Question: i need help with question 3 and 5 Page 264 Coupon rate: 7 percent Pape 264 Semiannual payments Calculate the price of this bond if

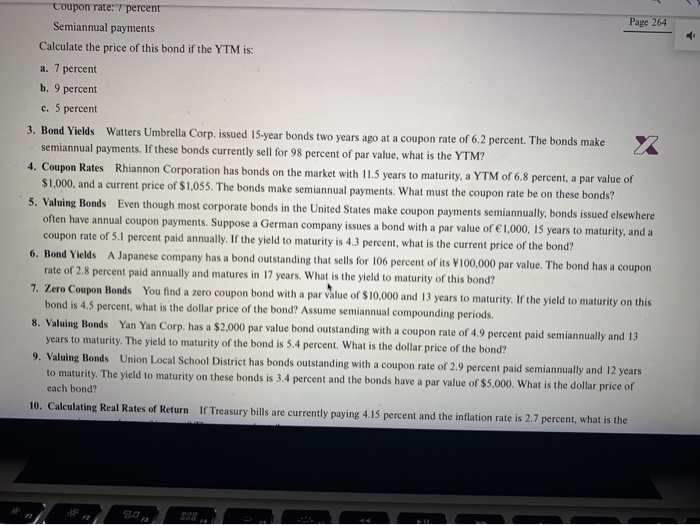

Page 264 Coupon rate: 7 percent Pape 264 Semiannual payments Calculate the price of this bond if the YTM is: a. 7 percent b. 9 percent c. 5 percent 3. Bond Yields Watters Umbrella Corp. issued 15-year bonds two years ago at a coupon rate of 6.2 percent. The bonds make semiannual payments. If these bonds currently sell for 98 percent of par value, what is the YTM? 4. Coupon Rates Rhiannon Corporation has bonds on the market with 11.5 years to maturity, a YTM of 6.8 percent, a par value of $1,000, and a current price of $1,055. The bonds make semiannual payments. What must the coupon rate be on these bonds? 5. Valuing Bonds Even though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have annual coupon payments. Suppose a German company issues a bond with a par value of 1.000, 15 years to maturity, and a coupon rate of 5.1 percent paid annually. If the yield to maturity is 4.3 percent, what is the current price of the bond? 6. Bond Yields A Japanese company has a bond outstanding that sells for 106 percent of its Y100,000 par value. The bond has a coupon rate of 2.8 percent paid annually and matures in 17 years. What is the yield to maturity of this bond? 7. Zero Coupon Bonds You find a zero coupon bond with a par value of $10,000 and 13 years to maturity. If the yield to maturity on this bond is 4.5 percent, what is the dollar price of the bond? Assume semiannual compounding periods. 8. Valuing Bonds Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.9 percent paid semiannually and 13 years to maturity. The yield to maturity of the bond is 5.4 percent. What is the dollar price of the bond? 9. Valuing Bonds Union Local School District has bonds outstanding with a coupon rate of 2.9 percent paid semiannually and 12 years to maturity. The yield to maturity on these bonds is 3.4 percent and the bonds have a par value of $5,000. What is the dollar price of each bond? 10. Calculating Real Rates of Return Treasury bills are currently paying 4.15 percent and the inflation rate is 2.7 percent, what is the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts