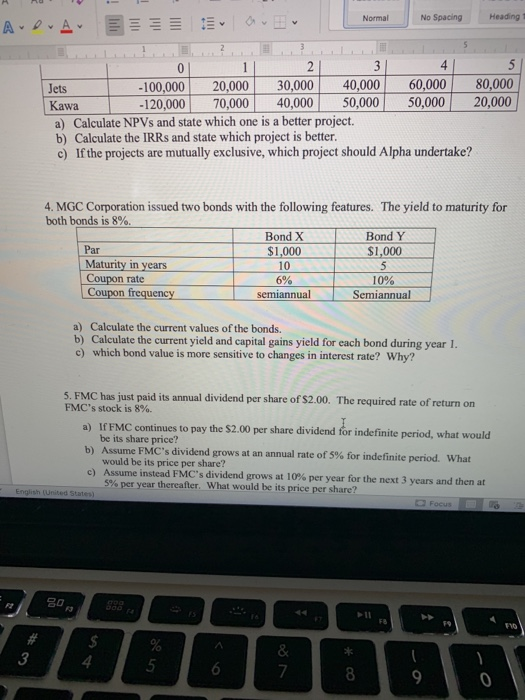

Question: i need help with question 4 Normal No Spacing av Heading ADA 0 1 2 Jets -100,000 20,000 30,000 40,000 60,000 80,000 Kawa -120,000 70,000

Normal No Spacing av Heading ADA 0 1 2 Jets -100,000 20,000 30,000 40,000 60,000 80,000 Kawa -120,000 70,000 40,000 50,000 50,000 20,000 a) Calculate NPVs and state which one is a better project. b) Calculate the IRRs and state which project is better. c) If the projects are mutually exclusive, which project should Alpha undertake? 4. MGC Corporation issued two bonds with the following features. The yield to maturity for both bonds is 8%. Bond X Bond Y Par $1,000 $1,000 Maturity in years 10 Coupon rate 6% 10% Coupon frequency semiannual Semiannual a) Calculate the current values of the bonds. b) Calculate the current yield and capital gains yield for each bond during year 1. c) which bond value is more sensitive to changes in interest rate? Why? 5. FMC has just paid its annual dividend per share of $2.00. The required rate of return on FMC's stock is 8%. a) If FMC continues to pay the $2.00 per share dividend for indefinite period, what would be its share price? b) Assume FMC's dividend grows at an annual rate of 5% for indefinite period. What would be its price per share? c) Assume instead FMC's dividend grows at 10% per year for the next 3 years and then at 5% per year thereafter. What would be its price per share? English (United States a Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts