Question: i need help with question 14,15 Question 14 1 pts A U.S.-based currency dealer has good credit and can borrow $1,000,000 or 800,000 for one

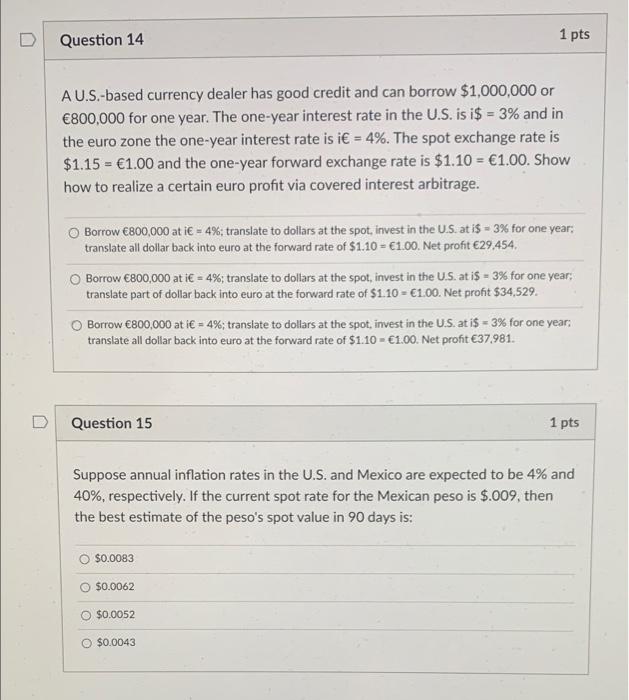

Question 14 1 pts A U.S.-based currency dealer has good credit and can borrow $1,000,000 or 800,000 for one year. The one-year interest rate in the U.S. is i$ = 3% and in the euro zone the one-year interest rate is i = 4%. The spot exchange rate is $1.15 - 1.00 and the one-year forward exchange rate is $1.10 = 1.00. Show how to realize a certain euro profit via covered interest arbitrage. Borrow 800,000 at i = 4%; translate to dollars at the spot, invest in the U.S. at i$ = 3% for one year, translate all dollar back into euro at the forward rate of $1.10 = 1.00. Net profit 29,454. Borrow 800,000 at i = 4%; translate to dollars at the spot, invest in the U.S. at i$ - 3% for one year, translate part of dollar back into euro at the forward rate of $1.10 = 1.00. Net profit $34,529. Borrow 800,000 at i - 4%; translate to dollars at the spot, invest in the U.S. at i$ = 3% for one year, translate all dollar back into euro at the forward rate of $1.10 - 1.00. Net profit 37,981. Question 15 1 pts Suppose annual inflation rates in the U.S. and Mexico are expected to be 4% and 40%, respectively. If the current spot rate for the Mexican peso is $.009, then the best estimate of the peso's spot value in 90 days is: $0.0083 $0.0062 O $0.0052 $0.0043

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts