Question: I need help with question 2! I already have done the work for question 1 the work is requires to do nukber 2, PLEASE HELP

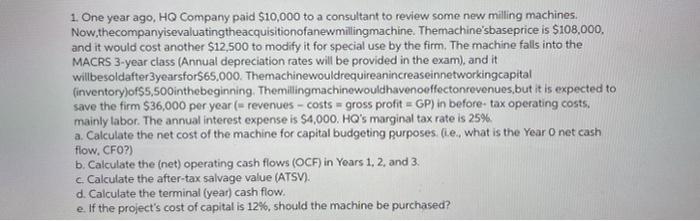

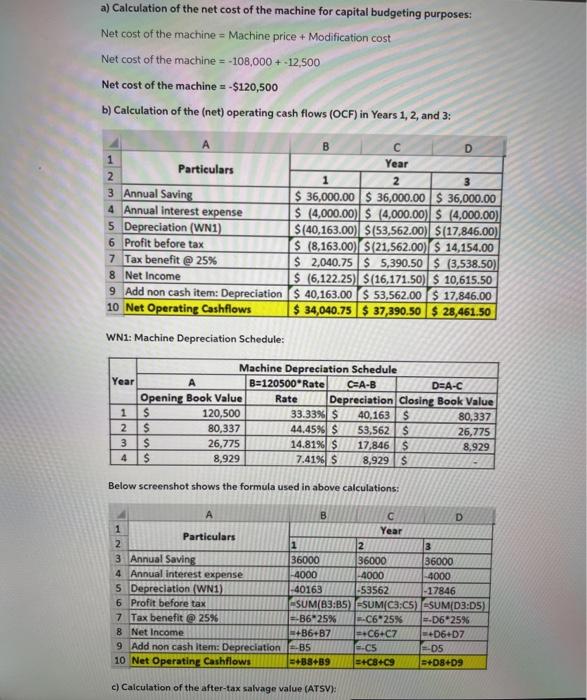

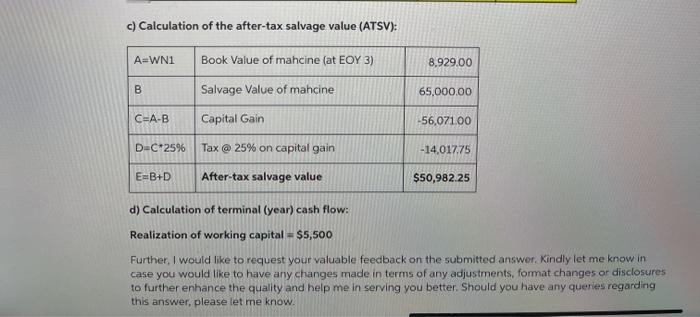

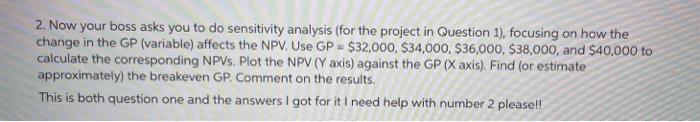

1. One year ago, HQ Company paid $10,000 to a consultant to review some new milling machines. Now.thecompanyisevaluatingtheacquisitionofanewmillingmachine. Themachine'sbaseprice is $108.000. and it would cost another $12,500 to modify it for special use by the firm. The machine falls into the MACRS 3-year class (Annual depreciation rates will be provided in the exam), and it willbesoldafter3yearsfor$65,000. Themachinewouldrequireanincreaseinnetworkingcapital (inventory of$5,500inthebeginning, Themillingmachinewouldhavenoeffectonrevenues, but it is expected to save the firm $36,000 per year (= revenues - costs - gross profit = GP) in before- tax operating costs, mainly labor. The annual interest expense is $4,000. HQ's marginal tax rate is 25% a. Calculate the net cost of the machine for capital budgeting purposes. (le, what is the Year O net cash flow. CFO?) b. Calculate the (net) operating cash flows (OCF) in Years 1, 2 and 3. c. Calculate the after-tax salvage value (ATSV). d. Calculate the terminal (year) cash flow. e. If the project's cost of capital is 12%, should the machine be purchased? a) Calculation of the net cost of the machine for capital budgeting purposes: Net cost of the machine - Machine price + Modification cost Net cost of the machine = -108,000 + 12,500 Net cost of the machine - -$120,500 b) Calculation of the (net) operating cash flows (OCF) in Years 1, 2, and 3: B 1 Particulars Year 2 1 2 3 Annual Saving 36,000.00 $ 36,000.00 $ 36,000.00 4 Annual interest expense $ (4,000.00) S (4,000.00) $ (4,000.00) 5 Depreciation (WN1) $(40,163.00) $(53,562.00) S(17,846.00) 6 Profit before tax $(8,163.00) S(21,562.00) $ 14,154.00 7 Tax benefit @ 25% $ 2,040.75 $ 5,390.50 $ (3,538.50) 8 Net Income $ (6.122.25) S(16,171.50) S 10,615.50 9 Add non cash item: Depreciation $ 40,163.00 $ 53,562.00 $ 17,846.00 10 Net Operating Cashflows $ 34,040.75 $ 37,390.50 $ 28,461.50 WN1: Machine Depreciation Schedule: Machine Depreciation Schedule Year A B=120500*Rate CEA-B D=A-C Opening Book Value Rate Depreciation Closing Book Value 1 $ 120,500 33.339 $ 40.163 $ 80,337 2 $ 80,337 44,45% $ 53,562 $ 26,775 3 $ 26,775 14.81% $ 17,8465 8,929 4 $ 8,929 7.419 $ 8,929S Below screenshot shows the formula used in above calculations: A B G D 1 Year Particulars 2 11 2 3 3 Annual Saving 36000 36000 36000 4 Annual Interest expense -4000 -4000 -4000 5 Depreciation (WN1) -40169 -53562 -17846 6 Profit before tax SUM(B3:BS) SUM(C3:05) SUM(D3:05) 7 Tax benefit @ 25% =-3625% --C6 25% =-D6.25% 8 Net Income =+B6+B7 -C6-C7 +06+07 9 Add non cash Item: Depreciation --B5 --C5 --05 10 Net Operating Cashflows +38+B9 3+C8+c9 +D8+D9 c) Calculation of the after-tax salvage value (ATSV): c) Calculation of the after-tax salvage value (ATSV): A=WN1 Book Value of mahcine (at EOY 3) 8,929.00 B Salvage Value of mahcine 65,000.00 CEA-B Capital Gain -56,07100 DEC 25% Tax @ 25% on capital gain -14,017.75 E=B+D After-tax salvage value $50,982.25 d) Calculation of terminal (year) cash flow: Realization of working capital - $5,500 Further, I would like to request your valuable feedback on the submitted answer. Kindly let me know in case you would like to have any changes made in terms of any adjustments, format changes or disclosures to further enhance the quality and help me in serving you better. Should you have any queries regarding this answer, please let me know. 2. Now your boss asks you to do sensitivity analysis (for the project in Question 1), focusing on how the change in the GP (variable) affects the NPV. Use GP - $32,000, $34,000, $36,000, $38,000, and $40,000 to calculate the corresponding NPVs. Plot the NPV (Y axis) against the GP (X axis). Find (or estimate approximately) the breakeven GP. Comment on the results. This is both question one and the answers I got for it I need help with number 2 please!! 1. One year ago, HQ Company paid $10,000 to a consultant to review some new milling machines. Now.thecompanyisevaluatingtheacquisitionofanewmillingmachine. Themachine'sbaseprice is $108.000. and it would cost another $12,500 to modify it for special use by the firm. The machine falls into the MACRS 3-year class (Annual depreciation rates will be provided in the exam), and it willbesoldafter3yearsfor$65,000. Themachinewouldrequireanincreaseinnetworkingcapital (inventory of$5,500inthebeginning, Themillingmachinewouldhavenoeffectonrevenues, but it is expected to save the firm $36,000 per year (= revenues - costs - gross profit = GP) in before- tax operating costs, mainly labor. The annual interest expense is $4,000. HQ's marginal tax rate is 25% a. Calculate the net cost of the machine for capital budgeting purposes. (le, what is the Year O net cash flow. CFO?) b. Calculate the (net) operating cash flows (OCF) in Years 1, 2 and 3. c. Calculate the after-tax salvage value (ATSV). d. Calculate the terminal (year) cash flow. e. If the project's cost of capital is 12%, should the machine be purchased? a) Calculation of the net cost of the machine for capital budgeting purposes: Net cost of the machine - Machine price + Modification cost Net cost of the machine = -108,000 + 12,500 Net cost of the machine - -$120,500 b) Calculation of the (net) operating cash flows (OCF) in Years 1, 2, and 3: B 1 Particulars Year 2 1 2 3 Annual Saving 36,000.00 $ 36,000.00 $ 36,000.00 4 Annual interest expense $ (4,000.00) S (4,000.00) $ (4,000.00) 5 Depreciation (WN1) $(40,163.00) $(53,562.00) S(17,846.00) 6 Profit before tax $(8,163.00) S(21,562.00) $ 14,154.00 7 Tax benefit @ 25% $ 2,040.75 $ 5,390.50 $ (3,538.50) 8 Net Income $ (6.122.25) S(16,171.50) S 10,615.50 9 Add non cash item: Depreciation $ 40,163.00 $ 53,562.00 $ 17,846.00 10 Net Operating Cashflows $ 34,040.75 $ 37,390.50 $ 28,461.50 WN1: Machine Depreciation Schedule: Machine Depreciation Schedule Year A B=120500*Rate CEA-B D=A-C Opening Book Value Rate Depreciation Closing Book Value 1 $ 120,500 33.339 $ 40.163 $ 80,337 2 $ 80,337 44,45% $ 53,562 $ 26,775 3 $ 26,775 14.81% $ 17,8465 8,929 4 $ 8,929 7.419 $ 8,929S Below screenshot shows the formula used in above calculations: A B G D 1 Year Particulars 2 11 2 3 3 Annual Saving 36000 36000 36000 4 Annual Interest expense -4000 -4000 -4000 5 Depreciation (WN1) -40169 -53562 -17846 6 Profit before tax SUM(B3:BS) SUM(C3:05) SUM(D3:05) 7 Tax benefit @ 25% =-3625% --C6 25% =-D6.25% 8 Net Income =+B6+B7 -C6-C7 +06+07 9 Add non cash Item: Depreciation --B5 --C5 --05 10 Net Operating Cashflows +38+B9 3+C8+c9 +D8+D9 c) Calculation of the after-tax salvage value (ATSV): c) Calculation of the after-tax salvage value (ATSV): A=WN1 Book Value of mahcine (at EOY 3) 8,929.00 B Salvage Value of mahcine 65,000.00 CEA-B Capital Gain -56,07100 DEC 25% Tax @ 25% on capital gain -14,017.75 E=B+D After-tax salvage value $50,982.25 d) Calculation of terminal (year) cash flow: Realization of working capital - $5,500 Further, I would like to request your valuable feedback on the submitted answer. Kindly let me know in case you would like to have any changes made in terms of any adjustments, format changes or disclosures to further enhance the quality and help me in serving you better. Should you have any queries regarding this answer, please let me know. 2. Now your boss asks you to do sensitivity analysis (for the project in Question 1), focusing on how the change in the GP (variable) affects the NPV. Use GP - $32,000, $34,000, $36,000, $38,000, and $40,000 to calculate the corresponding NPVs. Plot the NPV (Y axis) against the GP (X axis). Find (or estimate approximately) the breakeven GP. Comment on the results. This is both question one and the answers I got for it I need help with number 2 please

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts