Question: i need help with question 17 and 19 INTERMEDIATE (Questions 17-28) 17. Bond Price Movements Miller Corporation has a premium bond making semiannual payments. The

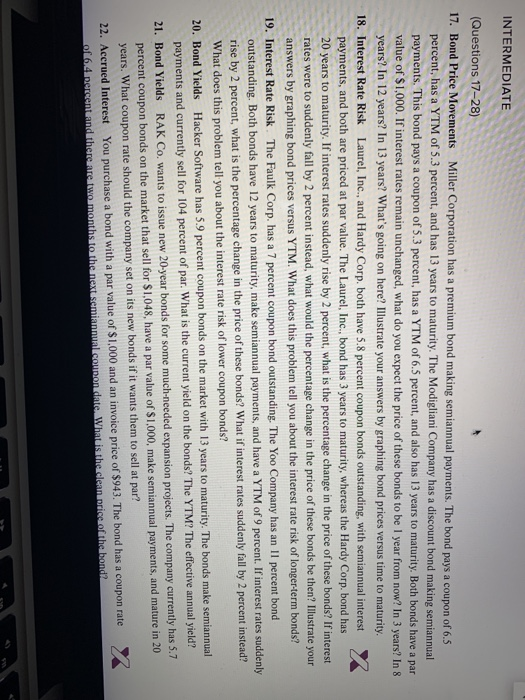

INTERMEDIATE (Questions 17-28) 17. Bond Price Movements Miller Corporation has a premium bond making semiannual payments. The bond pays a coupon of 6.5 percent, has a YTM of 5.3 percent, and has 13 years to maturity. The Modigliani Company has a discount bond making semiannual payments. This bond pays a coupon of 5.3 percent, has a YTM of 6.5 percent, and also has 13 years to maturity. Both bonds have a par value of $1,000. If interest rates remain unchanged, what do you expect the price of these bonds to be 1 year from now? In 3 years? In 8 years? In 12 years? In 13 years? What's going on here? Illustrate your answers by graphing bond prices versus time to maturity. 18. Interest Rate Risk Laurel, Inc., and Hardy Corp. both have 5.8 percent coupon bonds outstanding, with semiannual interest payments, and both are priced at par value. The Laurel, Inc., bond has 3 years to maturity, whereas the Hardy Corp. bond has 20 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? If interest rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of these bonds be then? Illustrate your answers by graphing bond prices versus YTM. What does this problem tell you about the interest rate risk of longer-term bonds? 19. Interest Rate Risk The Faulk Corp, has a 7 percent coupon bond outstanding. The Yoo Company has an Il percent bond outstanding. Both bonds have 12 years to maturity, make semiannual payments, and have a YTM of 9 percent. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? What if interest rates suddenly fall by 2 percent instead? What does this problem tell you about the interest rate risk of lower coupon bonds? 20. Bond Yields Hacker Software has 5.9 percent coupon bonds on the market with 13 years to maturity. The bonds make semiannual payments and currently sell for 104 percent of par. What is the current yield on the bonds? The YTM? The effective annual yield? 21. Bond Yields RAK Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 5.7 percent coupon bonds on the market that sell for $1,048, have a par value of $1,000, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? 22. Accrued Interest You purchase a bond with a par value of $1,000 and an invoice price of $943. The bond has a coupon rate of 64 percentand there are two months to the next semiannual.connon date. What is the clean price of the bandia

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts