Question: i need help with question 1 and 7 using formula bulider Question 1. GTF Corporation has 5 percent coupon bonds on the market with a

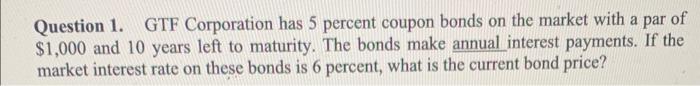

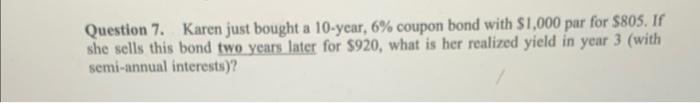

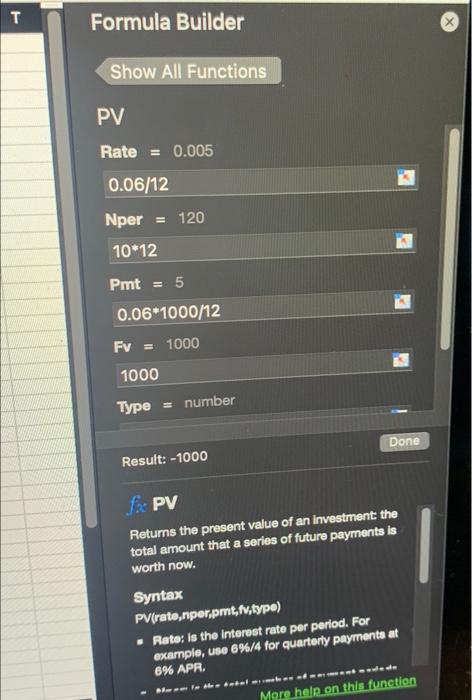

Question 1. GTF Corporation has 5 percent coupon bonds on the market with a par of $1,000 and 10 years left to maturity. The bonds make annual interest payments. If the market interest rate on these bonds is 6 percent, what is the current bond price? Question 7. Karen just bought a 10-year, 6% coupon bond with $1,000 par for $805. If she sells this bond two years later for $920, what is her realized yield in year 3 (with semi-annual interests)? fxPV Returns the present value of an investment the total amount that a series of future payments is worth now. Syntax PV(rate, nperpmt, w, type) - Rates is the interest rate per period. For example, use 6%/4 for quarterly payments at 6% APR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts