300 e Independently compute the owners equity attributable to the noncontrolling interest beginning and ending balances starting with the owners equity of the subsidiary Use a negative sise with your answer to indicate a reduction to net income > Nicotines e. Independently compute the owners' equity attributable to the noncontrolling interest beginning and ending balances starting with the owners'equity of the subsidiary. Use a negative sign with your answer to indicate a reduction to net income No controling 20 of book value of the nel sets of subsidiary 348.000 Add amortized AAP 74,400 ES 2014 af upstream deferrect interromperiy profies : (5.00) Nanotolinistrut at 12/31 20 book value of the news of subsidiary 220,000 Adds mortized AAP 70,000 Lens 200 of upstream oferred intercomreary profeso 500) 283.330 216.500 t. Independently calculate consolidated net income, controlling interest net income and noncontrolling interest net income Use a negative sign with your answer to indicate a reduction to net income Pre net income 200.000 Suicidary's standalone income 200.000 Plus 100 realed upstream deferred profiles 28.000 Cena 100 walised upotram delored profits 37,500) LE 100AP amortisation 12.000) Consolidated nec income de income 200.000 80. Subsidiary's standalone niet income Plus 80% realed upstream deferred profes 22.400 Les 30 ured upotream deferred profits 30.000) . 372.500 160.000 . 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts