Question: i need help with present value 3. In Tab 9-3, please complete the following activities: Suppose you are interested in purchasing a share of the

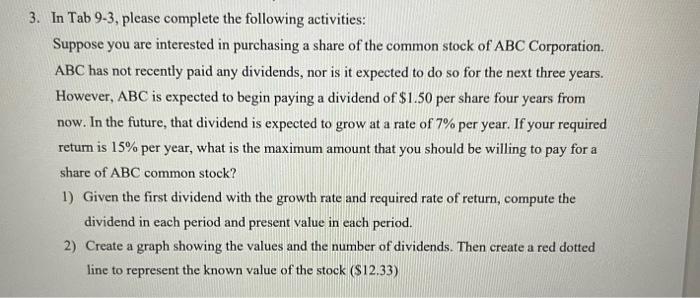

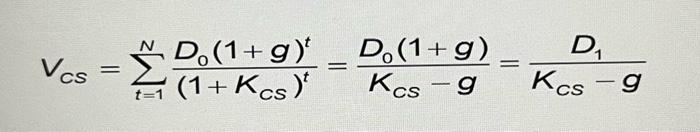

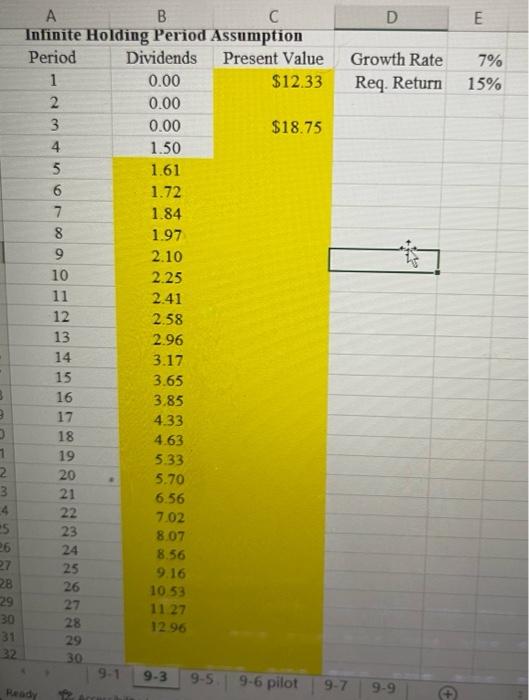

3. In Tab 9-3, please complete the following activities: Suppose you are interested in purchasing a share of the common stock of ABC Corporation. ABC has not recently paid any dividends, nor is it expected to do so for the next three years. However, ABC is expected to begin paying a dividend of $1.50 per share four years from now. In the future, that dividend is expected to grow at a rate of 7% per year. If your required return is 15% per year, what is the maximum amount that you should be willing to pay for a share of ABC common stock? 1) Given the first dividend with the growth rate and required rate of return, compute the dividend in each period and present value in each period. 2) Create a graph showing the values and the number of dividends. Then create a red dotted line to represent the known value of the stock ($12.33) VCS=t=1N(1+KCS)tD0(1+g)t=KCSgD0(1+g)=KCSgD1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts