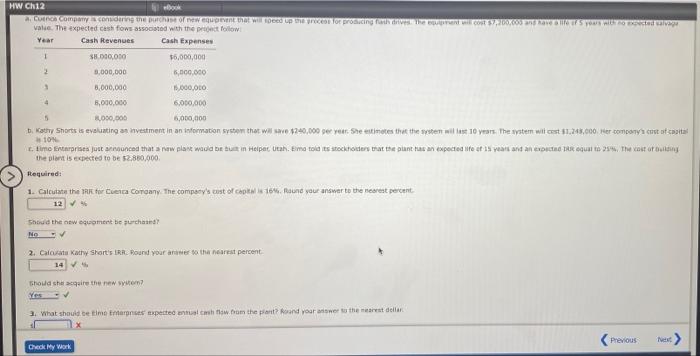

Question: i need help with question 3 HW Ch12 Book a. Cuence Company is considering the purchase of new equpevent that will speed up the process

HW Ch12 Book a. Cuence Company is considering the purchase of new equpevent that will speed up the process for producing flash drives. The equipment will cost $7,200,000 and have a life of 5 yours with no expected salvage value. The expected cash flows associated with the project follow Year Cash Revenues Cash Expenses 1 2 $8,000,000 8,000,000 8,000,000 8,000,000 8,000,000 b. Kathy Shorts is evaluating an investment in an information system that will save $240,000 per year. She estimates that the system will last 10 years. The system will cost $1,248,000. Her company's cost of capital 10% timo Enterprises just announced that a new plant would be built in Helper, Utah. Ema told its stockholders that the plant has an expected life of 15 years and an expected IRR equal to 25%. The cost of building the plant is expected to be $2.880,000. Required: Should the new equipment be purchased? No DV $6,000,000 6,000,000 $5,000,000 6,000,000 1. Calculate the IRR for Cuenca Company. The company's cost of capital is 16%. Round your answer to the nearest percent. 12 % Should she acquire the new system? Yes 6,000,000 2. Calcuts Kathy Short's IRR. Round your answer to the nearest percent 14 Check My Work 3. What should be Elmo Enterprises expected entual cash flow from the plant? Round your answer to the nearest della Previous Next HW Ch12 Book a. Cuence Company is considering the purchase of new equpevent that will speed up the process for producing flash drives. The equipment will cost $7,200,000 and have a life of 5 yours with no expected salvage value. The expected cash flows associated with the project follow Year Cash Revenues Cash Expenses 1 2 $8,000,000 8,000,000 8,000,000 8,000,000 8,000,000 b. Kathy Shorts is evaluating an investment in an information system that will save $240,000 per year. She estimates that the system will last 10 years. The system will cost $1,248,000. Her company's cost of capital 10% timo Enterprises just announced that a new plant would be built in Helper, Utah. Ema told its stockholders that the plant has an expected life of 15 years and an expected IRR equal to 25%. The cost of building the plant is expected to be $2.880,000. Required: Should the new equipment be purchased? No DV $6,000,000 6,000,000 $5,000,000 6,000,000 1. Calculate the IRR for Cuenca Company. The company's cost of capital is 16%. Round your answer to the nearest percent. 12 % Should she acquire the new system? Yes 6,000,000 2. Calcuts Kathy Short's IRR. Round your answer to the nearest percent 14 Check My Work 3. What should be Elmo Enterprises expected entual cash flow from the plant? Round your answer to the nearest della Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts