Question: I need help with preparing the financial statements(step 6). Please use the format of the last picture Part 2 (Recording Adjusting Entries & Preparing an

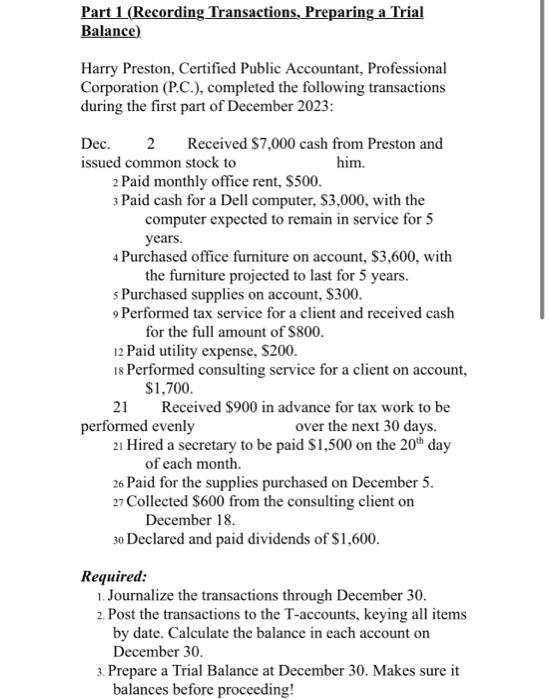

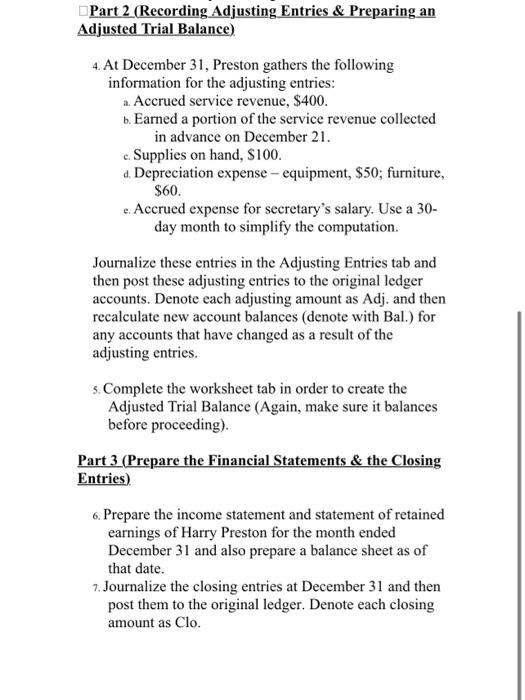

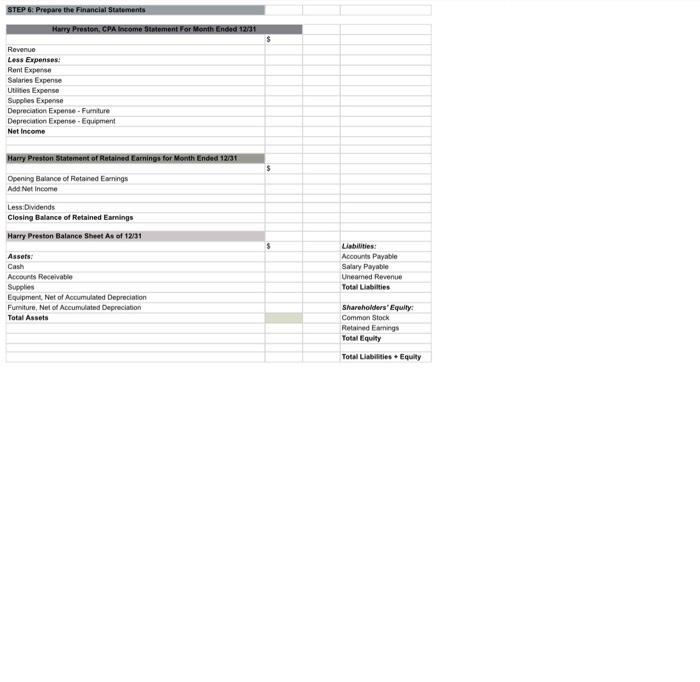

Part 2 (Recording Adjusting Entries \& Preparing an Adjusted Trial Balance) 4. At December 31, Preston gathers the following information for the adjusting entries: a. Accrued service revenue, $400. b. Earned a portion of the service revenue collected in advance on December 21. c. Supplies on hand, $100. d. Depreciation expense - equipment, $50; furniture, $60. e. Accrued expense for secretary's salary. Use a 30day month to simplify the computation. Journalize these entries in the Adjusting Entries tab and then post these adjusting entries to the original ledger accounts. Denote each adjusting amount as Adj. and then recalculate new account balances (denote with Bal.) for any accounts that have changed as a result of the adjusting entries. 5. Complete the worksheet tab in order to create the Adjusted Trial Balance (Again, make sure it balances before proceeding). Part 3 (Prepare the Financial Statements \& the Closing Entries). 6. Prepare the income statement and statement of retained earnings of Harry Preston for the month ended December 31 and also prepare a balance sheet as of that date. 7. Journalize the closing entries at December 31 and then post them to the original ledger. Denote each closing amount as Clo. Part 1 (Recording Transactions, Preparing a Trial Balance). Harry Preston, Certified Public Accountant, Professional Corporation (P.C.), completed the following transactions during the first part of December 2023: Dec. 2 Received \$7,000 cash from Preston and issued common stock to him. 2 Paid monthly office rent, $500. 3 Paid cash for a Dell computer, $3,000, with the computer expected to remain in service for 5 years. 4 Purchased office furniture on account, $3,600, with the furniture projected to last for 5 years. 5 Purchased supplies on account, \$300. 9 Performed tax service for a client and received cash for the full amount of $800. 12 Paid utility expense, $200. 18 Performed consulting service for a client on account, $1,700. 21 Received $900 in advance for tax work to be performed evenly over the next 30 days. 21 Hired a secretary to be paid $1,500 on the 20th day of each month. 26 Paid for the supplies purchased on December 5. 27 Collected $600 from the consulting client on December 18. 30 Declared and paid dividends of $1,600. Required: 1. Journalize the transactions through December 30. 2. Post the transactions to the T-accounts, keying all items by date. Calculate the balance in each account on December 30. 3. Prepare a Trial Balance at December 30. Makes sure it balances before proceeding! STEP 6: Prepare the Financial Statements \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ Rarry Presten, CPA locome 5tatement For Month Endad 1231} & \\ \hline & $ & \\ \hline \multicolumn{3}{|l|}{ Revenue } \\ \hline \multicolumn{3}{|l|}{ Less Expenses: } \\ \hline \multicolumn{3}{|l|}{ Rent Fxperse } \\ \hline \multicolumn{3}{|l|}{ Sslaries Expense } \\ \hline \multicolumn{3}{|l|}{ Utilites Expense } \\ \hline \multicolumn{3}{|l|}{ Supples Expense } \\ \hline \multicolumn{3}{|l|}{ Depreciation Eapense - Fumture } \\ \hline \multicolumn{3}{|l|}{ Depreciation Expense - Equipment } \\ \hline \multicolumn{3}{|l|}{ Net Income } \\ \hline & & \\ \hline \multicolumn{3}{|c|}{ Harry Preston Statement of Retained Earnings for Month Ended 1231} \\ \hline & $ & \\ \hline \multicolumn{3}{|l|}{ Opening Balance of Retained Earnings } \\ \hline \multicolumn{3}{|l|}{ Add Net Income } \\ \hline \multicolumn{3}{|l|}{ Less:Dividends } \\ \hline \multicolumn{3}{|l|}{ Closing Balance of Retained Earnings } \\ \hline \multicolumn{3}{|l|}{ Harry Preston Balance Sheet As of 12/31} \\ \hline & s & Labilities: \\ \hline Assets: & & Accounts Payable \\ \hline Cash & & Salary Payabie \\ \hline Accounts Receivatily & & Uneamed Revenue \\ \hline Supplies & & Total Liabilities \\ \hline \multicolumn{3}{|l|}{ Equipment, Net of Accumulated Depreciation } \\ \hline Fumiture, Net of Accumulated Depreciation & & Shareholders' Equity: \\ \hline \multirow[t]{5}{*}{ Total Assets } & & Comman stock \\ \hline & & Retained Eamings \\ \hline & & Total Equilty \\ \hline & & \\ \hline & & Total Liabilities + Equilty \\ \hline \end{tabular} Part 2 (Recording Adjusting Entries \& Preparing an Adjusted Trial Balance) 4. At December 31, Preston gathers the following information for the adjusting entries: a. Accrued service revenue, $400. b. Earned a portion of the service revenue collected in advance on December 21. c. Supplies on hand, $100. d. Depreciation expense - equipment, $50; furniture, $60. e. Accrued expense for secretary's salary. Use a 30day month to simplify the computation. Journalize these entries in the Adjusting Entries tab and then post these adjusting entries to the original ledger accounts. Denote each adjusting amount as Adj. and then recalculate new account balances (denote with Bal.) for any accounts that have changed as a result of the adjusting entries. 5. Complete the worksheet tab in order to create the Adjusted Trial Balance (Again, make sure it balances before proceeding). Part 3 (Prepare the Financial Statements \& the Closing Entries). 6. Prepare the income statement and statement of retained earnings of Harry Preston for the month ended December 31 and also prepare a balance sheet as of that date. 7. Journalize the closing entries at December 31 and then post them to the original ledger. Denote each closing amount as Clo. Part 1 (Recording Transactions, Preparing a Trial Balance). Harry Preston, Certified Public Accountant, Professional Corporation (P.C.), completed the following transactions during the first part of December 2023: Dec. 2 Received \$7,000 cash from Preston and issued common stock to him. 2 Paid monthly office rent, $500. 3 Paid cash for a Dell computer, $3,000, with the computer expected to remain in service for 5 years. 4 Purchased office furniture on account, $3,600, with the furniture projected to last for 5 years. 5 Purchased supplies on account, \$300. 9 Performed tax service for a client and received cash for the full amount of $800. 12 Paid utility expense, $200. 18 Performed consulting service for a client on account, $1,700. 21 Received $900 in advance for tax work to be performed evenly over the next 30 days. 21 Hired a secretary to be paid $1,500 on the 20th day of each month. 26 Paid for the supplies purchased on December 5. 27 Collected $600 from the consulting client on December 18. 30 Declared and paid dividends of $1,600. Required: 1. Journalize the transactions through December 30. 2. Post the transactions to the T-accounts, keying all items by date. Calculate the balance in each account on December 30. 3. Prepare a Trial Balance at December 30. Makes sure it balances before proceeding! STEP 6: Prepare the Financial Statements \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ Rarry Presten, CPA locome 5tatement For Month Endad 1231} & \\ \hline & $ & \\ \hline \multicolumn{3}{|l|}{ Revenue } \\ \hline \multicolumn{3}{|l|}{ Less Expenses: } \\ \hline \multicolumn{3}{|l|}{ Rent Fxperse } \\ \hline \multicolumn{3}{|l|}{ Sslaries Expense } \\ \hline \multicolumn{3}{|l|}{ Utilites Expense } \\ \hline \multicolumn{3}{|l|}{ Supples Expense } \\ \hline \multicolumn{3}{|l|}{ Depreciation Eapense - Fumture } \\ \hline \multicolumn{3}{|l|}{ Depreciation Expense - Equipment } \\ \hline \multicolumn{3}{|l|}{ Net Income } \\ \hline & & \\ \hline \multicolumn{3}{|c|}{ Harry Preston Statement of Retained Earnings for Month Ended 1231} \\ \hline & $ & \\ \hline \multicolumn{3}{|l|}{ Opening Balance of Retained Earnings } \\ \hline \multicolumn{3}{|l|}{ Add Net Income } \\ \hline \multicolumn{3}{|l|}{ Less:Dividends } \\ \hline \multicolumn{3}{|l|}{ Closing Balance of Retained Earnings } \\ \hline \multicolumn{3}{|l|}{ Harry Preston Balance Sheet As of 12/31} \\ \hline & s & Labilities: \\ \hline Assets: & & Accounts Payable \\ \hline Cash & & Salary Payabie \\ \hline Accounts Receivatily & & Uneamed Revenue \\ \hline Supplies & & Total Liabilities \\ \hline \multicolumn{3}{|l|}{ Equipment, Net of Accumulated Depreciation } \\ \hline Fumiture, Net of Accumulated Depreciation & & Shareholders' Equity: \\ \hline \multirow[t]{5}{*}{ Total Assets } & & Comman stock \\ \hline & & Retained Eamings \\ \hline & & Total Equilty \\ \hline & & \\ \hline & & Total Liabilities + Equilty \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts