Question: I need help with question 16. if you could help on question 17 as well that would be great. thanks! QUESTION 16 A stock you

I need help with question 16. if you could help on question 17 as well that would be great. thanks!

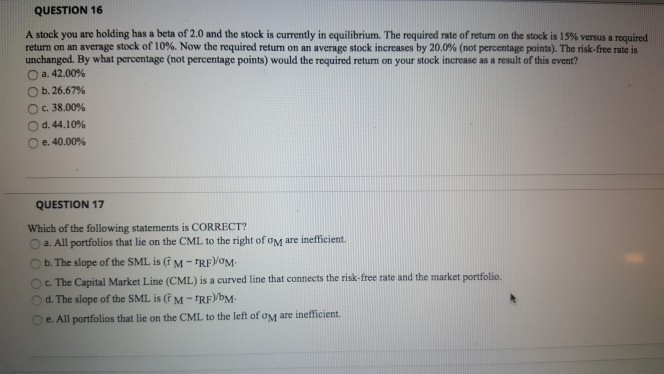

QUESTION 16 A stock you are holding has a beta of 2.0 and the stock is currently in equilibrium. The required rate of return on the stock is 15% versus a required return on an average stock of 10%. Now the required return on an average stock increases by 20 0% not percentage poins. The nk ee rate is unchanged. By what percentage (not percentage points) would the required return on your stock increase as a result of this event? a. 42.00% b. 26.67% O c. 38.00% Od, 44.10% e. 40.00% QUESTION 17 Which of the following statements is CORRECT? O a. All portfolios that lie on the CML to the right of M are inefficient. O b. The slope of the SML is (r M-rRFyoM. O c. The Capital Market Line (CML) is a curved line that connects the risk-free rate and the market portfolio. 0 d.The slope of the SML is (r M-RF)bM. D e. All portfolios that lie on the CML to the left of oM are inefficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts